Amazon's 2016: Five key cloud, e-commerce questions

Amazon had a banner year in 2015 as it likely captured more than half of all e-commerce growth in the U.S. and its AWS cloud business is emerging as a dominant cash cow in the years ahead.

Nevertheless, there are a few questions worth noting as the year sets up.

How much will be invested into AWS in 2016? In 2015, Amazon broke out the results of AWS and it became clear that the unit can and will carry the profit day most of the fiscal year. However, Pacific Crest analyst Brent Bracelin expects AWS' profit margins to slip a bit as the company invests in new regions. Specifically, Bracelin is modeling AWS regions to open in the U.K. Korea, India and Ohio. These additions will add to AWS' 11 regions to date. Bracelin said in a research note:

While AWS did not expand into any new regions during 2015, the company appears poised to add a record four new regions in 2016 across three new countries: the United Kingdom, India, South Korea and a new Ohio region in the United States. This should elevate capital expenditures, which could pressure operating margins...Each region holds increasing importance, considering this year each region on average generates about $715 million of revenue. This average revenue per region has more than doubled in the past two years.

AWS investment could be outlined a bit when Amazon reports its fourth quarter results, which will be dominated by the company's e-commerce success.

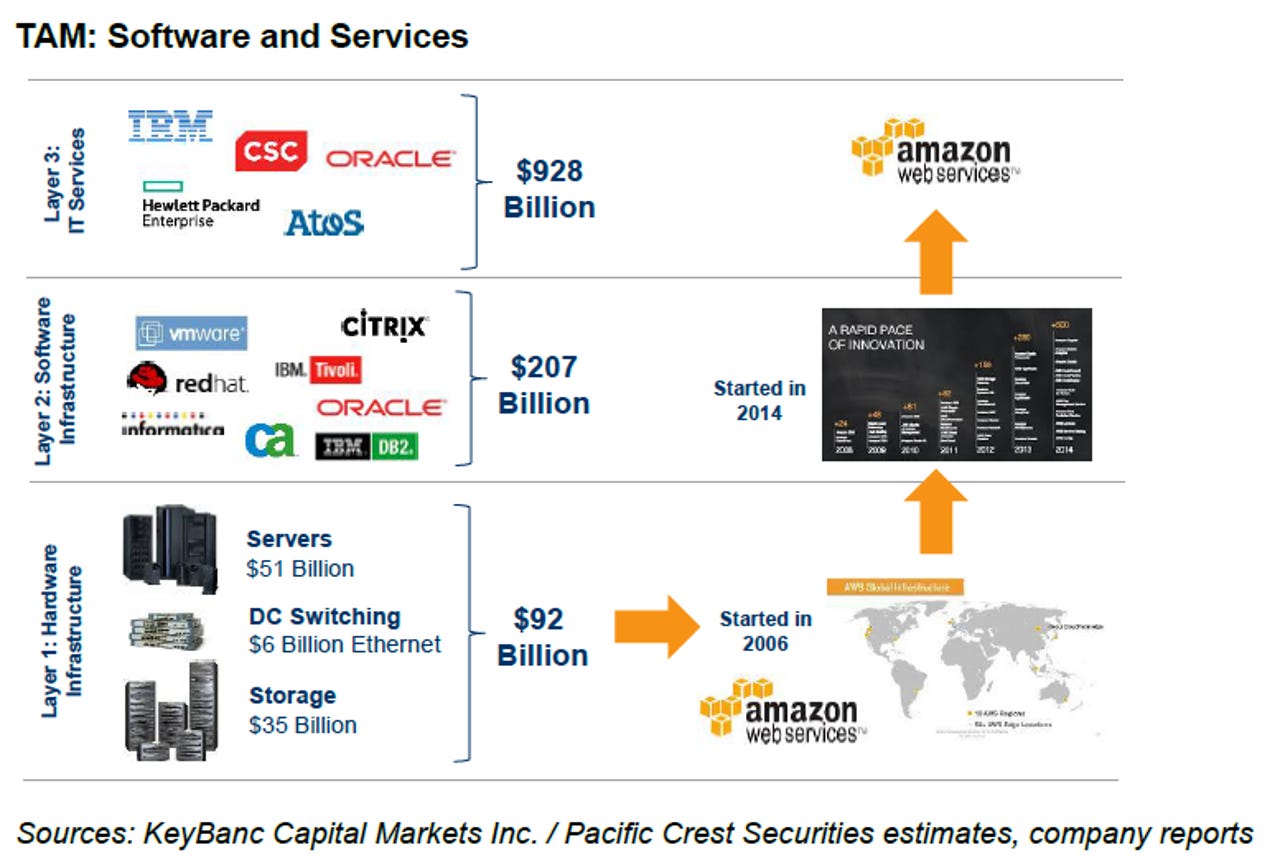

How far up the stack can AWS go? Amazon's re:Invent powwow last year shifted the pitch from price to features and new services to better move large enterprise workloads to the cloud. AWS also jumped into the Internet of things and broadened its analytics offering. Add it up and AWS is dominant in infrastructure as a service, but moving up the stack quickly. The big question is how far can AWS go in value-added services. These higher-margin services mean AWS will bump into tougher competition from incumbents who have retrenched in areas like analytics to stay away from the price war fray of infrastructure as a service. My take is that AWS will surprise folks with its ability to move into higher-end services just like it did with infrastructure initially.

Related: Amazon finds its profit horse in AWS: Why it's so disruptive to IT's old guard | Cloud shift spurs enterprise tech mergers as customers hit pause | AWS re:Invent: Five takeaways on Amazon's new cloud services | AWS chief defends absence of price cuts at annual cloud expo

Here's how AWS could move up the stack according to Bracelin:

Will Amazon build its own logistics network to cut out FedEx and UPS? As the holiday season wrapped up, the Wall Street Journal reported that the partnership with Amazon and UPS was tense. Why? Amazon was pondering its own delivery network that would take away UPS business and presumably cut shipping costs. Couple those reports along with drone delivery experiments and Prime Now and it's clear that Amazon will be handling more last-mile deliveries at some point. Perhaps 2016 highlights more material traction in the effort, but keep in mind that the costs of tackling the last mile are massive and it will take years for Amazon to minimize third party delivery services.

