APRA granted 20 banking licences in 12 years, with 10 since 2018

Since the Australian Prudential Regulation Authority (APRA) reworked its banking licence process in 2018, the regulator has seen an increase in applications and has granted 10 licences.

At the time, the regulator introduced a restricted authorised deposit-taking institutions (ADIs) licensing framework that was aimed at providing an alternative pathway to a full licence for new banking entrants.

APRA said such a framework was designed to support new entrants and accommodate different business models, "with the added benefit of removing barriers of entry into the market while not materially lessening entry standards that serve as important protections for the Australian community".

A potential new entrant, under this framework, is able to seek a restricted ADI licence. APRA explains that once granted, the applicant has two years to meet the full prudential framework requirements.

"This facilitates entry to the banking sector, allowing a new entrant to conduct limited banking business while developing their capabilities and resources," APRA said in its submission [PDF] to the Select Committee on Financial Technology and Regulatory Technology and its probe into the opportunities the two vectors present to Australia.

If the applicant, however, is unable to meet the requirements of the prudential framework within two years, the holder of a restricted licence would need to exit the banking industry "in an orderly fashion".

"Since the formation of the central team and the new licensing process there has been a considerable increase in licensing activity," APRA wrote.

"A large number of fintech firms have had early contact with APRA, some of which have progressed through to a formal application and a number have successfully been granted a licence."

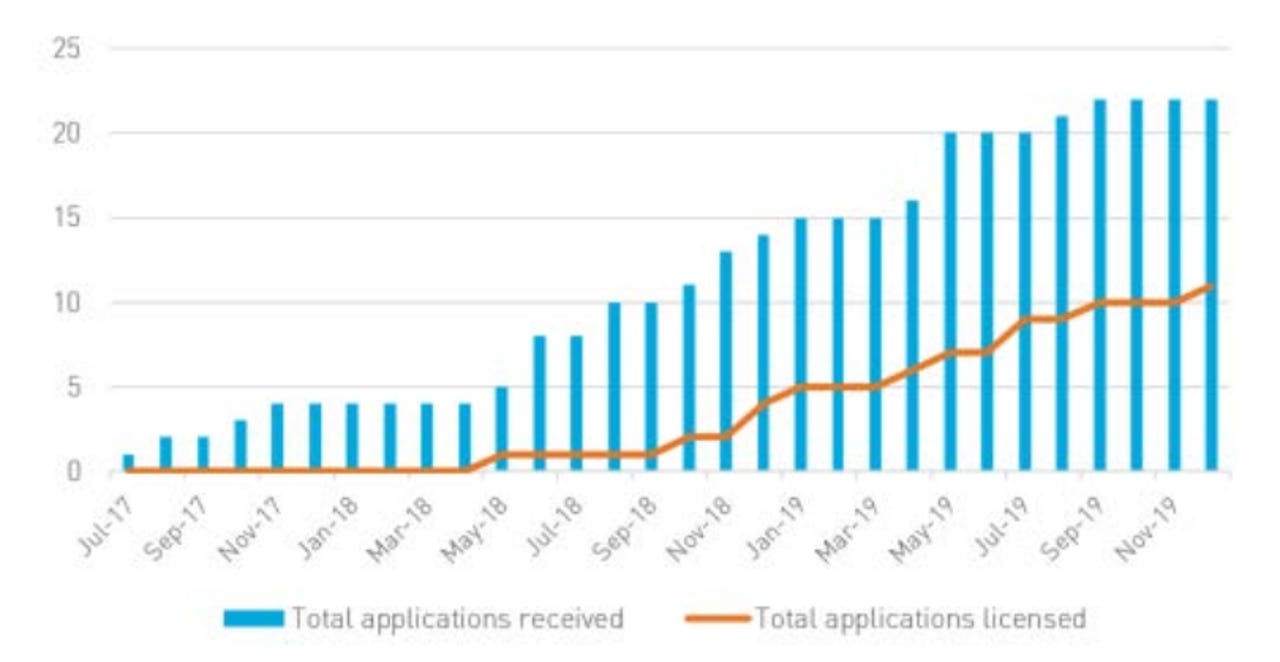

Total applications received and licensed since 2017

In the 10 years prior to July 2018, 10 banking licences were issued with only one being a locally incorporated ADI.

Since then, APRA has received a total of 64 ADI-related enquiries, 24 pre-applications, 14 applications, and granted 10 applications.

Included in these 10 licences are four Australian fintechs: Xinja Bank, 86 400 Ltd, Judo, and Volt who were each granted a full ADI licence, which allowed them to start rolling out transaction accounts to customers.

APRA charges AU$110,000 to apply for an ADI licence.

As the committee looks into the challenges facing the fintech space, APRA took the opportunity to highlight three non-regulatory challenges faced by applicants as they enter the sector: Access to capital, customer acquisition, and recruiting staff.

"Fintech and regtech can provide many benefits to the financial system and individual institutions," APRA said. "APRA regulated institutions often introduce new technology, outsource technological aspects of their business, or use fintech or regtech services, including through formal partnership arrangements or as part-owners of the fintech or regtech provider."

DIGITAL WALLET REGULATION

Through the Council of Financial Regulators (CFR), APRA, alongside the Reserve Bank of Australia (RBA), the Australian Securities and Investments Commission (ASIC), and the Treasury are reviewing the Payments System (Regulation) Act 1998.

The idea is to reduce complexity, increase competition, and foster innovation, which APRA said would lead to "improved consumer outcomes".

The work follows recommendations from both the 2014 Financial System Inquiry and the Productivity Commission's 2018 inquiry into competition in the Australian financial system.

The CFR recently delivered a paper setting out its recommendations for a new graduated framework for stored value facilities.

"The new framework is intended not only to be fit for purpose for the current financial system but also be able to accommodate future developments and technological advances, such as proposals for global stable coin eco-systems that have been the subject of significant attention in recent months," APRA said.

APRA said under this proposal, its role in the framework would be to oversee wallets that are widely used as a means of payment and store significant value for a reasonable amount of time -- which could potentially include Facebook's Calibra proposal.

APRA's framework, however, would not require it to capture digital wallets that are primarily used to pass payments through, such as Apple Pay.

RELATED COVERAGE

- APRA received 36 infosec breach notifications from financial services boards

- Starling built a bank from scratch in the cloud

- Aussie fintech Volt Bank starts by asking consumers what they want

- Banks warned of unhappy customers as tech giants join fintechs as competition

- Commonwealth Bank focused on innovating amid pressure from fintechs

- Why Westpac is making 'frenemies' with fintechs (TechRepublic)