Verizon sheds consumer lines in Q1, but adds business accounts amid remote work, COVID-19 demand shifts

Verizon lost 525,000 consumer postpaid wireless customers in the first quarter but delivered better-than-expected earnings even as revenue was light. Those consumer losses were largely offset by business accounts that were added in the quarter.

The company's moving parts highlight how Verizon's position as an enterprise and business carrier allowed it to weather consumer spending during the COVID-19 pandemic. Indeed, Verizon said it added 475,000 retail business additions---phones, smartphones, tablets and connected devices---over the quarter largely due to demand from remote workers and home schooling.

When the additions and subtractions were finished, Verizon lost 50,000 retail postpaid customers with a postpaid churn of 1.08%.

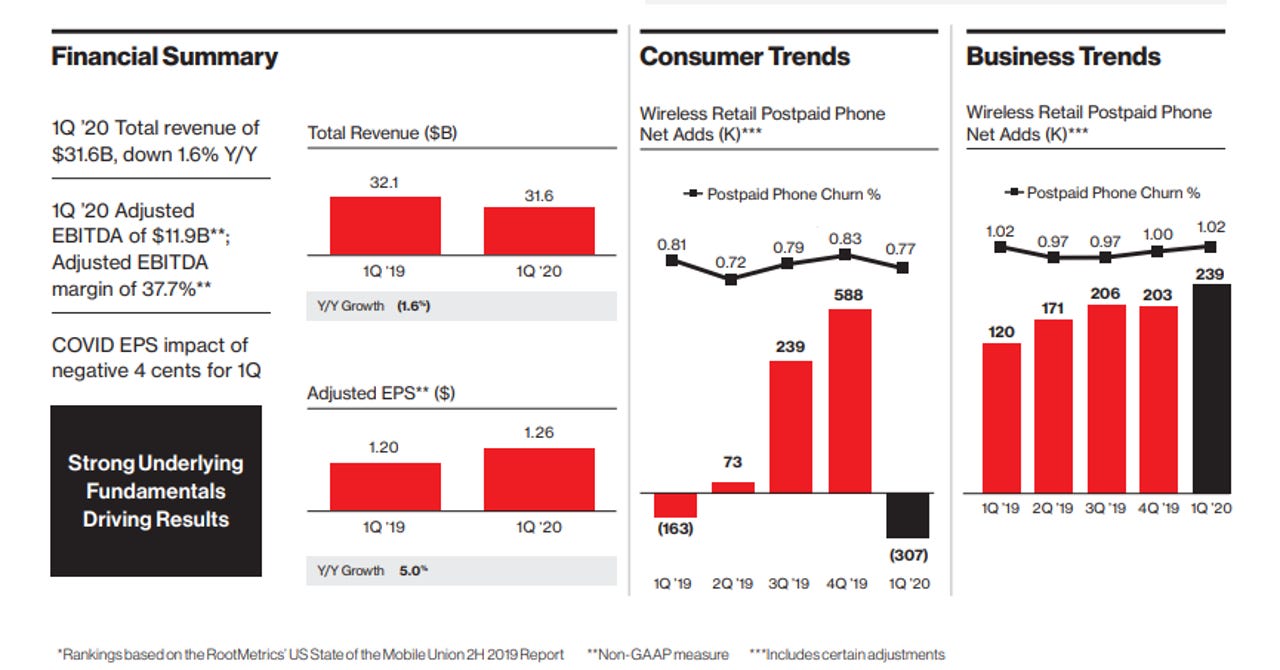

Verizon reported first quarter net income of $4.29 billion, or $1 a share, on revenue of $31.6 billion, down 1.6% from a year ago. Non-GAAP earnings for the first quarter were $1.26 a share.

- AT&T Q1 mixed amid COVID-19, plans more 5G investment as network traffic surges |

- Verizon to buy videoconferencing software company BlueJeans

- Remote workforce best practices: A conversation with Verizon HR chief Christy Pambianchi

Wall Street was expecting Verizon to report non-GAAP first quarter earnings of $1.23 a share on revenue of $32.4 billion.

Verizon's consumer business took a hit as it lost 307,000 net wireless phone customers and 167,000 postpaid smartphone net losses. The company also lost 84,000 Fios video customers but added 59,000 Fios Internet subscribers.

CEO Hans Vestberg said Verizon maintained network quality during the COVID-19 crisis, which shaved about 4 cents a share off first quarter earnings. Vestberg said on a conference call that the company is poised to perform well coming out of the pandemic:

Nobody really knows how this is going to end, but we have several scenarios and actions that we're working with as a leadership team. Let me talk about the network a little bit. You are seeing some staggering numbers like over 200% up on gaming, 10x up on collaboration, to 40% up on video. 800 million calls a day, which is twice the amount of what we have on Mother's Day, which is the biggest day a year. All that have been managing very well with the network. We have built a robust network, and we can deliver high quality.

Not surprisingly given the dynamics between consumer and business spending, Vestberg said Verizon would invest in the business unit. He said the acquisition of Blue Jeans is one example of that inestment.

Vestberg added:

When coming into this COVID-19, we saw the importance of Verizon Business Group, and we have a great opportunity going forward as we come with 5G and the trends in the industry. Digitization has been accentuated in this COVID-19. So I feel good about what we're doing here. The team is running as fast as they can with this transformation.

I also see it as a great opportunity for the 5G. With 5G at the edge suite, we will have a lot of low latency enormous throughput where video and transcoding will be important. So adding that asset is also important for the future. We feel good about our strategy in Verizon Business Group. We have some more work, and we're not holding back on that transformation as that will put us in even stronger position when they're done.

Key items in Verizon's quarter include:

- Verizon grew wireless service revenue in its consumer and business divisions, but equipment revenue fell as stores were closed.

- Verizon spent $5.4 billion on capital expenditures in the first quarter largely to build out its 5G network and support increased traffic.

- The company increased its bad debt reserve by $228 million based on customers that are likely to seek payment relief.

- Verizon closed 70% of its company-owned retail locations and that contributed to the customer losses.

- Jetpacks, VPN services and high-speed circuits all saw strong demand in the quarter.

- Verizon Media revenue was $1.7 billion, down 4% from a year ago, due to COVID-19. Verizon said customer engagement in its media properties surged, but ad rates fell.

As for the 2020 outlook, Verizon said it expects non-GAAP earnings to be between down 2% and up 2%. Verizon had projected earnings growth between 2% and 4%. Verizon pulled revenue guidance for the year.