Amazon forecasts Q3 operating loss; Q2 mixed

Amazon's second quarter results were mixed and the third quarter outlook disappointed.

The e-commerce giant reported second quarter earnings of $7 million, or a penny a share, on revenue of $12.83 billion, up 29 percent from a year ago.

Wall Street was looking for earnings of 2 cents a share on revenue of $12.88 billion. Amazon's revenue clearly fell short of expectations, but the earnings results for the second quarter were more debatable. Amazon said that the second quarter earnings included a loss of $65 million related to the integration of Kiva Systems, which was recently acquired.

If you back out those integration costs, Amazon's profit would have been $72 million, which was better than net income of $20.8 million projected by analysts.

The third quarter outlook, however, clearly was off the mark for Amazon. The company projected and operating loss for the third quarter between $350 million and $50 million. Wall Street was looking for an operating profit of $164 million.

Amazon also said its sales for the third quarter would be $12.9 billion to $14.3 billion. Wall Street was expecting $14.09 billion.

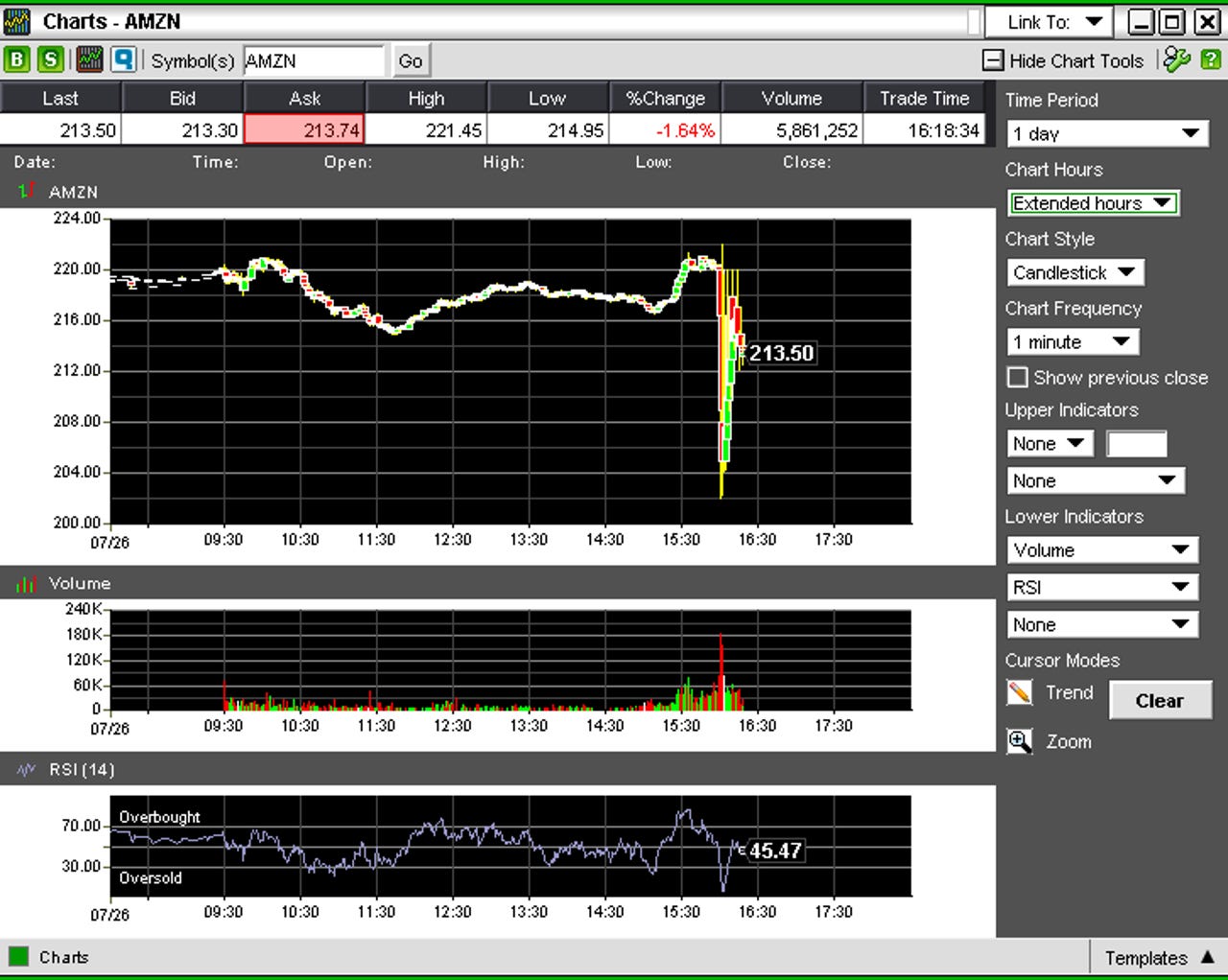

With those moving parts it's no surprise that investors weren't quite sure what to make of Amazon's results. Afterhours trading in Amazon was indecisive.

In a statement, Amazon CEO Jeff Bezos talked up Amazon Prime and as the "best bargain in the history of shopping."

Amazon CFO Tom Szkutak made the following points on an earnings conference call:

- The company is investing heavily in infrastructure and fulfillment for the fourth quarter.

- Capital expenses in the third quarter will push the $900 million mark.

- Amazon is excited about the Kindle Fire roadmap.

- The company collects tax for half of its business now.

- And the company is making some significant global bets. Szkutak said:

China is an area that is growing very fast, but we're certainly in investment mode there. In recent years we've launched Italy and Spain. We are investing in those geographies and we like what we see.

By the numbers:

- North America accounted for 57 percent of sales. International sales were 43 percent of revenue.

- The international unit delivered a second quarter operating profit of $16 million. And North America had operating income of $344 million.

- Other second quarter revenue, led by Amazon Web Services, was $554 million, up from $359 million a year ago. Other also had the fastest revenue growth in North America with growth of 58 percent.

- Inventories were $4.38 billion as of June 30, down from $4.99 billion on December 31.

- Amazon spent $657 million on assets such as Website development and software.