Verizon's 2014: $585 million in Internet of things, telematics sales

Verizon's fourth quarter results were in line with earnings expectations and the company highlighted how machine-to-machine and telematics revenue is beginning to scale.

The company reported a fourth quarter net loss of 54 cents a share due to charges related to pensions, severance and retirement of debt. Adjusted earnings for the fourth quarter were 71 cents a share on revenue of $33.2 billion, up nearly 7 percent from a year ago. Earnings were in line with expectations and revenue was a bit ahead.

For 2014, Verizon reported net income of $2.42 a share on revenue of $127.1 billion.

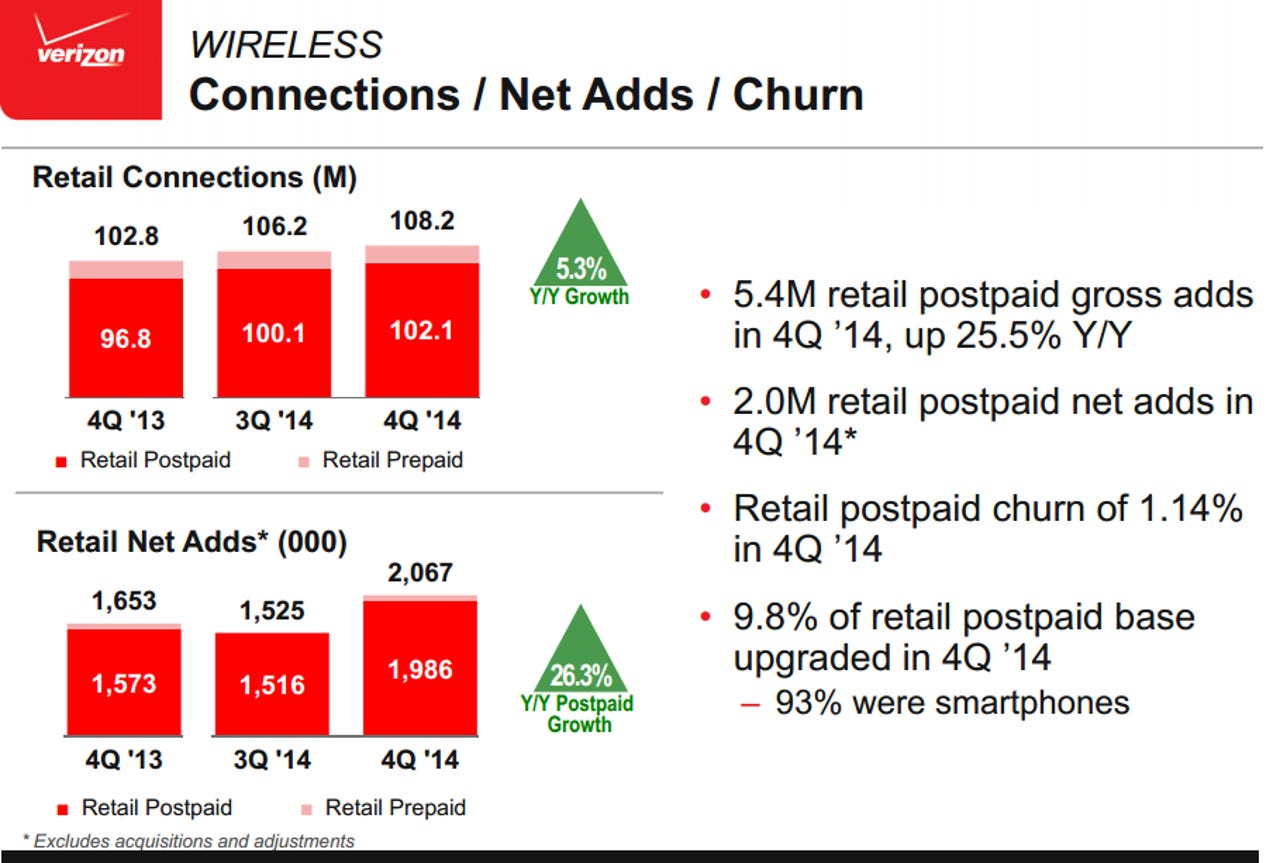

In many respects, Verizon's quarter was standard issue. Verizon added a bevy of retail post-paid customer additions and saw churn creep up. That latter point may indicate that competition from the likes of T-Mobile is having a modest impact.

As for the outlook, Verizon projected that will grow revenue at a 4 percent clip with adjusted earnings on par with 2014 levels.

High level metrics include:

- 2.1 million retail connections including 672,000 postpaid phones were added in the fourth quarter.

- Churn was 1.14 percent in the fourth quarter, up 18 basis points from a year ago. Retail churn was 1.39 percent in the fourth quarter, up 12 basis points from a year ago.

- Verizon had 108.2 million total retail connections.

- FiOS revenue was up 11.6 percent in the quarter with 145,000 FiOS Internet and 116,000 FiOS video customers added.

The bigger question is how Verizon will grow in its already crowded markets. For instance, wireless service is a saturated market in the U.S. Enterprise has been flattish at best. And the TV service market is crowded.

Verizon's answer appears to be the Internet of things and telematics. Verizon provided some color on what it hopes will be a big market. The company said Internet of things and telematics revenue for 2014 was $585 million, up 45 percent from a year ago. Verizon, like AT&T, is eyeing connected vehicles as a way to grow subscriptions.

By the slides: