Verizon's quarter holds up; Metrics mixed; Mum on Storm units

Updated: Verizon on Tuesday delivered a mixed bag for the quarter. FiOS TV additions were stronger-than-expected and wireless subscriber additions were on the light side. Meanwhile, the company didn't break out how many BlackBerry Storms it moved in the quarter.

The telecom giant reported fourth quarter earnings of 43 cents a share and 61 cents excluding items (statement). Revenue was $24.6 billion in the fourth quarter, up 3.4 percent from a year ago. That tally just missed estimates, which have been falling rapidly in the last month or so. Wall Street was expecting earnings of 62 cents, according to Reuters Estimates.

On a conference call with analysts, Verizon executives struck an optimistic tone. Verizon CEO Ivan Seidenberg stated that obvious: That the company is operating in "a difficult economic time." Nevertheless, Seidenberg was confident that Verizon could do well in a downturn. Verizon operating chief Dennis Strigl reiterated those comments.

CFO Doreen Toben highlighted Verizon Wireless' data revenue, which is at a $10 billion a year run rate. Toben spoke about FiOS and said she was "pleased with progress in New York City." More importantly, Toben said the triple play of wireless, TV and broadband is keeping customers in the Verizon fold.

Toben also noted that Verizon's enterprise unit is seeing a slowdown as CIOs delay making any big decisions and layoffs are hurting corporate call volumes. Strigl added that Verizon's enterprise unit will be partnering with Accenture to help business as well as cut costs.

Seidenberg was asked about how the Obama administration would impact Verizon. He said that the economic stimulus package was critical and noted that "we haven't received a call about network neutrality in weeks." Seidenberg said that network neutrality may go to the backburner as a lot of players have already altered their positions in advance of the Obama administration.

The business breakdown highlighted a few moving parts:

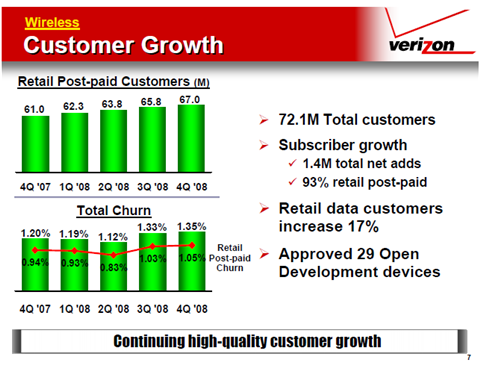

- Verizon added 1.4 million net wireless customers excluding acquisitions. Analysts were expecting about 1.6 million. Retail additions were 1.2 million.

- The company added 303,000 net FiOS TV customers and 282,000 net FiOS Internet customers. Both of those figures were better than expected. Wall Street was looking 250,000 FiOS TV additions and 250,000 FiOS Internet new subscribers. That may indicate that Verizon is putting a dent in cable rivals.

- Verizon Wireless finished the year with 72.1 million total customers.

- Verizon Wireless' churn rate was 1.35 percent and 1.05 percent for retail customers.

- For the year, Verizon reported earnings of $2.26 a share on revenue of $97.4 billion. Cash flow was $26.6 billion.

- Verizon Wireless average monthly revenue per customer was $51.72, up 1.4 percent from a year ago. Operating margin was 29.7 percent.

- The recently closed Alltel deal will give Verizon Wireless more than 80 million customers.

- Capital expenses were $17.2 billion for the year.

And a look at Verizon's enterprise unit:

Add it up and Verizon turned in a solid performance with metrics that were a bit mixed. Verizon CEO Ivan Seidenberg said the company "has shown that it is able to compete effectively in this economic environment" and has "a solid foundation" for 2009.

The big question among techies was focused on how the BlackBerry Storm sold. In the early going, Verizon only said:

Customers across the country lined up to purchase the new BlackBerry Storm, available exclusively in the U.S. from Verizon Wireless and launched in November. Designed for both consumers and business customers, the BlackBerry Storm offers customers the reliability of the Verizon Wireless 3G network and the full power of a revolutionary touch-screen, multimedia smartphone with global connectivity.

What's missing? A tally. If the Storm had sold iPhone-ish units rest assured Verizon would have told folks about it.

Other odds and ends:

Strigl was asked about a slowdown in wireless sales. He said:

We're selling more smartphones--37 percent of retail devices sold are smartphones. We're also increasing focus on the retail segment. I don't think we lost share this quarter. We have no evidence of customers slowing or trading down. Our churn did pick up a bit from last year.

Strigl added that some of the churn increase was due to layoffs--corporate customers taking back phones and cutting wireless plans. Another chunk of that churn can be attributed to disconnects due to the economy. Strigl said there is no evidence that these disconnects were customers going to other providers.

Verizon open platform efforts. Strigl said that Verizon Wireless' open platform development efforts were gaining momentum. He added that the goal was to take these open devices to consumers in the first half of 2010.