Tech earnings roundup: BMC's third quarter tops estimates

BMC reported third quarter earnings of $109 million, or 60 cents a share, on revenue of $540 million, up 6 percent from a year ago. Non-GAAP earnings were 79 cents a share.

Wall Street was looking for earnings of 75 cents a share on revenue of $531.6 million.

In a statement, BMC CEO Bob Beauchamp said that service automation, software as a service and cloud computing products all saw strong demand. Total bookings for the third quarter were $594 million, up 10 percent from a year ago. License bookings were up 19 percent in the quarter.

As for the outlook, BMC remained upbeat. The company kept its previous 2011 forecast and projected non-GAAP earnings of $2.92 a share to $3.02 a share. Bookings growth will be in the high-single digit growth range with revenue gains in the mid-single digits.

Among other tech earnings:

- RightNow, an on-demand CRM company, reported fourth quarter earnings of $23.5 million, or 64 cents a share, on revenue of $51.4 million, up 24 percent from a year ago. Non-GAAP earnings were 17 cents a share. RightNow's earnings got a boost from a deferred tax reversal. Wall Street was expecting earnings of 16 cents a share on revenue of $50.75 million. For 2010, RightNow reported earnings of $28.4 million, or 83 cents a share, on revenue of $185.5 million, up 22 percent from a year ago. For the first quarter, RightNow is projecting non-GAAP earnings of 8 cents a share on revenue of $52 million. That outlook falls short of the 9 cents a share on revenue of $52.7 million Wall Street was expecting. For 2011, RightNow is projecting net income of 6 cents a share on revenue of $225 million. Non-GAAP earnings will be 52 cents a share for 2011 in line with expectations.

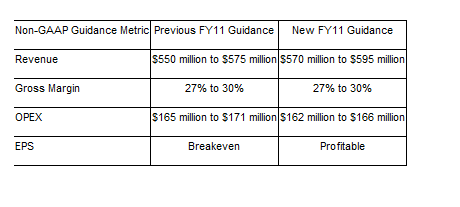

- Silicon Graphics reported second quarter earnings of 12 cents a share on revenue of $177.5 million. Non-GAAP earnings were 44 cents a share and gross margins were 29.5 percent. Here's a look at SGI's outlook: