Xero: A sole trader's take

Xero is fast becoming the go-to cloud accounting software platform for small businesses, with the company recently announcing that it has surpassed 200,000 subscribers in Australia. Of course, there's also an abundance of choice on the market, including MYOB's cloud offerings, Intuit's QuickBooks, Saasu, and Freshbooks, just to name a few.

The challenge is to find the right accounting software that best suits how your business works. A service-based business is unlikely to need inventory management features, and, by the same token, a retailer is less likely to use time tracking. Payroll capability is an unnecessary extra if you don't employ anyone, while multi-currency support would only be required if you deal with overseas suppliers or customers.

It's also important to remember that there is still a fair chunk of small business owners out there who get by with Excel spreadsheets, or even a paper-based system, and they might be looking to graduate to a cloud-based accounting product and the automated promise it brings.

This review is aimed at those potential users -- small business owners who have no experience in accounting software and are looking to perform three key tasks quickly and efficiently: Invoicing, bank feeds, and reconciliation of accounts. We also took into account the amount of time it takes to get set up, and the overall ease of use.

So how does Xero fare? We tested it over the course of a few weeks to find out.

Setup and invoicing

The setup process was fairly straightforward, and took about 10 minutes to get through. However, there are steps that will require input from your accountant, such as confirming your business' Chart of Accounts structure.

More on small business mobility

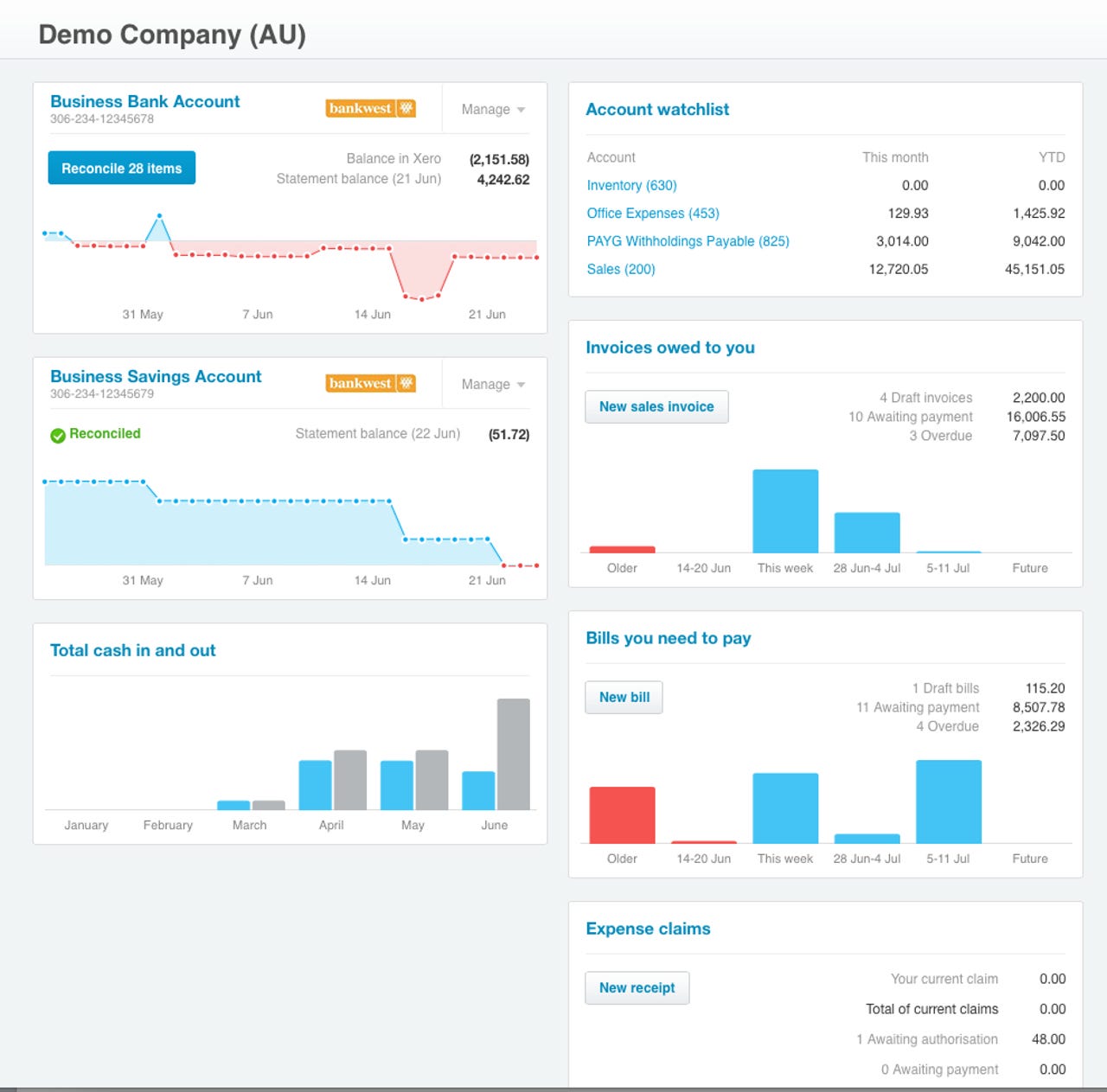

Once the setup process is complete, Xero will attempt to display a dashboard with settings that are relevant to your business. It's not foolproof, though, as it still displayed a fair few settings and menu items that weren't relevant to us. For example, we were presented with payroll and inventory management options, even though we specifically selected a sole trader service-based business. The default sales invoice template also incorrectly assumed that we were selling physical goods, and provided quantity and unit price columns instead of hours and rate.

