Intuit rides taxes, SMB to solid Q3

Intuit's fiscal third quarter, which usually brings home the profits due to tax preparation, got a little push from its focus on small businesses.

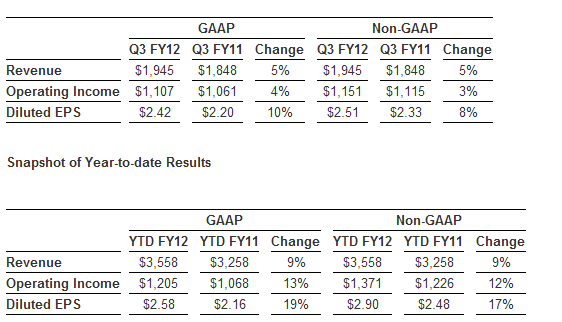

The company reported third quarter earnings of $734 million, or $2.42 a share, on revenue of $1.94 billion. Non-GAAP earnings were $2.51 a share, three cents better than expectations.

Intuit has been transitioning from a package software model to one based on services for years. For small businesses, Intuit is often the cloud ERP system. For instance, QuickBooks Online and Enterprise revenue was up 29 percent from a year ago.

The company also recently acquired Demandforce to bolster its small business focus.

On a conference call, CEO Brad Smith said the tax business growth was slower than expected. He said:

We continue to be at the center of the shift to digital tax prep which we estimate grew at 5% this year even when we didn't do our job and play our best game. We will apply what we learned this year as we look forward to next tax season.

Smith was more upbeat about SMB. He said:

This quarter QuickBooks Online subscribers grew 31% and while we are still early in our global expansion we have seen signs of success in markets outside the U.S. as well. Our small business payroll service is also benefiting from a shift to the cloud.

For the fiscal year ending July 31, Intuit projected non-GAAP earnings of $2.92 a share to $2.97 a share on revenue of $4.2 billion to $4.22 billion. For the fourth quarter, Intuit projected non-GAAP earnings of 5 cents a share to 7 cents a share on revenue of $647 million to $662 million. Those results were in line with expectations.