Coursera Q1 growth strong across consumer, enterprise, degrees

Coursera showed better-than-expected first quarter revenue and noted that education's digital transformation is in the early innings.

The company reported a first quarter net loss of $18.66 million, or 45 cents a share, on $88.36 million, up 64% from a year ago. Non-GAAP loss for the first quarter was 32 cents a share.

Wall Street was looking for first quarter revenue of $82.32 million and a non-GAAP loss of 31 cents a share.

Coursera CEO Jeff Maggioncalda said "we believe the digital transformation of higher education is only in the early innings." The COVID-19 pandemic has accelerated online learning and companies such as Coursera and Chegg have benefited.

- The most popular programming languages and where to learn them

- Microsoft adds new Azure specializations to Coursera

- Online learning firm Coursera climbs 18% in stock market debut

- Coursera launches private Guided Projects

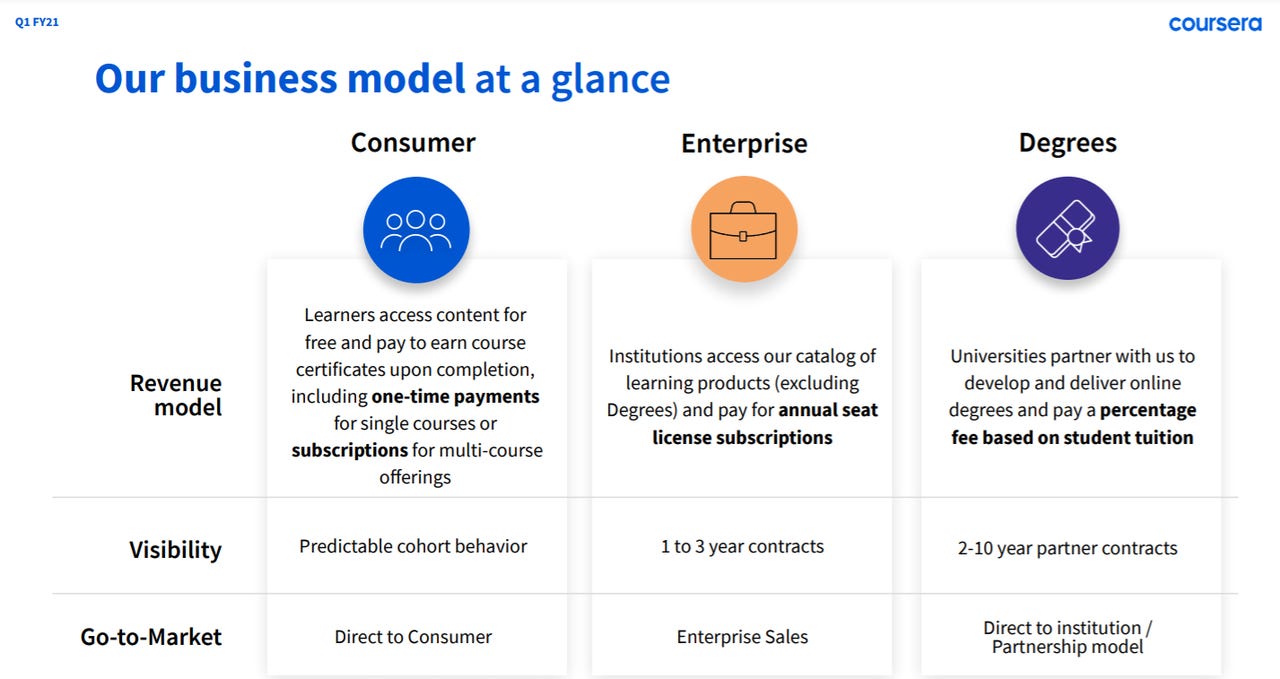

Consumer revenue remains the biggest chunk of Coursera, but enterprise and degree sales also grew in the first quarter. Here's the breakdown:

- Consumer revenue in the first quarter was $51.9 million, up 61% from a year ago. Coursera's professional certifications showed strong growth. Coursera added 5 million new registered users to end the quarter with 82 million.

- Enterprise revenue was $24.5 million, up 63% from a year ago. Paid enterprise customers were 479 as of the end of the first quarter. Companies are using Coursera for upskilling and reskilling.

- Degrees revenue in the first quarter was $12 million, up 81% from a year ago. For degree programs, Coursera revenue is a fee since students pay tuition directly to the university. Coursera had 13,493 degree program students at the end of the quarter.

For the second quarter, Coursera projected revenue between $89 million and $93 million. For 2021, Coursera expects revenue of $369 million to $381 million.