Yahoo: Business is fine and we're worth more; Do you buy it?

Yahoo said Tuesday that its first quarter results are on target with the company's guidance and provided a bullish outlook through 2010.

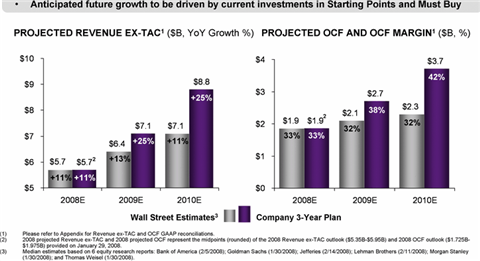

In a statement (Techmeme), Yahoo said that it expects to double operating cash flow over the next three years and generate revenue of $8.8 billion excluding traffic acquisition costs in 2010. Specifically, Yahoo is projecting operating cash flow to jump from $1.9 billion to $3.7 billion in 2010.

The $44.6 billion question: Do you buy it?

Yahoo's three year plan was presented to the company's board in December 2007 before Microsoft's $44.6 billion bid and before the economy roughly unraveled. Yahoo's motive for going public with this presentation is clear: Get Microsoft to raise its price or entice a white knight.

"In no uncertain terms, Yahoo is presenting its case to remain independent of Microsoft, or at minimum support why the buyout offer from Microsoft is insufficient in the Yahoo! board's estimation," says BMO Capital Markets analyst Leland Westerfield. "Normally, reaffirmed guidance would be a positive news event; however, our interpretation of the decision to issue the release is that Yahoo sees fewer ways that it can gain leverage over Microsoft to force a raised bid."

Yahoo says:

The presentation supports the unanimous determination by the Company’s board of directors that Microsoft's January 31, 2008 unsolicited acquisition proposal substantially undervalues Yahoo!. The board cited Yahoo!’s global brand, large worldwide audience, significant recent investments in advertising platforms and future growth prospects, free cash flow and earnings potential, as well as its substantial unconsolidated investments, as factors in its decision. Yahoo!'s board of directors is continuing to evaluate all of its strategic alternatives to maximize value for Yahoo! stockholders.

Meanwhile, the first quarter of 2008--which some have worried is a disaster--is on track. The full year outlook is also on track. According to Thomson Financial, Yahoo is expected to report first quarter earnings of 11 cents a share on revenue of $1.32 billion. For 2008, Yahoo is expected to report earnings of 46 cents a share on revenue of $5.6 billion.

The rest of the presentation was rehash of previous statements.