Anaplan Scales Up, Adds More Apps

Is your business headed for disruption, or are you going to be a disruptor? That's the question Frederic Laluyaux, CEO of Anaplan, put to the more than 1,000 attendees of the company's AnaplanHub15 event this week in San Francisco.

Laluyaux, leader of this fast-growing, cloud-based planning, analysis and optimization vendor, said the difference between the disruptors and the disrupted gets down to agility and corporate culture. "Are you harvesting the collective intelligence in your organization, or are you making decisions far from the point of impact?" he asked. It's great if you know that disruption is coming, he said, but without agile, connected planning, "you won't be able to do anything about it."

Constellation Research CEO R "Ray" Wang joined Laluyaux onstage to talk about disruption, the topic of his new book, Disrupting Digital Business. That conversation led into panel discussions with Anaplan customers including Aviva, Diageo, Hewlett-Packard, McAfee, Tribune Media, and VMware. One surprise was just how many of these big companies turned to Anaplan to replace spreadsheet-based planning processes.

Executives from HP and VMware, two of Anaplan's largest customers, explained global rollouts that replaced spreadsheet-intensive processes that were "breaking Excel." HP now has 3,500 "Anaplanners" doing sales planning involving more than 150,000 partners. VMware started "Anaplanning" in sales forecasting and its next move is into territory and quota planning.

Anaplan is going after large ($1 billion-plus) companies and young companies experiencing hyper growth. Companies that fit either description are likely facing hyper change and need lots of help with planning. The company's strength is landing and expanding into multiple planning roles, often expanding from financials or sales into HR and operational areas.

Spreadsheets notwithstanding, there are plenty of aging on-premises systems that are ripe for replacement. Partners and consultants I spoke to at the event talked about displacing Cognos TM1 and Oracle Hyperion deployments. Laluyaux mentioned "saving customers from monolithic modeling, planning and consolidation systems from that big German company" more than once. There are cloud competitors too -- Adaptive Insights, Host Analytics, and Tidemark, in that order of impact - but they were scarcely mentioned here. SAP recently introduced a Cloud for Planning app built on SAP's Hana Cloud, but it's very new.

Upgrades: From integration to interfaces

New and soon-to-be released functionality introduced at Hub15 included integration, scalability and usability improvements. The list of upgrades included new or deeper technical ties with Boomi, Informatica, and MuleSoft, among integration partners, and Salesforce and Workday, among apps partners. Anaplan has an Excel add-in, but it announced deeper, two-way integration with Excel workbooks. In beta is a two-way integration with PowerPoint through which you can embed tables, charts, text, item names and values into PowerPoint Decks and later refresh the underlying data. Microsoft Word integration is coming later this year.

Anaplan is scaling up behind the scenes of its cloud platform so customers can build really big models while supporting hundreds of concurrent collaborators on those models. Right now the company supports models with more than 10 billion data points, but the goal is to support 100-billion-cell models. As these containers gets bigger, the company is splitting task requests into smaller, granular blocks of processing power and memory for better performance.

To improve usability, Anaplan introduced a slick new user interface with a sliding left-hand navigation pane. The navigation links populated in this pane are dynamic, so they change as you move in and out of models. You can also slide the pane out of the way to gain screen real estate. The look and feel is clean and modern, and Anaplan says it has cut down on clicks and restyled to put the data at the forefront, not the technology.

It's about the apps

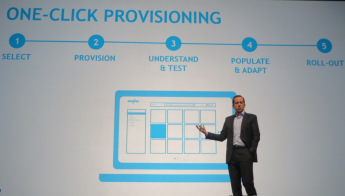

The big push for Anaplan is offering as many prebuilt planning apps as possible, and it's doing this through a restyled Anaplan App Hub with more than 66 apps available at this writing. Many are from partners and integrators, but the company itself now has a staff of 16 developers focused exclusively on developing new apps. Anaplan showed analysts app roadmaps for the next 12 months, and execs stressed that these apps are rich with functionality and nearly ready to run with customer-specific tweaking -- not just lightweight templates for apps.

For now all these apps are free, and Laluyaux stressed that they can be quickly tested, tweaked and deployed. VMware, for example, was able to do a sales forecasting proof-of-concept within two days and it was fully deployed in production within three months.

As customers roll out more and more apps, the need for model management is intensifying. The vendor is working on richer app, data and user management through the Anaplan Enterprise Architecture. App lifecycle management, for example, will bring test-and-development features that will make it easier to push data and changes from one model to another.

A promised data-management console is being developed to control how data flows from one model to another. The company demonstrated the ability to visualize data connections among models, and the ability to collaborate on models down to individual cells. Authentication and access controls already exist at the model level, but they'll be introduced at the higher model-management level.

MyPOV: Evolution and growing pains

Anaplan is clearly on a roll, annually tripling in size on dimensions including revenue, bookings and number of employees over the last two years, according to Laluyaux. The customer list is impressive, and customer executives here were openly effusive about the agility and flexibility of planning capabilities.

Fast growth has brought growing pains, but Anaplan is responding with its internal scalability improvements and enterprise architecture plans for model- and app-lifecycle management capabilities.

Also impressive was Anaplan's commitment to delivering visibility into model logic, dependencies, and data- and process-flow visibility. This visibility is available both within models and across models, and the system is built for change, with alterations documented and made visible immediately.

Anaplan had a lot to say about being an apps company, but a systems integrator here put it best when he said this is the vendor to choose when you ultimately have multiple planning applications in mind. The company has a use-case subscription option, so you can start with just one app. But the growing strength of Anaplan is the platform, which lets you take advantage of an agile, consistent planning approach across finance, sales, HR, operations and a growing number of industry- and task-specific use cases.