As a point of comparison, Freshbooks -- which is exclusively designed for service-based small business owners like consultants, freelancers, and creative professionals -- required only the entry of a business name, email address, name, password, and what industry the business is in before we could start sending invoices and tracking time on projects. Unlike Xero, the default invoice template contained the correct fields that we needed right off the bat.

It's also worth noting that Xero lacks native time-tracking support, but this functionality can be added by installing an add-on product like Harvest from the company's marketplace. However, add-ons do usually incur a separate subscription cost.

Both Xero and FreshBooks have the very handy feature of displaying whether the customer has viewed the invoice, which could potentially be a time saver for a small business owner who would otherwise need to waste valuable hours chasing up lost invoices. The invoices also contain direct links to your preferred payment facility, such as PayPal.

Bank feeds and reconciliation

One of the real time-saving features of cloud-based accounting software is its ability to automatically record expenses and paid invoices by matching relevant transactions from your bank account or credit card. It means that you may never have to manually record a phone bill or rent payment again, while customer payments will automatically be reconciled with your invoices.

In order to do this, you will need to set up a bank feed for all of your relevant debit cards and accounts (excluding bank loans), which is very straightforward to set up from Xero's dashboard interface. Bank accounts only require the account name and number, while credit cards only require the last four digits of your card.

There are more than 30 Australian banks that support direct feeds, including the big four, but there are some exceptions, like ING. If your bank is not supported, then you can use a third-party add-on called Yodalee to pull transactions from your bank into Xero. The problem with Yodalee is that it requires you to enter your internet banking login details, which is a potential security risk that could open the door to fraudulent access. Keep in mind that if you do decide to disclose your password, your bank is unlikely to absorb any losses.

Once partner (direct) feeds are up and running, you'll no longer need to download and manually import bank statements to get transactions into Xero.

While bank feeds can save a significant amount of time, they're not always 100 percent accurate, and may require a bit of human intervention to get them working the way you like. For example, we needed to set up rules like logging all taxi, silver service, and Uber transactions in our dummy bank account to travel in Xero. Invoices containing a mixture of GST and non-GST items are another example where manual intervention will be required in order to correctly determine GST.

Nonetheless, this type of automation is a time saver that helps ensure the accounts are up to date, and increases the likelihood of everything being captured and claimed.

Xero makes the matching process fairly painless, tracking your bank statement balance as well as your balance in Xero, while allowing you to attach files like scanned receipts to record expenses. You can either directly match a transaction to an invoice or bill by simply clicking on the "OK" button, then mark it as a transfer, code it as an expense or revenue, or leave notes for someone else to see. We also like the one-step reconciliation process in Xero, as opposed to the tedious two-step process present in some other popular cloud-based accounting software.

Design

Xero doesn't have the legacy baggage of some of its competitors, with a UI that is built from the ground up with the cloud in mind. It's not as aesthetically pleasing as QuickBooks, but it's more straightforward, and scales well to different screen sizes.

Our one qualm with the Xero interface is the inability to hide some of the menu options. There are a lot of complex accounting features built into Xero that some small business owners won't need access to -- for example, payroll. Why not grant the ability to remove them from the UI altogether?

Support

Another key consideration for any business owner is the quality of the support. We submitted a few tickets during testing, and we usually received responses within 12 hours. There's also an extensive online knowledge base, with plenty of videos to walk you through the more common scenarios.

The downside is that Xero still doesn't offer telephone support or online live chat, which can be frustrating if you need to get an issue resolved immediately. QuickBooks offers live chat, while Canadian-based FreshBooks offers toll-free phone support, though it is largely outside of local business hours.

Final comments

There's no denying that Xero offers a lot out of the box, but its one-size-fits-all approach means that it isn't exactly an ideal starting point for some, such as a one-person operation requiring only the basics, like invoicing and time tracking.

Freshbooks is geared towards service-orientated solo business owners, and, as such, offers a better invoicing and time-tracking experience that is very easy to use. However, it doesn't support direct feeds with Australian banks, which makes expense recording a chore.

Xero -- like QuickBooks Online Plus -- offers a lot, as long as you're willing to invest the time to learn its accounting structure. Xero's shortcomings in invoicing and timekeeping can always be addressed through the use of add-ons (at an additional cost), and its scalability means that it can grow with your business. It also helps if you're using accounting software that your accountant is likely to be familiar with, which should go a long way in making your life easier around tax time.