Sprint's Q2: Surviving not thriving

Sprint's second quarter results were better than expected, but the real news may be all the retooling that's happening in the background. What’s unclear is whether this multi-year network overhaul will allow Sprint to gain ground.

Simply put, Sprint remains a network in progress as it shuts down legacy services (Nextel's iDEN) and tries to migrate those customers to more efficient services. Meanwhile, Sprint has to move iPhones to satisfy commitments to Apple, plot its 4G network and maintain improved customer service levels.

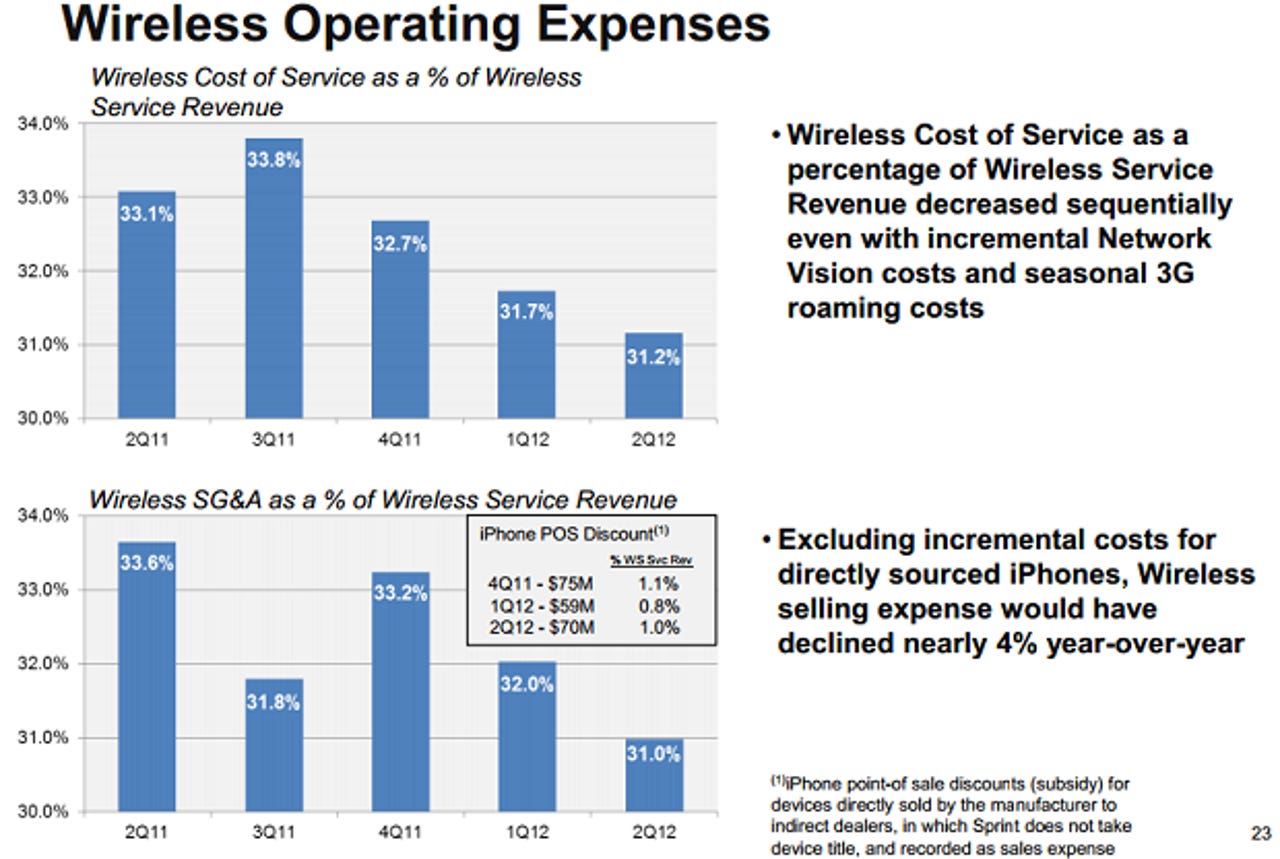

It's a tall order for the No. 3 wireless carrier. So far, Sprint appears to be doing ok. Analysts were generally heartened by Sprint's ability to manage expenses. However, Sprint's turnaround is far from complete.

The company reported a second quarter net loss of $1.4 billion, or 46 cents a share, on revenue of $8.83 billion, up 6 percent from a year ago. Excluding various charges such as the shutdown of the Nextel platform and investment hit due to Clearwire, Sprint lost 39 cents a share. Wall Street was looking for a loss of 40 cents a share on revenue of $8.73 billion.

CNET: Sprint CEO: Verizon benefited most from Nextel turnover | Sprint CEO confirms business-centric Motorola Photon Q | Sprint loses $1.37B, sells 1.5M iPhones in Q2

Sprint raised its adjusted OIBDA (operating income before depreciation and amortization) to $4.5 billion to $4.6 billion for 2012.

Among the moving parts in the quarter:

- Sprint shut down the Nextel network and was able to recapture 60 percent of users as postpaid customers.

- Sprint sold 1.5 million iPhones. That tally trails Verizon and AT&T by a healthy margin, but keeps Sprint in the game.

- 9,600 Nextel sites were taken offline.

- The company has completed leasing deals for 12,700 new network sites, known as Network Vision, and has zoning for 13,900 sties.

- 6,300 sites are ready for construction or in process for Sprint's new network.

- 15 cities have 4G LTE services.

The issue here is that Sprint is doing a lot of heavy lifting just so it can survive not necessarily thrive. Sprint is lagging on 4G LTE sites. Meanwhile, Sprint missed projections by losing 246,000 postpaid subscribers in the second quarter. Sprint added 442,000 postpaid subscribers to its brand, but lost 688,000 net due to the Nextel network shutdown. Prepaid subscribers in the quarter---141,000---also missed projections.

The other big concern is that Sprint just isn't attracting new customers. Stifel Nicolaus analyst Christopher King said:

The concern in the quarter from a subscriber standpoint stems from the 442,000 post-paid net adds on the Sprint platform. 431,000 of those came from iDEN subscribers migrating over--suggesting very little traction from a subscriber growth perspective on the Sprint platform side in the quarter, despite churn levels of 1.69%. These metrics, to us, suggest continued struggles from a gross add perspective. The 11,000 "true" net adds on the Sprint post-paid platform in the quarter are compared with approximately 138,000 a year ago--despite Sprint now having the iPhone as a part of its product lineup. When compared with AT&T's 320,000 post-paid net adds and Verizon's 888,000 post-paid net adds this quarter, we see increased troubling signs regarding Sprint's ability to grow its market share flow of post-paid gross adds onto its Sprint platform.