Will cloud computing economics add up for Microsoft?

Microsoft at its financial analyst meeting made the case for being a cloud computing leader and argued that its economic prospects will improve as information technology shifts to an on-demand model.

The big question: Do you buy the argument that cloud computing will accelerate Microsoft's earnings and revenue growth? Let's face it: Every software vendor is talking cloud computing, but the economic theory is that it's better to cannibalize your own business than allow some rival to do it. Few established software vendors have argued that the cloud will gussy up their financial metrics.

Microsoft CFO Peter Klein, however, made the case that cloud computing is going to be big business, improve the company's gross margins, cut costs and bring in more customers. And, as noted by Altimeter partner Ray Wang, Klein did a decent job putting cloud computing in financial terms. It's too early to put any hard data around Microsoft's nascent Azure efforts, but Klein said that the software giant could grab a bigger piece of the enterprise IT pie. After all, the historical dividing lines between vendors---software, hardware, networking and storage---are melting away.

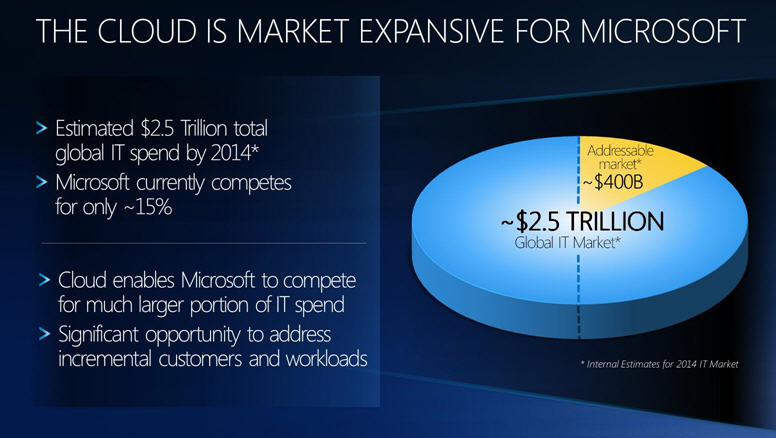

So how's Microsoft going to harness the cloud for financial gain? Klein had a few big themes to ponder: The cloud opens up a broader IT spending pie. In cloud computing, software, hardware and services blend together. You don't buy servers. You buy capacity. Klein said:

Obviously, the total global IT spend, which we're going to address more of now in the cloud world, is much bigger. And so obviously at a high level is an incredible opportunity for the cloud to have us address a much larger piece of the IT market.

Microsoft can sell to more users. Klein talked a lot about how cloud computing can allow Microsoft to be more of a player for midmarket companies that don't have the resources to implement a SharePoint infrastructure. Klein said:

[The cloud] allows us to sell to more users. This could either be new customers that we don't serve today or new users within existing customers today. So, this is greenfield incremental opportunity selling to users that today don't have Microsoft products.

He continued:

And with business users, I want to start with the mid-market segment. Historically, while the mid-market has been a very attractive market for us, it also poses some challenges. Number one, it's highly fragmented, and number two, there's a little bit of a gap between the needs and desires in terms of IT capabilities that mid-market companies have and the resources and expertise they have to deliver those capabilities. In some sense, you could say a mid-market company has the needs of enterprise IT but the capability of a much smaller business. The cloud really solves that problem by bringing cost-effective, easy-to-deploy technology solutions to mid-market customer in ways they can't today.

Delivering software via the cloud will improve gross margins by lowering costs for Microsoft and customers. The automation of deployments, configuration and ongoing maintenance will cut costs for all parties. There are also hardware savings. Klein said:

Interestingly, the one thing I want to point out on this, the 10 percent savings is net of what an organization would pay us for the Azure service. So, it's the net of what they would pay more, in addition to the licenses and for the service, and on top of that there's 10 percent savings. And again, given the one instance that you're running, given the automation, you reduce support costs. It's actually a good thing for not only the customer but for Microsoft. And you add all that up and that's a 30 percent savings, again, net of what Microsoft would make for the existing software license, plus gross margin on the service.

The cloud makes it easier for Microsoft to garner "competitive migrations"---essentially poaching customers from rivals. "All that revenue is brand new and incremental to our bottom line," said Klein.

Microsoft can make a "pretty smooth" transition to the cloud and lower costs of goods sold (COGS) and improve gross margins from the 80 percent mark today, said Klein. For comparison's sake, Salesforce.com's gross margins are roughly 82 percent and Oracle's is projected to have margins in the 75 percent range (down from 80 percent due to its Sun hardware business). The pace of this transition remains to be seen, but Microsoft is confident. He said:

We spent a lot of time thinking, both from a sales and revenue perspective, and a sort of build-out perspective, how do we smooth out the impact of that. And I think we've got -- we've done some great work on the sales side for our customers in particular to provide a smooth transition from sort of our existing business models to the cloud model.

And from a margin perspective in terms of the COGS, I think, number one, we're able to sort of leverage all the investments we make across the company in datacenter technology, which provides good scale for us and ability to smooth. And we've done a lot of work to plan out how we think about datacenter build-out, how we get really smooth about how we just get it right in front of sort of the demand. So, we've done a much better job in forecasting demand and then making out build plans on datacenter. So, both from the revenue side, I think we've got some good licensing plans to make that smoother, and then from the COGS side -- unless there's sort of just dramatic spikes, which of course I think will cause COGS to go up. I think we can smooth that out pretty well.

There were a few missing elements. Klein wasn't specific about estimates for margin improvement and percentages on future growth, but it's too early for that level of detail. Add it up and Microsoft's case for cloud economics was a lot more fleshed out than details provided by other software companies.

More from Microsoft’s analyst meeting:

- Microsoft's Windows Phone 7 potential marketing pitch: 'I'm a phone too'

- Microsoft’s Ballmer: Windows 7 slates are ‘job number one’

- Steve Ballmer: Microsoft has been focusing on cloud for 15 years

- Microsoft’s stump speech: We’re leading the cloud parade

- Microsoft Internet Explorer 9 beta due in September

- Microsoft: We are focusing on eight core businesses