Assessing the business benefits of social business

There is now statistically significant evidence that technology-enabled collaboration with external stakeholders helps organizations gain market share from the competition. On Monday social business platform leader Jive Software released the results of a recent customer survey on the benefits of social software. The details of the survey were explored earlier this week by fellow ZDNet blogger Oliver Marks and provides a good overview of at least what Jive customers are reporting today in terms of specific returns.

Those who are championing social tools in their organization will surely be heartened by the results of this survey. The double digit gains listed are almost universally positive and run the gamut from faster location of needed information to significant decreases in e-mail and support call volume. It's also good to see the results broken down by workforce engagement vs. customer engagement, which is the primary line of demarcation for enterprise social media. However you slice it, it seems that adoption provides broad spectrum benefits to the way that organizations work.

And social business benefits is not an idle topic; business leaders this year are very much looking at the tools that can drive growth in their organizations this year. A recent PwC report (yes, a survey, so add your grain of salt) of the 2011 outlook for CEOs says that "54% are funneling funds towards growth initiatives, including emerging technologies in mobile devices, social media and data analytics." Social media (now increasingly called social business when applied to work) is very much on the strategic agenda while the benefits seem increasingly obvious.

Deriving enough benefits from social business

But benefits alone do not a positive ROI make. Depending on how much it costs to deploy and maintain a Enterprise 2.0 solution across an organization, it might take a while for the reported benefits to provide a net gain. Worse, continued reports of information overload and wasted time in social media, are of concern to some and making them question if real productivity and efficiency gains take place.

Adding on security concerns, ease of architectural integration, marketplace maturity, and ongoing support costs like community management, and there's still enough uncertainty to make more conservative organizations take a wait and see approach, even as many of them that I speak with now realize that broad deployment of social tools is now primarily a timing issue.

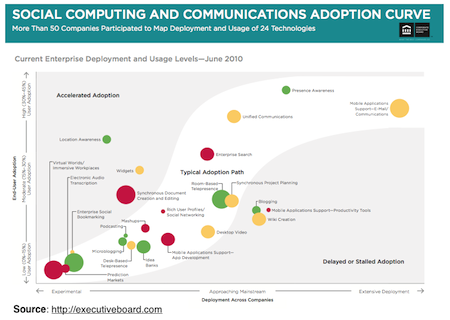

In terms of what IT departments are looking at in terms of harder sets of data, probably one of the most ambivalent yet useful reports on Enterprise 2.0 of all came out last summer from the Executive Board, which reported the actual adoption level, risk, and maturity of social computing solutions from their members.

The adoption curve chart above from the Executive Board survey shows a different type of picture than most social computing surveys and is therefore useful as contrast. The size of the bubbles on the chart indicated the expected value (larger is greater) with enterprise search, synchronous document creation and editing (collaborative Google Docs-type apps), electronic audio transcription, room-based telepresence, and unified communications among the "social" technologies that were believed to have the greatest business value.

I do like the Executive Board view because it provides a greater perspective on a fuller range collaborative solutions that can be applied by organizations, not just a myopic view of social with the usual suspects like blogs, wikis, and community forums only. This is the true palette of collaborative solutions that organizations must consider as they adopt new technologies to improve collaborative business performance and allow us to make better decisions.

That's not to say that the data points that come out of product surveys like Jive's aren't useful. They certainly are and they can help us form an overall picture of what organizations think they are experiencing with social tools. Thus, in terms of synthesizing what we've seen up to and including 2011, the various data seems has shown the following picture emerging in terms of actual value:

Aggregate reported business value of Enterprise 2.0

- Workers can find the information and people they need faster with social tools. This has most broadly come out of the various industry surveys for years and is consistent right up to and including the Jive survey. Social tools makes internal information and business processes more visible, findable, and shareable, and makes it possible to see who knows what.

- Communication overhead in legacy platforms shrinks when social tools are deployed. When social tools are adopted, previous communication tools see reduced usage, particularly e-mail. Most data I've seen shows that the communication intensity and duration in the new (typically social) collaborative platforms is higher than in the old. Mostly this seems to be positive for productivity and not an indicator of wasted time, but data is harder to find to verify that yet. Either way, your workers will spend less time in e-mail and more time in collaborative interaction.

- There is a correlation between increased marketshare and socially networked organizations. This started to be noticed first by the Altimeter/WetPaint survey a few years ago and was most recently verified again by the McKinsey Web 2.0 in business results reported in December, 2010. Their statistical analysis of companies found that "Market share gains reported by respondents were significantly correlated with fully networked and externally networked organisations. This, we believe, is statistically significant evidence that technology-enabled collaboration with external stakeholders helps organisations gain market share from the competition.." These are potent results indeed but it's still hard to combine the Executive Board value estimates for specific technologies and this macro view from McKinsey to determine what your organization should do specifically.

The take away from all this is the following: There are now consistently reported benefits of social for most organizations (the benefits in the short list above.) Other benefits may not apply to you. Use survey results with carefully in your discussions about how to move forward with social business. Others' results are very likely not going to apply to your organization, even in the same industry, in my experience. Do look at what strategically drives forward value in your organization and look at using social tools to improve these. Make sure to use the right tools for the job (in other words, what you have at hand is not necessarily the best solution.) Connect your strategic goals with the right collaborative solutions that have the risk and adoption profile your organization can tolerate.

Finally, measure what you do. The biggest challenge I see organizations today facing is not measuring KPIs before and after social tools and seeing what the benefits were.

Are you using industry data to find out how to drive your social software strategy? Why or why not. Please leave your comments in Talkback below.