Violin Memory bets software suite, appliances boosts market share

Violin Memory, a solid-state Flash memory storage system company, on Thursday rolled out a software suite and set of appliances designed to speed up legacy infrastructure.

The company makes memory arrays, cards and appliances is the market leader in flash memory systems and competes with IBM, EMC and Fusion-io to some degree. Violin, backed by Toshiba, has 19 percent of the flash storage array market with EMC second at 16 percent, IBM at 15 percent and NetApp at 11 percent, according to Gartner.

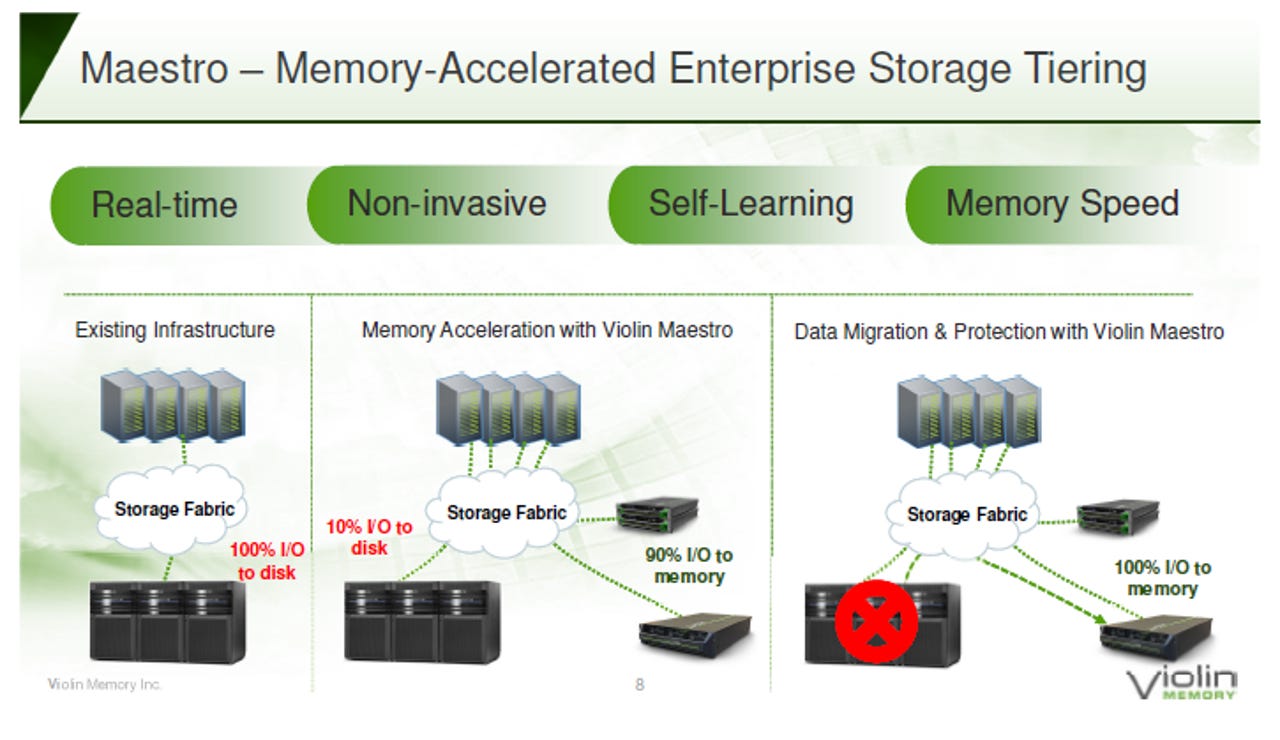

Narayan Venkat, vice president of product at Violin, said the company's Maestro Memory Services Software Suite aims to tier storage, accelerate application performance, allow for easier data migration and preserve investments in traditional storage systems.

The software suite, which is delivered via two appliances, attaches to existing architecture. "We're seeing interest in deploying in existing environment and then customers move more to memory," said Venkat. "Customers start with the most demanding applications in memory, see the performance gains and the benefits of acceleration and then move to mission critical applications."

So far, Violin's Maestro suite is in production with about 25 customers.

The company on Monday revised its IPO filing to set a price range of $8 and $10. For the six months ended July 31, Violin reported a net loss of $59.17 million on revenue of $51.3 million.

The 21st Century Data Center

According to Violin, the biggest target for its software is EMC's FAST storage software, which Venkat calls slow.

The plan for Violin is to get into enterprise data centers with its software and appliances and then expand its wallet share from there. In 2013, the company has acquired GridIron, forged an alliance with Toshiba as well as partnerships with Dell and Fujitsu. In August, Violin launched its Symphony Management Software and next-gen memory array. The moves all add up to a push into tier one storage accounts.

Will Violin find an audience for its software and appliances? Yes. Violin's move to preserve existing investments and avoid storage disruptions to current infrastructure will be appealing. Indirectly, Violin will wind up competing with everything from Oracle's Exadata machines to much larger storage vendors.

In Violin's IPO filing, the company cites IBM, Dell, EMC, Hitachi, HP 3Par, NetApp and Oracle as competitors. But with a fast-growing market, Violin has plenty of legroom and the bet is that software appliances can widen its market.

More:

Violin Memory expected to buy GridIron Systems for data center products