Sprint: Subscribers continue to bolt

Sprint continues to lose customers to other carriers as the company reported a third quarter subscriber tally of 50.5 million, down from 54 million a year ago.

The company lost 1.3 million wireless customers on a net basis in the third quarter including 1.1 million post-paid. Wall Street was expecting about 1 million subscribers to leave Sprint.

Sprint's churn rate was 2.15 percent, up from 2 percent in the second quarter (statement). That rate is well above the churn rates of AT&T and Verizon, but better than T-Mobile. Churn for Sprint's Boost service was 8.2 percent, up from 7.4 percent in the second quarter.

Sprint is our last stop on our financial tour of wireless carriers. Also see:

- T-Mobile: Churn spikes in third quarter

- Verizon’s third quarter on target; iPhone dings wireless churn

- iPhone 3G: Was it really such a great deal for AT&T?

Sprint reported a third quarter net loss of $326 million, or 11 cents a share, on revenue of $8.8 billion. Excluding items Sprint broke even, but Wall Street was expecting a profit of 3 cents a share. In the year ago quarter, Sprint reported a profit of $64 million, or 23 cents a share, on revenue of $10 billion. Simply put, the Sprint fall off has been dramatic.

The company's challenges are clear. Keep customers, improve customer service and push new devices to get so-called prime subscribers that will pay their bills.

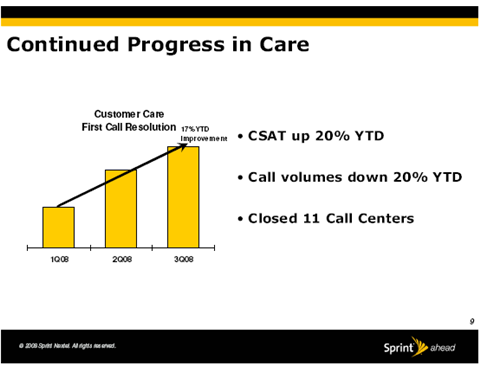

Here's the customer service improvement touted by Sprint:

Sprint said 83 percent of its post-paid customers were "prime." In other words, 83 percent of their customer base can pay the bills. The other customers are basically sub-prime--perhaps that's why Boost churn is so high. The company said it is

Overall, the company is making some progress. It swapped a $6 billion credit line for a smaller one $4.5 billion. Sprint also paid down $1.1 billion of debt. And Sprint's venture with Clearwire was approved by the FCC. That deal will lower Sprint's capital spending as it rolls out WiMax in cities such as Baltimore.

Nevertheless, Sprint sees tough times ahead. In a statement Sprint gave the following outlook:

Sprint Nextel expects continued pressure on post-paid subscribers in the fourth quarter; however, we expect that gross adds will stabilize and that churn rate will be consistent with the third quarter. We also expect slight downward pressure on post-paid ARPU in the fourth quarter.

Sprint added that its operating income adjusted for depreciation and amortization will fall, but it is generating positive cash flow.

By the numbers:

- Sales, general and administrative expenses fell 11 percent from a year ago.

- Nine percent of post-paid customers upgraded handsets in the third quarter.

- Wireless service revenue was $6.8 billion, down 13 percent from a year ago.

More:

Beyond mobile broadband, WiMAX is about blowing up the wireless business model