Verizon rides iPhone 4S, LTE in Q4 at expense of profit margins

Verizon's wireless unit rode an iPhone 4S upgrade cycle and Long-Term Evolution 4G devices to a strong fourth quarter. However, the company overall reported a loss due to pension charges.

The telecom giant reported a fourth quarter loss of 71 cents a share largely due to pension charges. Adjusted earnings, which exclude the actuarial charges valuing the company's pensions, were 52 cents a share, a penny short of estimates. For 2011, Verizon reported earnings of 85 cents a share, $2.15 on a non-GAAP basis.

Revenue was $28.4 billion in the fourth quarter, up 7.7 percent from a year ago. For 2011, revenue was $110.9 billion, up 4 percent. Company executives have said that the ramp of iPhone sales would crimp margins.

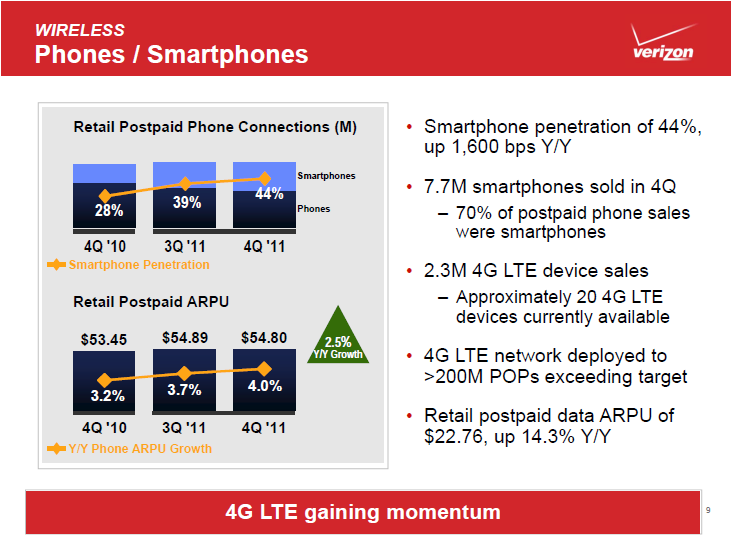

For instance, Verizon reported a 23.7 percent operating income margin for its wireless unit in the fourth quarter. Non-GAAP margins on service revenue were 42.2 percent, down 530 basis points from a year ago. Verizon said earlier this month that it sold 4.2 million iPhones in the fourth quarter and 2.3 million LTE devices. That mix of iPhones translated into a margin hit due to subsidy costs. Overall, Verizon sold 7.7 million smartphones.

On a conference call, Fran Shammo, CFO of Verizon, said the company is balancing today's profits with future growth. He said:

While very disciplined in our approach to capital spending, we continued to invest in networks and new technologies which will be the platform for accelerated growth. On the strategic front we made some moves that will significantly improve our competitive position . These include the acquisitions of Terremark and CloudSwitch in the cloud computing space, several agreements to purchase additional spectrum, joint efforts around innovation with a number of partners including the cable companies and of course, our continued leadership in the rapid development of the 4G LTE ecosystem.

In a statement, Verizon CEO Lowell McAdam touted the following:

- Verizon Wireless posted strong growth, but margins were hit in the short-term. He indicated that Verizon is focused on growing the 4G ecosystem.

- FiOS rebounded from the third quarter.

- And Verizon is ramping global IP and cloud services in its enterprise unit.

By the numbers:

- Verizon added 1.5 million net retail additions. That sum includes 1.2 million postpaid subscribers.

- At the end of the fourth quarter, Verizon had 108.7 million total connections with 92.2 million retail customers.

- Wireless revenue was $18.3 billion, up 13 percent a year ago.

- Wireless retail service average revenue per user was $53.14, up 2.6 percent.

- Wireline revenue in the fourth quarter was $10.1 billion, down 1.5 percent.

- Verizon added 201,000 FiOS Internet subscribers and 194,000 video users. That tally illustrated a rebound from the third quarter.

- FiOS ARPU was $148 a month.

- Strategic service revenue was 51 percent of global enterprise sales.