Best Buy cuts outlook; Sees 'most difficult climate ever seen'

Best Buy said Wednesday that it is facing "rapid, seismic changes in consumer behavior have created the most difficult climate we’ve ever seen" and cut its earnings and revenue projections. Indeed, Best Buy's same store sales fell a whopping 7.6 percent for October.

The company's outlook comes two days after rival Circuit City declared bankruptcy.

In a statement, Brad Anderson, CEO of Best Buy didn't sugar coat anything:

“Since mid-September, rapid, seismic changes in consumer behavior have created the most difficult climate we’ve ever seen. Best Buy simply can’t adjust fast enough to maintain our earnings momentum for this year. We’re beginning to adjust our cost structure to restore earnings momentum and still gain market share. We firmly believe that our strategy of customer centricity is of great value in driving our performance versus the industry, and that’s the strategy we plan to pursue to continue to strengthen our position in the marketplace.”

That cost structure Anderson refers to is all about Best Buy's expansion plans. The company was steadfast on expanding and taking advantage of Circuit City's demise. Now Best Buy is playing defense and cutting spending and inventory levels. Best Buy added that it is "working with its vendors to adjust both its inventory levels and its near-term working capital position." That inventory crunch will ripple through the tech sector and companies like Apple, HP and Dell among others.

By the numbers, Best Buy said that its same store sales for the last four months of its fiscal year ending February 2009 could fall 5 percent to 15 percent. That drop would bring Best Buy's annual same store sales down 1 percent to 8 percent.

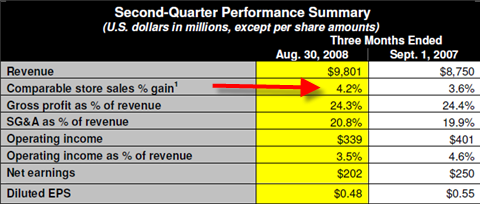

The charts tell the tale. Here's a look at Best Buy's fiscal second quarter same store sales:

And what has happened since:

In other words, October was a complete disaster. That October drop-off will translate into annual revenue of between $43.7 billion to $45.5 billion, including Best Buy Europe, with earnings of about $2.30 a share to $2.90 a share. The midpoint of that range means earnings will fall 17 percent from fiscal 2008. Wall Street was looking for earnings of $3.03 a share.

Best Buy isn't even coming close to its prior guidance. The company said in September that earnings would be $3.25 to $3.40 a share in fiscal 2009 with same store sales up 2 to 3 percent.

Brian Dunn, chief operating officer of Best Buy added:

“In 42 years of retailing, we’ve never seen such difficult times for the consumer. People are making dramatic changes in how much they spend, and we’re not immune from those forces."

Looks like a bah humbug holiday season for electronics this year.