Vonage a victim of "the long tail?"

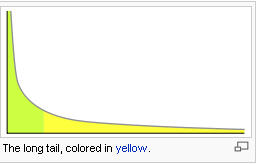

You may have heard of the notion of the "long tail." That's the principle which describes how a collection of products or services with comparably little demand can collectively account for a proportionately larger market share than the big players.

Yet from reading remarks by Forrester Research analyst Sally Cohen quoted by Telephony Online's Carol Wilson just this morning, Verizon might well be suffering from- rather than benefitting from- the phenomenon.

"Increasingly," Carol describes Cohen as noting, "the voice market looks a little like the Internet content market in the sense that there are a larger number of niches – almost like long-tail content – that attract a smaller number of people.

“I think there will always be a niche consumer market, you are not going to get a better deal on long distance, especially international long distance than from pure-play VoIP company,” Cohen said. “Their rates are always going to be best. Someone who is calling internationally a lot even someone calling long distance a lot may still want a pure-play.”

Carol also points out that single-service VoIP providers such as Vonage are being edged out of the residential market by cable companies and even mobile phones.

"Pure-play VoIP providers such as Vonage are getting squeezed out of the residential market by cable companies and are losing out as well to mobile phones," Carol describes Cohen as noting. "Consumers now have so many alternatives, including voice over Instant Messaging services from Google, Yahoo!, AOL and Microsoft, that the VoIP niche is being carved up into many pieces, Cohen said.

“Vonage had the largest subscriber numbers for pure-play provider -- 2.2 million last year, but that’s just a drop in the bucket of the larger voice market,” Carol direclty quotes Cohen as noting. “They had to work hard before all this patent stuff came up. Consumers don’t want new telephone technology. They want their phone to look and feel and sound like it always has. That is where cable is pulling away from VoIP pure-play providers – they install a line that looks and feels and sounds like phones always have. The phone jack still plugs into the wall. VoIP pure play was not that way. You have to buy the piece of equipment that allows your phone to plug into your broadband connection. Consumers had to make that leap on their own and they didn’t want to do that.”

Where consumers are looking for alternatives to a landline phone, they are more likely to turn to mobile phones than to VoIP pure-play phones, Cohen added. “I think that we see mobile phones in 75% of U.S. households right now,” she said. “That is where future lies.”

Carol also amplifies the analyst's point that because of churn and customer turnover, a freeze in new Vonage sign-ups that might be re-established as a result of the April 24 appeal of a judgment that Vonage infringed on three Verizon patents could result in significant net losses of subcribers.

If that happens, I say, watch Vonage circle down the drain.