SAP confirms Business ByDesign delay

Updated: SAP on Wednesday confirmed a delay in its Business ByDesign software as a service suite.

The company said:

Since last September’s announcement of SAP Business ByDesign, the Company has been working closely with early customers and partners to validate and fine-tune the solution. As a result of this process, SAP has elected to modify the rollout strategy for SAP Business ByDesign to ensure a more focused and controlled ramp-up process.

That roughly means that Business ByDesign is being delayed. Reports began leaking out about the delay earlier this week. Key points:

- The SAP Business ByDesign 2008 debut will focus on six countries, where all the current productive early customers are based. Additional country rollouts in 2009.

- It is expected to take around 12 months to 18 months longer than the original 2010 target to reach the SAP Business ByDesign $1 billion revenue and 10,000 customer potential.

- SAP said "SAP Business ByDesign innovations and technologies for the existing solutions and this will contribute significantly to the overall revenues of SAP in 2010."

- BusinessByDesign will have significantly less than 1,000 customers in 2008.

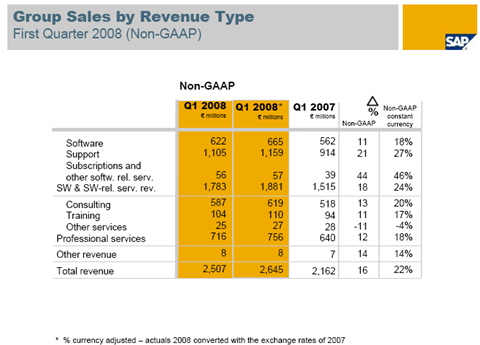

The confirmation came along with SAP's earnings results. SAP's first quarter results fell short of analyst estimates across the board. In particular, SAP's total revenue was 2.46 billion euros, compared to estimates of 2.54 billion euros. Net income also missed analyst targets.

Also see: CNBC to SAP America’s president: get media training

SAP’s CTO: Business knows ‘what’, IT knows ‘how’

SAP reported first quarter net income of 242 million euros on revenue of 2.46 million euros, down from a profit of 310 million euros on sales of 2.16 million euros a year ago. Software revenue was 622 million euros, up 11 percent from a year ago. Software and software related service revenue as 1.74 billion euros, up 15 percent from a year ago.While the results appear disappointing at first glance it should be noted that SAP is getting hurt by the weak dollar since it's translating its U.S. sales into euros. IBM, Oracle and others have benefited from the weak dollar. For instance, SAP's software revenue would have been up 18 percent instead of 11 percent if currency rates were constant. Total revenue would have been up 22 percent instead of 14 percent if currency rates were constant.

Wall Street analysts noted the currency impact on SAP, but acknowledged they were disappointed with the Business ByDesign delay.

As expected, a disappointing quarter, in our view, driven by negative foreign exchange rates, weakness in the Americas, and possible challenges in integrating Business Objects," said Wedbush Morgan Securities analyst Michael Nemeroff in a research note. "Management effectively admits that the SAP Business ByDesign (BBD) rollout strategy was too aggressive."

JMP Securities analyst Patrick Walravens added that SAP's moved its goal to get 10,000 customers from 2010 to 2011 or 2012. "Our due diligence suggests the number of customers is around 60 and that problems with multiple data models are hurting the Business ByDesign solution," said Walravens.

In a followup call, Walravens said that his hunch is that Business ByDesign operates on a model where each workstation has a different data model. "Business ByDesign may have different workstations in silos instead of one integrated suite," said Walravens. "You can see how that might have happened, but it's not the right approach. Netsuite has one data model. Part of reason SAP is spending money to fix this is it's trying to get to one data model."

Walravens added that the company hasn't detailed its data model strategy for Business ByDesign, but the question for SAP at its Sapphire conference is obvious: Does Business ByDesign have multiple data models or just one and what does that mean for potential customers?

Update: SAP disputes Walravens' take. According to the company Business ByDesign has one data model, but each individual customer has one database instance. This "mega-tenancy" model means customers can be isolated for data privacy and customize as they see fit. "This unique feature of mega-tenant strict isolation is enabled by database virtualization techniques," said an SAP spokesman.

The outlook:

And breakdown by region (click for full slide):

By the numbers:

- SAP took a write-down of 47 million euros in the first quarter due to the purchase of Business Objects.

- SAP reckons its market share is 32.6 percent among core enterprise application vendors.

- Business ByDesign investment will be cut in 2008 by about 100 million euros in a move that will increase margins to 28.5 percent to 29 percent from 2007's clip of 27.3 percent.

The Business ByDesign delay is also likely to provide Oracle and Salesforce.com with some ammo. Here's a video of a Salesforce.com vs. SAP debate: