Amazon delivers mixed Q3 results as AWS growth slows

Amazon published its third quarter financial results on Thursday, falling short of earnings expectations and delivering a weak Q4 outlook. Amazon's cloud business, Amazon Web Services, once again accounted for a significant portion of Amazon's operating income, though its growth rate slowed on a year-over-year and sequential basis.

Meanwhile, morphing Amazon's Prime subscription offering into a one-day shipping program continues to be a costly endeavor. Amazon is expecting a nearly $1.5 billion penalty in Q4 year-over-year for the cost of shipping, CFO Brian Olsavsky said, and has incorporated that into its Q4 outlook.

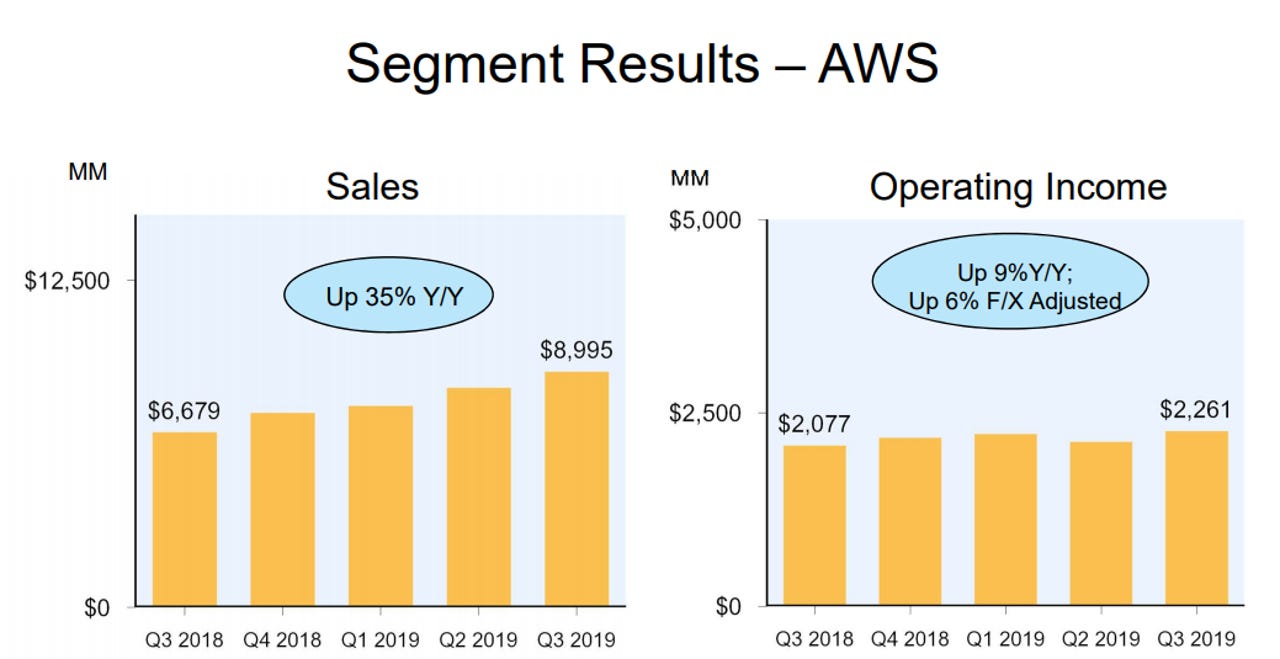

AWS in Q3 had $8.99 billion in sales, with a growth rate of 35 percent year-over-year. The cloud businesses's operating income came to $2.26 billion for the quarter.

By comparison, AWS had a 37 percent growth rate in Q2 2019 and a 46 percent growth rate in Q3 2018.

On a conference call Thursday, Olsavsky said the company's leadership remains pleased with AWS's top line and bottom line. The biggest impact on the cloud business in Q3 was tied to costs related in sales and marketing, he said.

"We're chasing a large opportunity here," Olsavsky said with respect to the sales and marketing expansions, adding that it will be "bumpy as we go along, but we're fully confident that will be a fully-leveraged cost as we get to scale."

A secondary impact came from infrastructure costs. "There's been a step in infrastructure costs to support the higher usage demands," Olsavsky said.

Overall, Amazon's net income in Q3 came to $2.1 billion, or $4.23 per diluted share, compared with net income of $2.9 billion, or $5.75 per diluted share, in the third quarter of 2018. Net sales for Q3 increased 24 percent year-over-year to $70 billion.

Wall Street was looking for earnings of $4.62 on revenue of $68.81 billion.

In a statement, Amazon CEO Jeff Bezos stressed that turning Prime into a one-day shipping program is worth the upfront investment. In Q2, Amazon spent more than $800 million to expand its one-day shipping offerings.

Thursday's earnings report showed that worldwide shipping costs in Q3 came to $9.6 billion, up 46 percent year-over-year.

"We are ramping up to make our 25th holiday season the best ever for Prime customers — with millions of products available for free one-day delivery," CEO Jeff Bezos said in a statement. "Customers love the transition of Prime from two days to one day — they've already ordered billions of items with free one-day delivery this year. It's a big investment, and it's the right long-term decision for customers. And although it's counterintuitive, the fastest delivery speeds generate the least carbon emissions because these products ship from fulfillment centers very close to the customer — it simply becomes impractical to use air or long ground routes."

Amazon North America had $42.6 billion in Q3 sales, with a 24 percent year-over-year growth rate, and an operating income of $1.28 billion.

International business brought in $18.34 billion in sales and an operating loss of $386 million.

Advertising is another fast-growing source of revenue for Amazon. Advertising services is the primary driver of sales in Amazon's "Other" category, which is not an official business segment. Amazon said the category grew 45 percent in the first quarter to bring in $3.59 billion in net sales.

For the fourth quarter, Amazon expects net sales between $80 billion and $86.5 billion. Analysts are expecting Q4 sales of $87.37 billion.