2012 tech mergers to be pushed by cloud, social, says PwC

The outlook for 2012 mergers and acquisitions in the technology industry is expected to be strong as giants aim to nudge their way into new markets such as social, cloud computing and big data, according to a report from PwC.

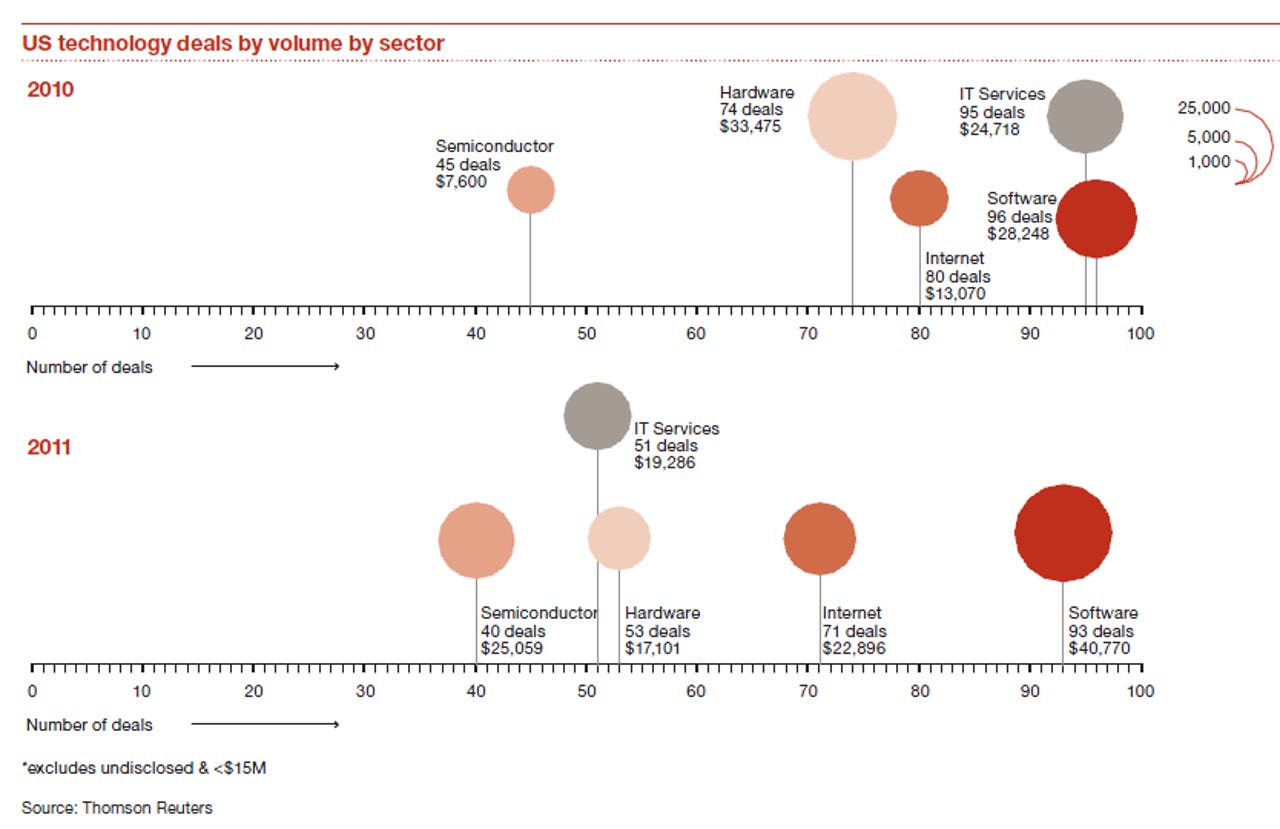

In a report, PwC the volume of 2012 deals is likely to mirror 2011's tally. Tech M&A deals checked in at $125 billion in 2011, up from $107 billion in 2010. Deal volume, however, fell. Big deals from HP (Autonomy), Intel (McAfee), Texas Instruments (National Semiconductor), and Microsoft (Skype) drove the 2011 totals. PwC said:

The consumerization of products has pushed businesses to adopt technologies in the enterprise that have consistently been favorites at home. Some technology majors have more fully developed strategies to position themselves as cloud leaders, buying up players in the fragmented cloud market in the process. Social media has moved to center stage with announced and completed IPOs by several prominent businesses, and rumblings among businesses on methods to adopt social media platforms as an enterprise collaboration solution. All of these trends bode well for M&A activity among tech companies in the coming year.

Meanwhile, transformation deals---HP buying Autonomy and Google acquiring Motorola Mobility---are expected to become the norm. Large players---SAP and Oracle---are looking to build their cloud stack as a way to hedge their existing businesses.

Here's a look at the charts: