World record sales for robots as sector reaches $16.5 billion in investment

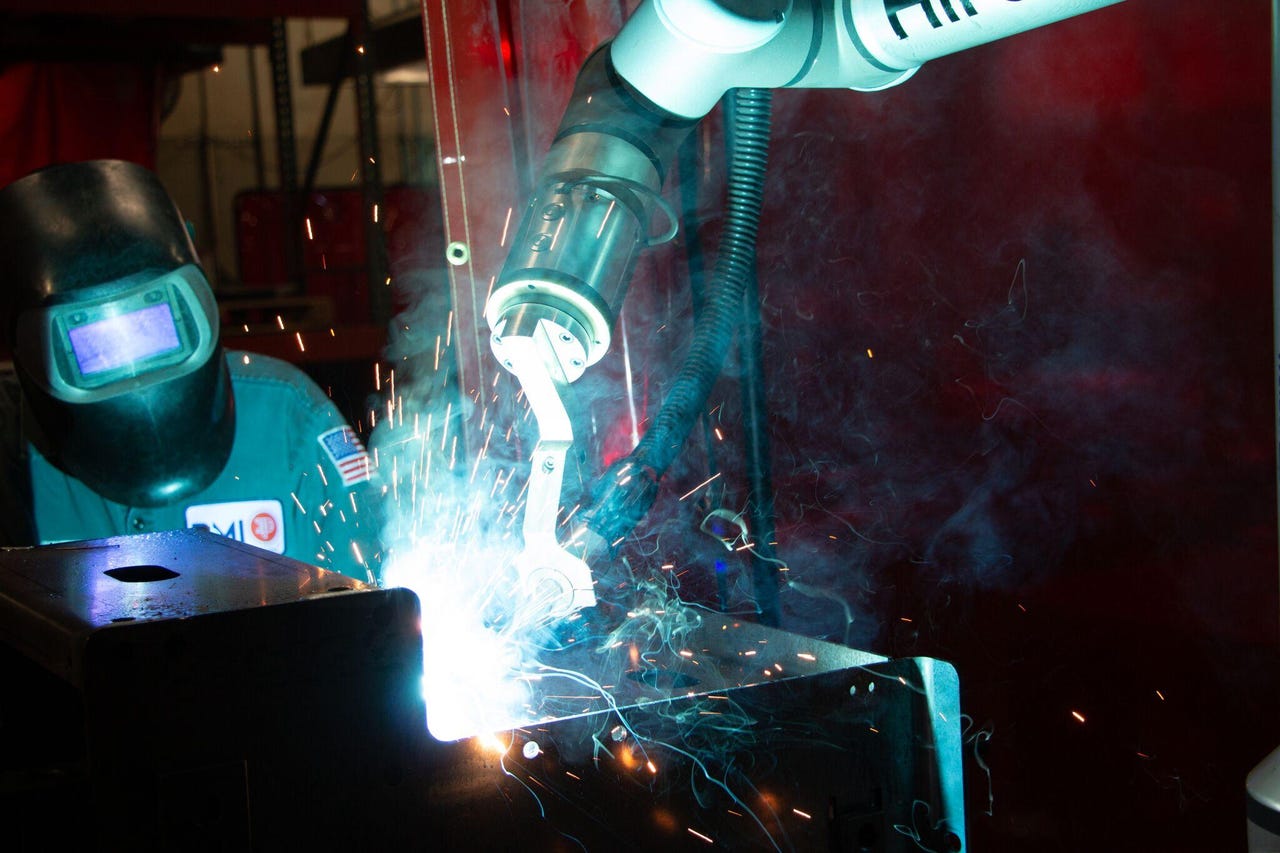

Do you work with a robot? Jokes about the boss aside, if you're in a growing list of sectors, including light manufacturing, components, oil and gas, and various kinds of applied sciences, it's increasingly likely the answer will soon be yes, if it isn't already

The robots that service these industries are called collaborative robots, or cobots, and they're becoming more capable and diverse in their assignments by the day. They're also becoming more prolific. A lot more prolific.

That's one takeaway from World Robotics Report by the International Federation of Robotics, which tracked a growth of 23 percent in annual installations of collaborative robots (cobots) from 2017 to 2018. In 2018 almost 14,000 new cobot arms were installed, and that number could double in three years.

Cobots were a standout in 2018, but the robotics sector as a whole grew impressively. According to the report, 422,000 units were shipped globally in 2018, an increase of 6 percent compared to 2017. Those numbers are especially telling given that some of the industries that are traditional automation consumers struggled, which points to the spread of automation to new sectors.

"We saw a dynamic performance in 2018 with a new sales record, even as the main customers for robots – the automotive and electrical-electronics industry – had a difficult year," says Junji Tsuda, President of the International Federation of Robotics. "The US-China trade conflict imposes uncertainty to the global economy – customers tend to postpone investments. But it is exciting, that the mark of 400,000 robot installations per year has been passed for the first time. The IFR´s longer term outlook shows that the ongoing automation trend and continued technical improvements will result in double digit growth, with an estimate of about 584,000 units in 2022."

The growth into new sectors is part of a larger trend of automation creep into areas like construction, mining, and healthcare, among others. Newly capable automation technologies are rapidly coming online as developers try to respond to labor crunches following strong global economies.

Globally, China continues to reign supreme as the world's largest industrial robot market, accounting for 36 percent of total units installed, more than the number of robots installed in Europe and the Americas together. Traditionally, China's bots have come from foreign suppliers, but the Made in China 2025 initiative has given domestic Chinese developers a leg up. Chinese robot suppliers increased their share of total installations on the domestic market by 5 percent, according to the report, while installations of foreign robot suppliers fell by 7 percent.

Robot installations in the United States increased for the eighth year in a row to a new peak in 2018 and reached about 40,300 units, a full 22 percent higher than in 2017.

The growth of the cobot market, in particular, which virtually didn't exist a decade ago, has been a boon to several down chain robotics companies, including those that specialize in end of arm tooling. End effectors are the equivalent of robotic hands, lending task-agnostic cobots specialized tools for various use cases. One of these companies, OnRobot, is praising the report as a sign of strong growth to come.

"In this growing market, OnRobot is poised to become the world's leading end of arm tooling manufacturer," says Enrico Krog Iversen, CEO of the company. "The target is to extend our number of products from 10 to 50 next year alone. With a single robotic system, a single platform for programming and training, and single vendor relationship, manufacturers now have access to a full range of tools, full robot compatibility, and virtually unlimited possibilities for collaborative applications."