Should Prime be disaggregated? Amazon last week outlined some heady Prime momentum. For instance, Amazon said more than 3 million people signed up for new Prime memberships during the third week of December. Meanwhile, more than 200 million items shipped with Prime during the holidays. That tally was double the 2014 mark. In addition, Prime Music consumption increased 350 percent from a year ago and hours for Prime Video doubled.

We all get the model: More Prime subscriptions mean more revenue for Amazon. Prime subscribers buy more stuff. They also buy more digital content. There's a revenue flywheel that starts rolling with Prime members. The big question is whether Prime is one all-you-can-eat service or a series of standalone items that can ultimately be disaggregated. Yes, Prime Video is a nice tack-on item for the shipping deal, but some folks would pay for the content ala carte. In some ways, Amazon's approach with Prime is starting to look like a newfangled cable bundle. At some point, the math could work out so Amazon might separate services from the Prime bundle. Amazon's response would be that Prime value is sticky and reason enough to justify a big bundle.

There's no need to rush when it comes to disaggregating Prime. Macquarie analyst Ben Schachter estimates that at least 25 percent of U.S. households are Prime subscribers and Amazon is capturing about half of all U.S. e-commerce growth (and 24 percent of retail growth).

Can Google's move to hire former VMware chief Dianne Greene threaten AWS? Google Cloud Platform has a new leader in Greene who knows the enterprise as well as how to sell to it. Enterprises are interested in Google Cloud Platform, but have historically been wary about how serious the search giant is about the unit. Google initially talked up its cloud services, then went quiet, then launched features and now is pitching its wares more. However, CIOs are never quite sure how serious Google is about the enterprise. Greene's mission will be to change that perception. What remains to be seen is whether Google can woo CIOs while matching the feature pace of both Microsoft Azure and AWS, two cloud rivals that have become enterprise staples. Google is likely to target AWS first.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on the Monday Morning Opener:

- Tech predictions 2016: 4 business trends to watch

- The 5 trends that rocked business tech in 2015

- The state of enterprise software: 5 lessons

- How TV apps are about to remake the small screen and unleash a new land grab

- Starbucks' digital transformation: The takeaways every enterprise needs to know

- Tech's dirtiest little secret: Sometimes we agree to go backward

- Artificial intelligence: Should we be as terrified as Elon Musk and Bill Gates?

- Encryption and surveillance: The unstoppable force and the immovable object of the internet age

- The death of this revolution has been greatly exaggerated

- Apple's iPhone: Looking at its past and present to predict its future

- Intel's next frontier: Powering robots