Best Buy's fourth quarter: Strong earnings, mixed demand picture

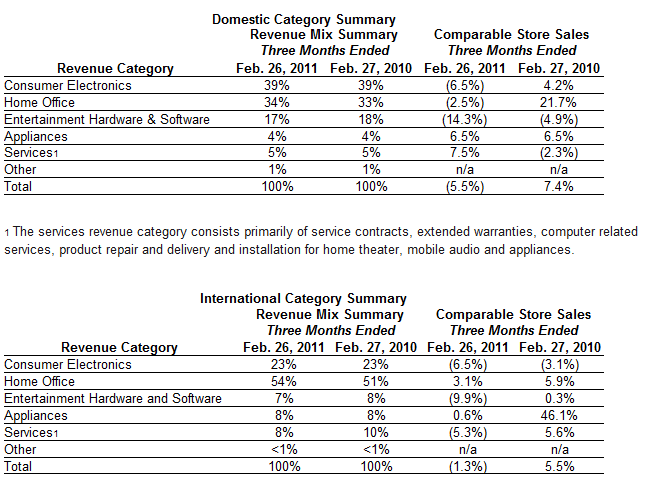

Best Buy reported strong fourth quarter earnings, but many of its categories---consumer electronics, home office and entertainment hardware and software---are sucking wind. The one growth area: Services like repair, extended warranties and installation.

The electronics retailer reported fourth quarter earnings of $651 million, or $1.62 a share, on revenue of $16.25 billion, down from $16.55 billion a year ago. Non-GAAP earnings were $1.98 a share. Wall Street was expecting earnings of $1.85 a share on revenue of $16.3 billion.

For fiscal 2011, Best Buy reported earnings of $3.08 a share on revenue of $50.3 billion, up 1 percent from a year ago. Online revenue for fiscal 2011 was up 14 percent from a year ago to $2.5 billion.

As for the outlook, Best Buy projected fiscal 2012 revenue of $51 billion to $52.5 billion. Same store sales will be flat to a decline of 3 percent and earnings will be about $3.28 a share to $3.53 a share. Non-GAAP fiscal 2012 earnings will be $3.30 a share to $3.55 a share. Wall Street was expecting earnings of $3.56 a share on revenue of $52.13 billion.

Despite the solid results, the demand picture is a bit mixed. Among the key points:

- Same store sales were down 4.6 percent in the fourth quarter.

- Entertainment software and hardware sales in the U.S. and TVs had a "low double-digit decline." Best Buy said "consumer demand in new television technologies had not yet emerged as a significant revenue driver."

- Laptop sales were down in the fourth quarter in mid-single digits due to tough year ago comparisons because of the Windows 7 upgrade cycle. Sales of tablets offset some of those declines.

- Mobile phones and smartphones had low double-digit sales increases.