Best Buy earnings disappoint: Sees weak consumer tech spending

Best Buy's fiscal second quarter results fell short of expectations and the company cut its outlook amid "challenges to overall consumer spending and lower consumer electronics industry sales."

Specifically, Best Buy reported second quarter earnings of $177 million, or 47 cents a share, down from 60 cents a share a year ago. Revenue was $11.34 billion, flat compared to the second quarter a year ago. Wall Street was expecting Best Buy to report second quarter earnings of 53 cents a share on revenue of $11.47 billion.

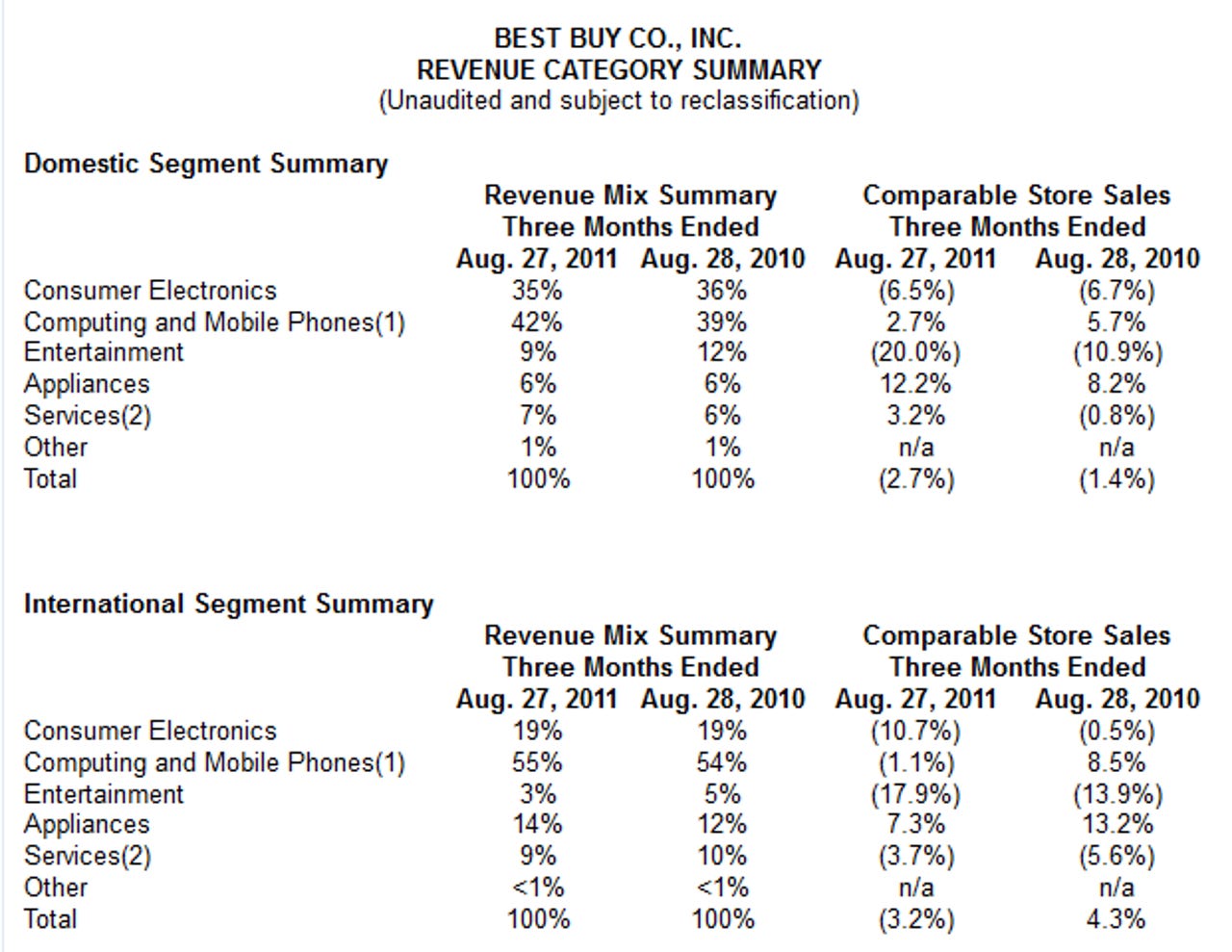

In the second quarter, same store sales were down 2.8 percent from a year ago.

As for the outlook, Best Buy projected fiscal 2012 revenue to be between $51 billion and $52.5 billion with same store sales flat to down 3 percent. Wall Street was looking for revenue of $52 billion.

For fiscal 2012, Best Buy said earnings would be between $3.35 a share to $3.65 a share. Those results include a boost from share repurchases that will boost earnings 20 cents a share to 25 cents a share. Excluding share repurchases, Best Buy said its earnings outlook is lower than the $3.30 a share to $3.55 a share before. Wall Street was expecting fiscal 2012 earnings of $3.46 a share.

Among the key data points:

- Online revenue was up 13 percent in the quarter.

- Tablet and e-readers sales were strong in the U.S., but those gains were offset by weak TV, gaming, camera and physical media sales. Mobile phone same store sales fell 5 percent because there was a dearth of new phones launched in the quarter.

- Inventory was up slightly from a year ago at $6.4 billion.

- Best Buy ended the quarter with cash and equivalents of $2 billion.