Xinja Bank gets full Australian banking licence

The Australian Prudential Regulation Authority (APRA) has handed out another banking licence to a new player in the market, with neobank Xinja Bank granted a licence to operate as an authorised deposit-taking institution (ADI) without restrictions.

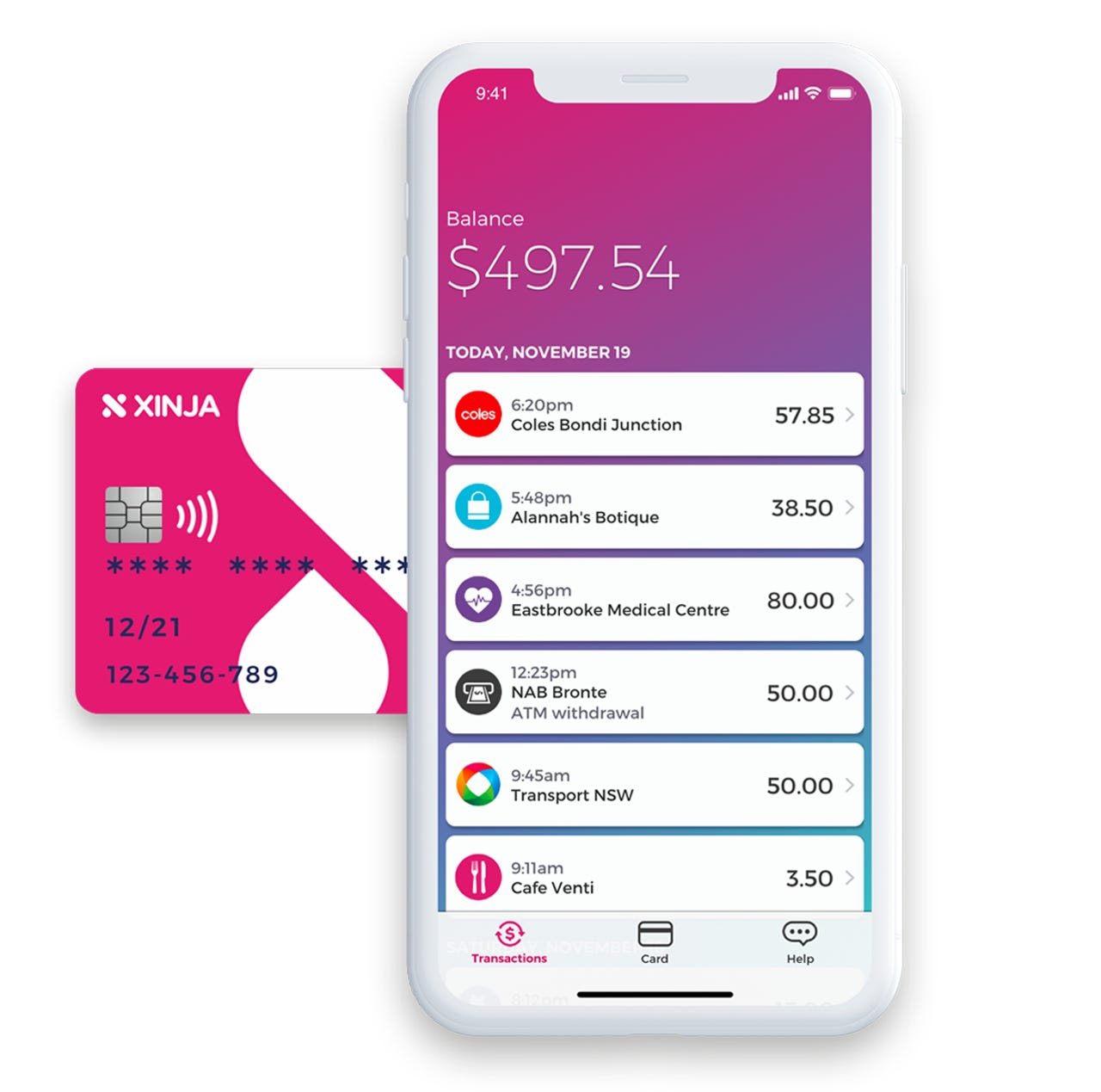

The green light from APRA on Monday means Xinja can start rolling out transaction accounts to customers. The accounts are accessed solely via the company's app and come with a Xinja Debit Mastercard.

Xinja Bank is 100% digital and designed for mobile, with founder and chief executive Eric Wilson saying the company plans to shake up Australia's old-style bank sector.

"It's enormously exciting that Australians have a new, independent bank," he said. "It's time Australia's very old banking model was disrupted. We are 100% digital, and we want people to have a real alternative to the incumbent banks. We want to give customers a real choice to be able to be with a bank that looks after them."

Xinja said it would soon launch "Stash" savings accounts, and plans to add lending products in the first quarter of 2020, "as well as some other fun, 'unbanky' surprises".

Xinja was previously licensed by APRA in December 2018 as a Restricted ADI.

The company has had products in the marketplace and customers on board since 2018. It has distributed more than 12,000 prepaid cards and said over 28,000 people have already signed up for Xinja.

Xinja said that as its offering is built on new technology, it's designed for flexibility, allowing the roll out of additional services "driven increasingly by the dynamic use of data".

"This is what banking should be," Wilson added. "Hyper-personalised services that leverage customers' data in their interests. We don't have bricks and mortar branches or old technology that we are constantly patching to meet the needs of customers."

APRA similarly in July granted 86 400 Ltd a licence to operate as an ADI.

The other two fintech startups that have been granted a full ADI licence in a little over a year are Volt and Judo, which were given APRA approval in May 2018 and April 2019, respectively.

RELATED COVERAGE

- Starling built a bank from scratch in the cloud

- Aussie fintech Volt Bank starts by asking consumers what they want

- Australia's open banking regime: Generic product data available from 1 July

- Banks warned of unhappy customers as tech giants join fintechs as competition

- CBA preparing for 'digital gorillas' to join fintechs as competitors

- Boards of Australian financial firms face tougher infosec rules from 1 July

- Why Westpac is making 'frenemies' with fintechs (TechRepublic)