ARM Holdings' 2015 plan: Grab PC, server share

ARM Holdings, owns the mobile market when it comes to licensing chip architecture, but by 2015 the company expects to have a foothold in the PC and server market.

That's the primary takeaway from ARM Holdings earnings conference call earlier this week. ARM is basically an intellectual property licensing company. As a result, it's a dominant processing company without actually manufacturing a processor. Instead, companies like Nvidia do the heavy lifting. Nevertheless, the message is clear: ARM Holdings is deadly serious about being a PC and server player and at CES 2011 some of the pieces fell into place. And why not? Microsoft is supporting ARM. Nvidia's Tegra chipset is landing server design wins.

Warren East, CEO of ARM Holdings, held court on the grand PC plan and the role of its Cortex-A processors.

Among the key quotes:

There is a blurring between computers and smartphones and that's helping ARM's very strong presence in smartphones and helping us get into computing. But at CES there were some great brand names and the whole show was indeed a showcase for lots of ARM technology and showed ARM very strongly positioned, as the consumerization of the Internet that we talk about takes place over the coming years.

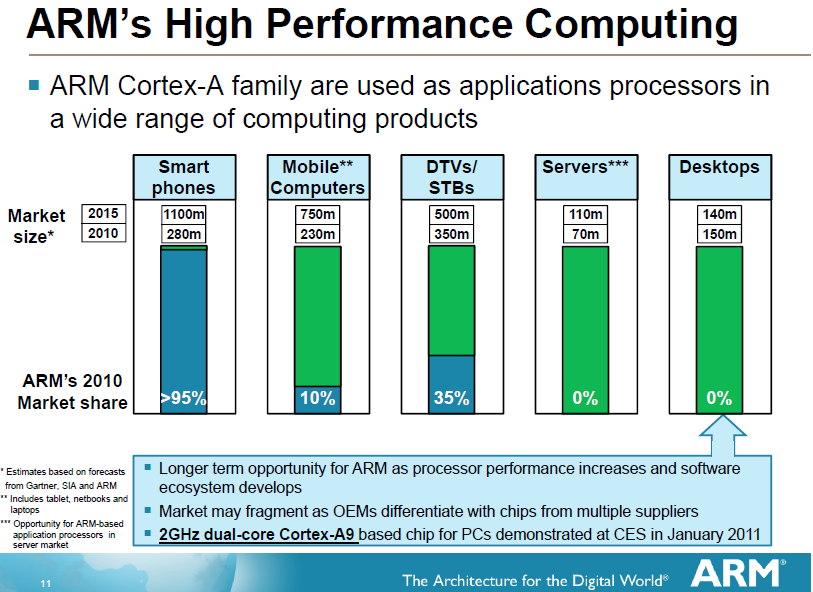

This is all about ARM in computing and we just thought it would be worth taking a moment or two to talk about the Cortex-A family of processors. And why Cortex-A in computing? You can see there has been a lot of talk about some new areas of computing, where we have zero market share today but where we hope to gain market share in the future.

As we move across to mobile computers, then people want very thin, lightweight products, with a long battery life. ARM technology is great for that, saving space, saving power and, at the same time, bringing an ecosystem from the smartphone space, an ecosystem around PCs and smartphones are becoming much more of a single ecosystem.

In servers, you can see the Cortex-A processors scaling to deliver higher levels of performance. It's -- more use of the Internet drives more server usage. ARM is very attractive in terms of power savings and potentially cost savings going forward.

The ARM Cortex-A processors support multi-processing and that delivers the high levels of performance required for server applications. And in this space we have zero market share today and we have an ecosystem that we need to develop. So this is very much a potential opportunity and it's market growth in the out years.

And similarly I would say in desktops, where there's a very established, capable and competent incumbent architecture there and so ARM presence in that space is probably some way out. But certainly, as our performance -- as the performance of ARM processors increases over the years and as the ecosystem develops, with companies like Microsoft supporting the ARM architecture, then that's clearly a market opportunity for the future.

Indeed, here's ARM's market share by category today:

And what the company projects in 2015:

So what's possible for ARM? Analysts are mixed. Morgan Stanley's Francois Meunier said ARM is likely to become a dominant platform in the future. Meunier sees ARM taking laptop share with Microsoft's help and becoming a dominant tablet player as Apple, RIM, LG, Samsung and Motorola launch devices.

Other analysts are wary about ARM. The near-term prospects look good, but investor seem to be valuing ARM based on future PC and laptop gains, which may not arrive for about four years. The other wild card is that Intel, dominant in the PC and server space, is aiming for the mobile market via the acquisition of Infineon.