Yahoo's dwindling search share: Time to panic?

Microsoft's Bing search engine continues to grab market share from Yahoo in a perverse dance before these two companies partner in an attempt to conquer Google.

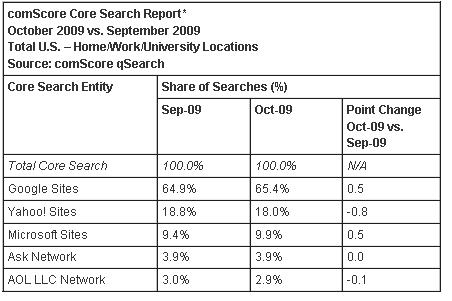

The latest comScore stats tell the tale. Simply put, Microsoft has nearly garnered 10 percent market share as Yahoo gives ground monthly. Google continues to gain share.

Now compare this to the picture at the end of 2008:

The twisted part: Microsoft and Yahoo are future partners on search (assuming regulators play along).Since then, Microsoft has systematically grabbed share from Yahoo. It appears that Microsoft will grab its search share with or without Yahoo. And if Microsoft acquires Ask.com, which may be on the block, the software giant picks up more share. Bottom line: Microsoft

Is it time for Yahoo to hit the panic button? Bernstein analyst Jeffrey Lindsay addresses the issue in a research note Wednesday.

At a high-level Lindsay reckons:

- Since the Yahoo-Microsoft deal was negotiated Microsoft has grabbed 130 basis points of U.S. search queries.

- 18 percent market share for Yahoo is an unprecedented low.

- Each 100 basis points of share loss equals a penny of earnings per share.

- Yahoo's 18 percent market share in search is worth $6 per share to investors.

- Yahoo's search share could fall nearly 4 points before the deal closes.

Lindsay writes:

The deal structure gives Microsoft a perverse incentive to try and gain search share from Yahoo! rather than Google. As Microsoft cranks up its marketing engine to promote trial of Bing, the player it seems to be hurting most is Yahoo! followed at some distance by AOL. Whether this is a deliberate tactic by Microsoft (which we think unlikely) or not, the 130 bps of search share lost by Yahoo! to Bing we estimate has already cost Yahoo! shareholders $0.40/per share.

Even with all of those moving parts, Lindsay says that the financial impact isn't as severe as some folks fear. Yahoo's owned and operated sites carry the day. Simply put, Yahoo is more destination than search player.

Nevertheless, Yahoo is in a dangerous limbo here. Yahoo's search team is more likely to be focused on sending resumes than advancing the ball. Advertisers are holding out for the deal to close before picking sides and they're likely to go to the alpha male in the Microhoo deal---Microsoft.

And the biggest problem: Google isn't standing still. Google is ramping up its mobile features and adding features and functionality at a rapid clip.

Also: Yahoo, Microsoft extend negotiations for search pact

- Yahoo: Major businesses have stabilized; update on Microsoft deal

- Yahoo pays its 'technical debt' with IT overhaul

- Yahoo's search strategy: We're not fighting "the megawatt war"

- Yahoo-Microsoft deal: Details from the SEC filing

- Ballmer on the Microsoft-Yahoo deal: 'Nobody gets it'

- Microsoft-Yahoo: Gauging the IT integration risks

- It’s official: Microsoft-Yahoo ink 10-year search pact; Regulator scrum begins