Yahoo's first quarter good; Not good enough for a higher Microsoft bid; Yang wants more

Updated: Yahoo CEO Jerry Yang said he was "open to all and any alternatives including a sale to Microsoft" following the company's first quarter results. The brief comments indicate Yahoo hasn't ruled out a Microsoft purchase, but wants something better than the software giant's $31 a share offer.

However, Yang declined to talk about potential strategic alternatives with its international holdings or other partnerships.

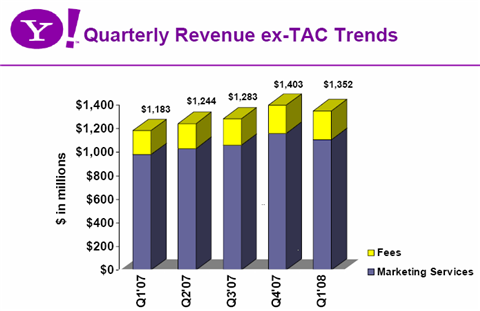

Yang made the comments on Yahoo's first quarter earnings conference call (notes from News.com and Silicon Alley Insider). Yahoo reported first quarter earnings Tuesday of $542 million, or 37 cents a share, on revenue excluding traffic acquisition costs of $1.35 billion. The highly anticipated report isn't likely to force Microsoft to raise its bid. Yahoo's net income was padded by $401 million -- a gain from the Alibaba IPO. Yahoo estimated that the value of Alibaba and its overseas investments amounts to about $10 a share.

Excluding one-time items, Yahoo reported earnings of 11 cents a share. Wall Street was expecting the company to report earnings of 9 cents a share on revenue of $1.32 billion, according to Thomson Financial.

Yang said he was "very proud" of Yahoo's results, noting that the results were in the top half of its projected range. He noted that Yahoo bucked economic uncertainty.

To say Yahoo's earnings report (statement) was highly anticipated is quite an understatement. The report could have altered the course of the Microsoft bid--either forcing Steve Ballmer & Co. to raise its $31 a share offer or even giving the software a giant an excuse to really play hard ball and lower it.

Instead, Yahoo's report is right down the middle--unlikely to move Microsoft either way. In fact, Yahoo's quarter is anticlimactic, as Microsoft is already playing the game with Ballmer telling Reuters that Yahoo's results aren't going to change his plan. That leaves room for a lot of yapping among Wall Street, pundits, Microsoft, Yahoo and even Google and AOL on Wednesday, followed by Microsoft earnings on Thursday, and a proxy war deadline on Saturday.

Yang kicked the games off on the conference call, noting that Yahoo has valuable assets. He talked up AMP, Yahoo's ad network. Yang reiterated that Microsoft's bid undervalues Yahoo. "Our board and management team continues to be open to all and any alternatives including a sale to Microsoft," said Yang.

Among other notable conference call nuggets:

- Yahoo president Sue Decker outlined the company's social networking efforts and added that the company isn't aiming to be a social networking site. Instead, Yahoo will integrate social tools into its properties and "facilitate social connections."

- Decker touted Yahoo's search progress, which she measured on relevancy rates. "We've come from behind 18 months ago to close the relevancy gap," she said. Seems like Yahoo's new mantra will be relevancy not market share. Decker said the goal is to deliver 10 percent compound search growth over the next three years.

- Decker also said Panama is strong, delivering good gains. "The financial gains we saw in 2007 are continuing into the first quarter," said Decker. Of course, there's an elephant in the room: If Panama is so hot why do the limited test with Google? Decker said there is significant upside to price per click pricing.

- Speaking of Google, Decker addressed outsourcing search to its rival. She said "we've narrowed the monetization gap," but "there may be more than one way to achieve that goal."

- CFO Blake Jorgensen said acquisitions and currency exchange rates (weak dollar) each contributed 2 percent to Yahoo's growth. That statement implies a slower organic growth rate.

- Slowdown in the U.S? Decker said that financial, travel and retail sectors are seeing declines in display and search advertising. "Where we're seeing weakness we're seeing it in both," she said

Yahoo projected second quarter revenue of $1.73 billion to $1.93 billion with operating income before depreciation, amoritization and stock based compensation of $425 million to $475 million. It's not clear how that translates to Thomson Financial estimates given that analyst exclude TAC.

Wall Street estimates for the second quarter (earnings of 11 cents a share on sales of $1.37 billion) are slightly higher.

In the statement, Yang maintained his optimistic outlook through 2010 saying:

We believe we can significantly accelerate our revenue growth, return to our historically high margins, and double our operating cash flow by 2010. This quarter’s solid performance underscores the fact that we are executing on that plan. Yahoo! is beginning to realize the benefits of the very substantial and deliberate long-term investments we’ve made to capitalize on the opportunities ahead in display and to recapture momentum in search.

By the numbers (revenue includes TAC):

- Revenue on a gross basis was $1.82 billion, up 9 percent from a year ago.

- Traffic acquisition costs in the first quarter were $465 million, down from $488.7 million a year ago.

- Operating expenses were higher than a year ago. Total operating expenses for Yahoo were $942 million in the first quarter, up from $789 million. For instance, sales and marketing expenses were $424.6 million, up from $367 million. Product development costs were $305.6 million, up from $239 million a year ago.

- U.S. revenue was $1.3 billion, up 19 percent. International revenue was $510 million, down 11 percent from a year ago. The international revenue decrease may indicate that Yahoo is losing ground abroad to Google. It also indicates that Yahoo can't get the weak dollar pop that other technology companies have.

- Marketing service revenue was $1.57 billion, up 7 percent from a year ago. Marketing services revenue from owned and operated sites was $966 million, up 18 percent from a year ago, with affiliate revenue falling 7 percent to $606 million.

- Severance pay and charges related to Yahoo's restructuring was $29 million.

- Yahoo generated first quarter free cash flow of $647 million, up 75 percent from a year ago. The rub: That free cash flow includes a $350 million one-time payment from AT&T.