IAC: Shareholder value or money pit?

IAC reported its first quarter earnings on Wednesday and it's the usual mix of mental hurdles, GAAP reconciliations and imagining what it could be. The big question: Is IAC really worth your time?

IAC, an Internet conglomerate that's Barry Diller's baby, is planning to break itself up into five chunks--a new IAC that will include Ask.com and other Internet properties, a retailing unit (HSN), LendingTree (real estates and loans), Interval (condos and vacations) and Ticketmaster. The conglomerate's results (Techmeme): Net income of $52.8 million, or 18 cents a share, on revenue of $1.6 billion. Sales were up 8 percent from a year ago and earnings were down 8 percent from a year ago.

But where things really get interesting is IAC's "imagine this" technique with its results. The company details what IAC will look like once all the spin-offs happen.

"With this quarter's results, it couldn't be clearer that we are on the right course in separating IAC into 5 distinct public entities. Each of the businesses have their own unique opportunities - some with current challenges and others with wind at their backs," said IAC's Chairman and CEO, Barry Diller in a statement.

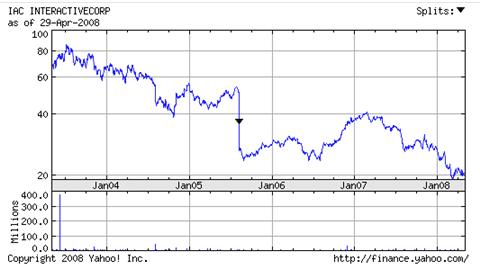

Just what IAC shareholders need: Another magic potion to deliver shareholder value. First, folks were told IAC's willy nilly business model would be e-commerce utopia. Then there was the purchase, addition and then subtraction of Expedia. And now a five-way breakup is supposed to deliver shareholders to the promise land.

Color me skeptical. Maybe it's the IAC shareholder value delivered over the last five years:

Diller's fix? Hypothetical results summed up in this chart.

You don't need to be an accountant to realize that the remaining IAC is half decent and the rest falls into two categories (junk and semi-junk). The bright side for what will remain of IAC after the spin-offs is that Google is improving monetization.

But overall the quarter had its "usual plusses and minuses," according to Merrill Lynch analyst Justin Post. One of the big minuses is that IAC always requires you to perform mental gymnastics to figure out if the company is worth your time. Simply put, there are too many moving parts to take IAC all that seriously.