Starling built a bank from scratch in the cloud

Starling Bank is a 100 percent mobile, cloud-based bank that operates out of the United Kingdom. The company was founded in 2014 by Anne Boden, who was previously the chief operating officer of Allied Irish Banks.

AWS re:Invent

The startup was opportunistic, and in a time when the United States had stopped granting licences to financial services providers in the aftermath of the global financial crisis, the UK was doing the complete opposite, almost handing them out like candy.

"There isn't really an equivalent of Starling in the US because up until the GFC, the US regulators were really good at issuing financial licences ... since then they've only given out about two or three," Starling Bank chief platform officer Megan Caywood told AWS re:Invent on Tuesday.

Pre-financial crisis, the UK didn't issue any bank licences, but Caywood said the regulators became keen on innovation and began issuing something known as Option B, which enables tech startups like Starling to start a bank from scratch with a full bank licence so they can compete with the bigger banks.

All of the regulators were supportive as they had been looking for new ways to make banking more transparent post-2008.

She said that up until 2008, banks were reasonably good at keeping up with technology and change, but after the GFC, large amounts of regulations were imposed and there began to be distance between what a consumer wanted and what a bank was offering.

This became even more disparate with the launch of the iPhone, which occurred in the same year.

"It completely changed the game," Caywood added.

Starling was granted a banking licence by the Bank of England in July 2016 after raising £48 million and launched its first mobile-only personal current account in May 2017 available as a mobile app for both iOS and Android phones.

It followed this with the UK's first digital-only business bank account in March 2018.

The London-based startup first tackled the process of opening a bank account, but it looked at it from the perspective of being a tech company, not a bank.

"At a bank, you'd usually have to go into a branch location, bring a lot of documents, come back with another utility bill -- it would be a long process and it would be rather painful," Caywood continued.

"So we made it such that you could just go into the app store, download Starling, open a bank account in less than three minutes from your phone, provision a card with Google Pay or Apple Pay, or whatever you prefer, and then start to use it immediately."

Being completely cloud and mobile-based, Starling's cost basis is much lower than traditional institutions; it doesn't charge fees and makes the majority of its money from Mastercard Interchange, and the new bank even pays interest.

"It's only possible because of the way that we use the tech," she explained.

While competitors at the time were focused solely on the consumer interface, often building on top of other banking templates, Caywood said Starling saw the backend tech as a huge differentiator.

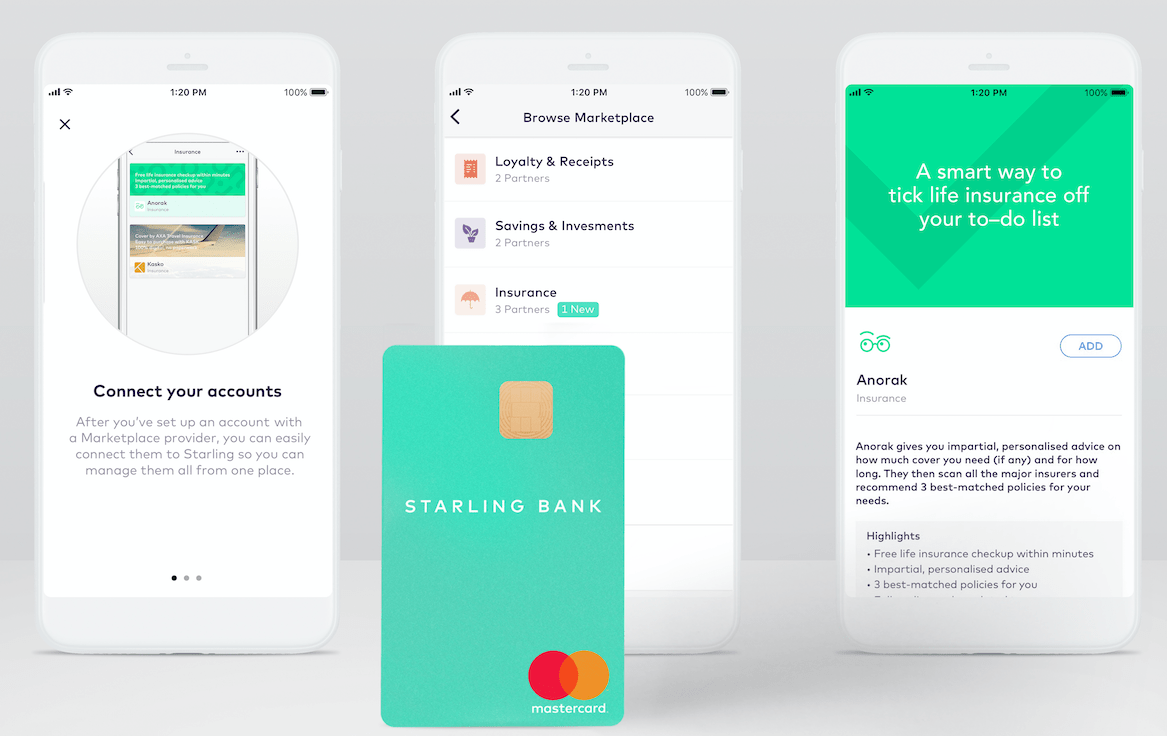

Starling began with the idea of being a platform that offers the world's best current account.

"But for every other financial service -- savings, investments, mortgages, and loans -- we wanted to allow those providers to plug in to offer them to our customers," she said.

Starling built a bank with an open API from day one.

"This was pretty unheard of in banking ... APIs really changed the way the software was brought to market and consumed ... rather than reinventing the wheel, we strategically integrated in those services via API instead," Caywood said.

Starling Bank used AWS to build all of its infrastructure.

It currently uses AWS for secure virtual server hosting through Amazon EC2; a fully-managed, scalable database engine with Amazon RDS; automated cloud services from AWS CloudFormation; data lake data storage and retrieval with Amazon S3; and runs code without provisioning or managing servers through AWS Lambda.

Disclosure: Asha Barbaschow travelled to AWS re:Invent as a guest of AWS

RELATED COVERAGE

- London's tech startups are booming, but their biggest challenge is just around the corner

- Wells Fargo: Banks entering a legal quagmire in the name of technology

- APRA advises regulated entities to manage risks when adopting cloud

- Banks warned of unhappy customers as tech giants join fintechs as competition

- Why NAB won't be upgrading its core banking platform any time soon

- Here's what developers really think about AWS, Microsoft Azure, and Google Cloud (TechRepublic)

- Cloud lessons: Five tips for firms moving to AWS (TechRepublic)