AT&T Q4 mixed as wireless churn increases amid media merger integration

AT&T delivered mixed fourth quarter results as earnings matched expectations, but revenue fell short.

Like Verizon, AT&T's fourth quarter sales fell short. The company reported fourth quarter earnings of $4.9 billion, or 66 cents a share, on revenue of $48 billion. Adjusted earnings were 86 cents a share. Wall Street was expecting fourth quarter earnings of 86 cents a share on revenue of $48.5 billion.

For 2018, AT&T reported earnings of $2.85 a share, down from $4.76 a share a year ago due to tax reform, on revenue $170.8 billion.

AT&T reaffirmed outlook and said it would focus on paying down debt. AT&T has bulked up by buying Time Warner, which has become WarnerMedia. AT&T also acquired AppNexus in an attempt to grow ad revenue. AT&T CEO Randall Stephenson said the top priority is reducing debt and using cash flow to invest in the business.

One of those key investments will be 5G deployments. AT&T said it added 3.8 million wireless net adds in North America with 2.8 million in the U.S. and 1 million in Mexico.

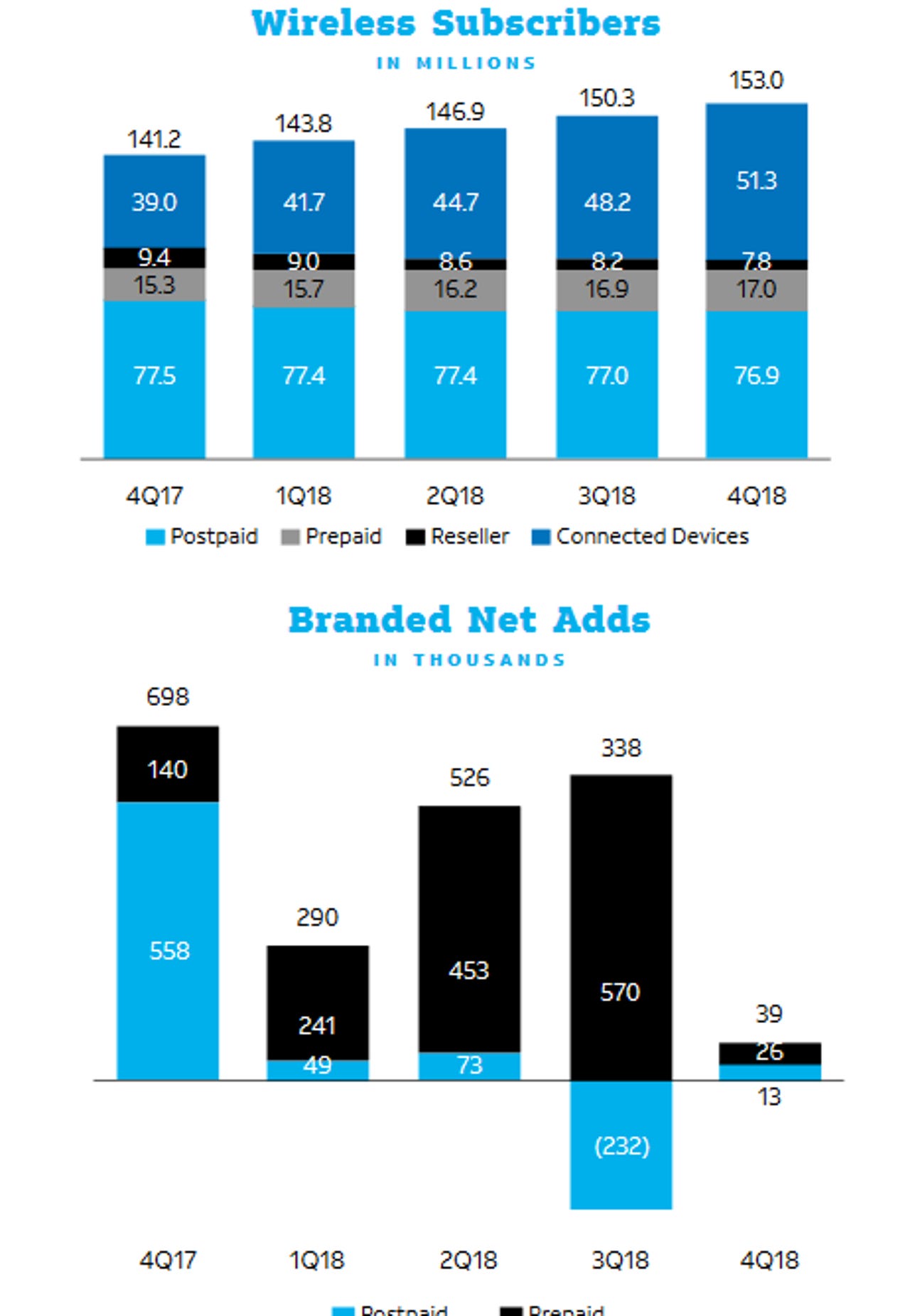

AT&T ended the year with 153 million wireless subscribers, up from 141.2 million a year ago. Connected devices are becoming a larger chunk of the subscriber base.

Phone net additions in the U.S. were 147,000 in the fourth quarter. In an investor briefing, AT&T noted that its churn increased:

Postpaid churn was 1.24%, up from 1.11% in the year-ago quarter largely due to limited promotional activity. Postpaid phone churn was 1.00%, compared to 0.89% in the year-ago quarter. Branded churn was 1.82%, compared to 1.75% in the year-ago quarter.

AT&T added that DirecTV Now subscribers down 267,000 as discounted offers expired. Traditional video customers fell 391,000 in the quarter.

AT&T's presentation was mostly focused on integrating mergers and businesses beyond wireless. Here's a look at AT&T's 2019 to-do list.