Amazon delivers mixed Q2 results with Prime's one-day shipping under way

Amazon published its second quarter financial report on Thursday, delivering mixed results. Sales surpassed expectations, with Amazon Web Services and Amazon's advertising business once again proving to be fast-growing sources of revenue. However, earnings fell short as the e-commerce giant invested significantly in morphing its Prime subscription offering into a one-day shipping program.

Amazon anticipated spending around $800 million in Q2 to expand its one-day shipping offerings, but it ended up spending slightly more, CFO Brian Olsavsky said on a conference call Thursday.

"We're in the middle of a journey here," Olsavsky said, later adding it would take "multiple quarters to play out."

Amazon has already accounted for the continued expense in its Q3 outlook, he said.

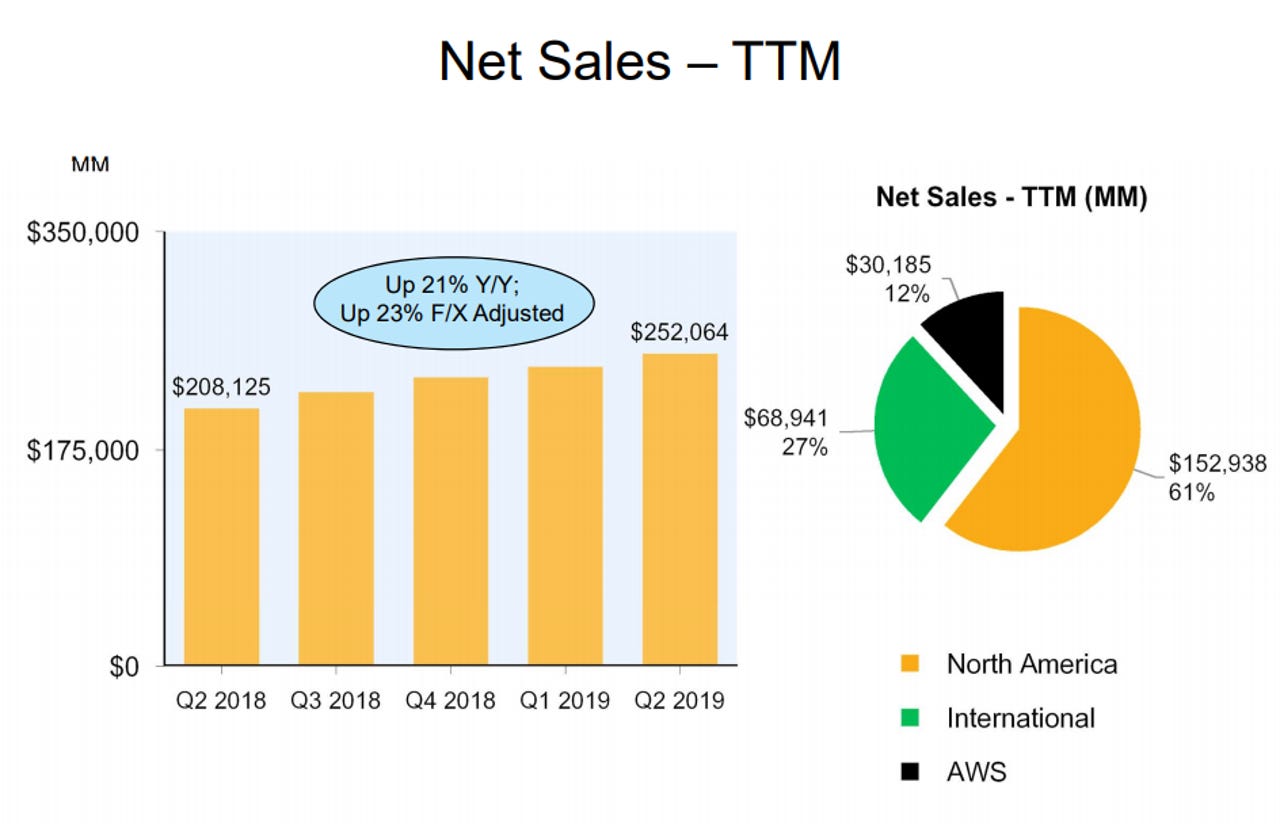

Amazon's net income in Q2 came to $2.6 billion, or $5.22 per diluted share, compared with net income of $2.5 billion, or $5.07 per diluted share, in the second quarter of 2018. Net sales for Q2 increased 20 percent year-over-year to $63.4 billion.

Analysts were looking for earnings of $5.57 per share on revenue of $62.48 billion.

Amazon North America had $38.65 billion in Q2 sales, with a 12 percent year-over-year growth rate, and an operating income of $1.56 billion.

International business brought in $16.37 billion in sales and an operating loss of $600 million.

Meanwhile, AWS in Q2 had $8.38 billion in sales, with a growth rate of 37 percent year-over-year. The cloud businesses's operating income came to $2.12 billion for the quarter.

Advertising is another fast-growing source of revenue for Amazon. Advertising services is the primary driver of sales in Amazon's "Other" category, which is not an official business segment. Amazon said the category grew 37 percent in the first quarter to bring in $3 billion in net sales.

In a statement, CEO Jeff Bezos stressed that customers are responding positively to Prime's move to one-day delivery.

"We've received a lot of positive feedback and seen accelerating sales growth," he said. "Free one-day delivery is now available to Prime members on more than ten million items, and we're just getting started."

Expanding Amazon's one-day shipping program is a costly endeavor, Olsavsky explained, as it leads to shifts in warehousing and inventory and generally lower warehouse productivity. While the company has experience handling large changes in its distribution and transportation logistics, "it does create a shock to the system," he said.

Aside from investments in one-day shipping, Amazon faced other higher expenses in the quarter, including growing AWS marketing costs, a growing headcount and a higher stock-based compensation expense.

For the third quarter, Amazon expects net sales between $66 billion and $70 billion. Analysts are expecting Q3 sales of $67.27 billion.