One in three banks ignoring core systems, just 6% prioritising IT security: Capgemini

More than one-third of banking and financial services organisations are doing nothing to revise their core operational and payment systems – and just 6% are prioritising IT security – despite increasing competitive pressures and demand for towards real-time processing, a survey of banking executives has found.

The Capgemini survey – conducted amongst a live audience at FST Media’s recent Future of Banking & Financial Services conference – found that while 21% said systems modernisation was their top corporate priority, fully 36% said it was “not on the agenda”. A further 18% each said it was a top-three and top-ten priority, while 6% said it was a priority for individual business units only.

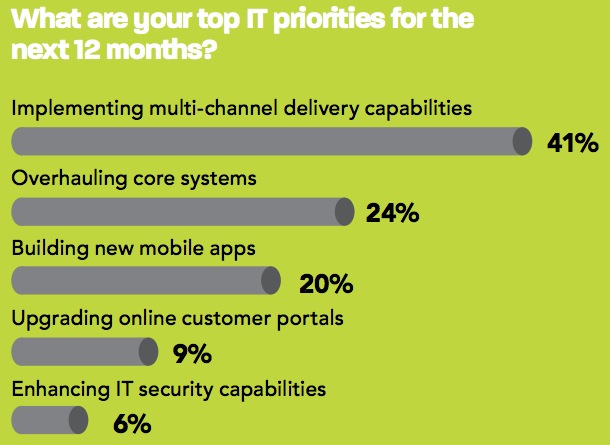

Members of the hundreds-strong audience were invited to respond to a series of survey questions about their technology priorities, with 41% saying that the implementation of multi-channel delivery capabilities was top on their list. Just 24% indicated they were focused on overhauling core systems, 9% were upgrading online customer portals, and only 6% were busy enhancing their IT security.

This last figure may surprise many given that security was broadly flagged as a key focus for increasingly-online banks going forward.

“Security is absolutely essential, particularly given the increasing levels of cybercrime and our operations in 32 countries with demanding regulatory bodies,” Anne Weatherston, CIO of top-four Australian and Asia-Pacific financial giant ANZ Bank said at the event.

“We’re in a major plan to modernise the bank, and even though it will complete in 2014 the reality is that the growing nature of cybercrime will necessitate a sustained and continuous investment in this area.”

Asked about the challenges they faced in delivering a multi-channel customer experience, participants flagged a number of different concerns. Aging bank technology was a problem in 35% of environments, while new channels and time-to-market pressures were flagged by 28%.

Trends for initiatives to be siloed within business lines were named as a challenge by 22% of respondents, while competing channels and channel profitability were relatively low concerns with 9% and 7% responses, respectively.

Those issues reflected a growing need for continuous technological change amongst banks and financial services providers.

The future “will demand that the organisation sees and accepts the imperative to change,” Weatherston said, “and can organise and execute that. The skills required to architect and build this proposition will be very different from the skills for business and banking technological skills.”

Mobile banking strategies remained a source of considerable focus, with one in five respondents working to build new mobile apps. This reflects a growing interest in the use of mobile banking to improve customer service or, in the case of some progressive banks, as the primary method of customer interaction.

Mobiles were seen by 43% of respondents as conduits for targeted offers or information, while 20% said they would use mobiles to engage customers through social-media channels. Just 11% flagged the value of mobiles for workforce collaboration, and only 6% were interested in using mobiles to track customer behaviour.

Asked about their priorities for the year ahead, data analytics (45%) and the use of mobiles and digital wallets (39%) were by far the dominant priorities, with biometrics (7%), videoconferencing (5%) and gamification (5%) taking up the rear.

Finally, surveyed banks were broadly optimistic about the potential for new online channels to increase revenues, with 65% indicating they new revenue sources to be material; conversely, just 20% said they expected revenues to decrease because of new competitors.