Wireless carriers' revenue grab: How you're paying for the machines

The big wireless carriers are going gaga for new services, eliminating unlimited data plans and looking to boost revenue.

In T-Mobile's latest earnings report, the company said:

M2M customers, which have significantly lower ARPUs (averaging less than $2) than other contract customers, totaled 2.7 million at March 31, 2012.

Overall, carriers have to offset those tight M2M margins somewhere. Tag you're---consumer and business customers who will have to make the difference---it.

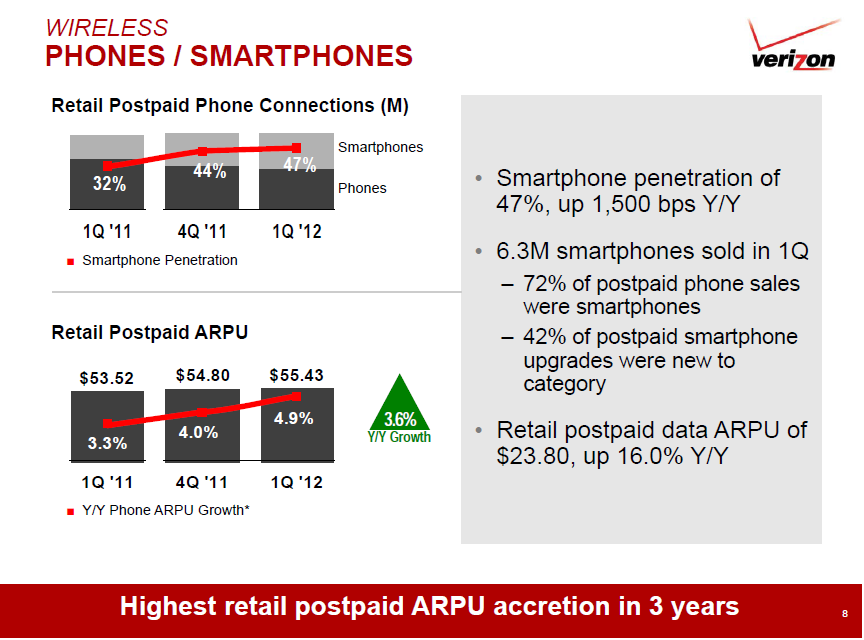

In other words, you will be squeezed to pay for those ARPU-destroying e-reader connections so wireless carriers will have something to excite Wall Street about. The most galling point is that AT&T and Verizon are seeing ARPU either stay at high levels or surge.

- Verizon CFO Fran Shammo this week basically said that unlimited data plans, which were grandfathered in for long-time customers, are history.

- Verizon has also recently touted a home LTE service to compete with wired broadband.

- AT&T this week touted an effort called Digital Life, which replaces wired alarm and home automation systems with wireless technology.

- Every wireless carrier is looking to enable vertical applications in health care and other industries.

The common thread: Carriers are trying to shore up a metric---ARPU---that is likely to hit the wall at some point. Subscriber growth in the U.S. is largely saturated. New data plans will boost revenue, but only for a bit as customers offload to Wi-Fi and watch prices more.

Speaking at a recent Jefferies investment conference, Robert Vrij, executive vice president of the Americas at Alcatel-Lucent, said service providers are looking for new revenue streams such as home monitoring and advertising. "Carriers get it and are pursuing add-on services," said Vrij.

Vikash Varma, CEO of mobile broadband access company Stoke, wasn't so sure. Varma said that carriers can alienate customers by moving from flat fee to tiered services. "Carriers will take steps that alienate customers," explained Varma. "Humans react well when they understand the unit of measurement like minutes. What is a GB? It's a unit of measurement not well understood until you use your quote in two days. Carriers shoot themselves in the foot by introducing another message to extract more ARPU."