Verizon's first quarter better than expected; Alltel makes it largest U.S. wireless player

Verizon delivered a solid quarter as the company added wireless customers at a rapid clip and continued to land FiOS Internet and TV customers. Like rival AT&T, Verizon is proving to be recession resistant.

Verizon on Monday reported first quarter net income of $3.2 billion, or 58 cents a share, on revenue of $26.6 billion. Excluding items, Verizon reported earnings of 63 cents a share, handily topping Wall Street estimates of 59 cents a share. In the first quarter a year ago, Verizon reported net income of $3.05 billion, or 57 cents a share, on revenue of $23.8 billion.

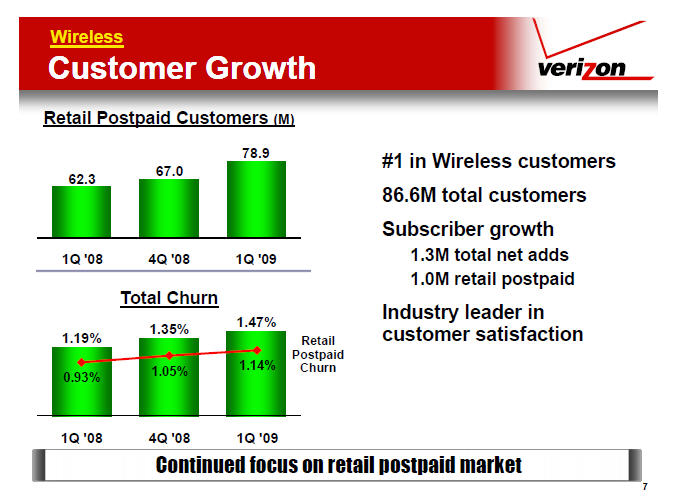

In a statement, Verizon noted that it had 86.6 million wireless customers as of March 31. That figure, boosted by the acquisition of Alltel, was up 28.8 percent from a year ago. Alltel added 13.2 million subscribers. Meanwhile, retail churn for Verizon Wireless was 1.14 percent with a total churn rate of 1.47 percent. For comparison's sake, AT&T ended its first quarter with 78.2 million subscribers and a retail churn rate of 1.2 percent.

Meanwhile, there appears to be a tug of war between Verizon and AT&T for deal with Apple over the iPhone. AT&T is looking to keep an exclusive deal while Verizon is looking to add the iPhone to its lineup. On a conference call with analysts, CFO John Killian talked up Verizon's plans to build out a 4G LTE (an alternative to WiMax) network and the company's ability to cut costs while investing in growth. "The move to LTE over the next year will only strengthen our position in the market place," said Killian. He added that Verizon will save $1 billion over the next year as it cuts costs associated with the Alltel acquisition.

By the numbers:

- Verizon was the largest wireless carrier in the U.S. Verizon Wireless revenue was $15.1 billion, up 29.6 percent from a year ago courtesy of the Alltel acquisition.

- Verizon Wireless operating margin excluding acquisition charges was 28.2 percent. Average monthly service revenue per user (ARPU) was $50.74 in the quarter, down slightly from a year ago.

- The wireless business now represents 57 percent of Verizon's revenue.

- Verizon added 299,000 new FiOS TV customers for a total tally of 2.2 million. Verizon added 298,000 new FiOS Internet customers for a total of 2.8 million.

- Enterprise revenue in the quarter was down 3.4 percent to $3.7 billion.