AT&T says 5G network nationwide by mid-year as Q4 earnings solid

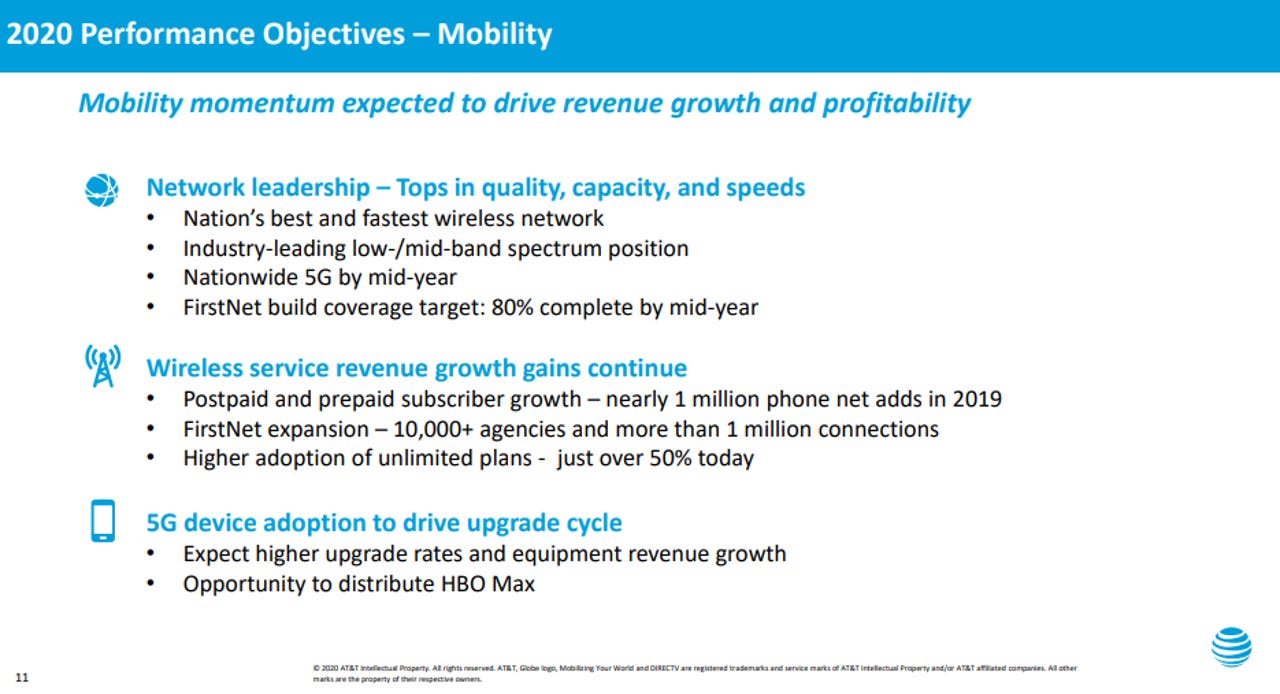

AT&T's fourth quarter earnings topped expectations as the company added 229,000 net wireless postpaid customers but continued to lose video subscribers. The company said its 5G network will be launched mid-year.

The company, a telecom, wireless and media conglomerate, reported adjusted fourth quarter earnings of 89 cents a share on revenue of $46.8 billion.

Wall Street was expecting AT&T to report fourth quarter revenue of $46.96 billion and adjusted earnings of 87 cents a share.

What is 5G? Everything you need to know about the new wireless revolution

For the year, AT&T reported earnings of $1.89 a share on revenue of $181.2 billion. The company also said it cut its net debt by $20.3 billion over the year and achieved its savings target of a $700 million run rate after acquiring Time Warner. AT&T ended the quarter with $151 billion in net debt.

AT&T is prepping the launch of its HBO Max streaming service in May. The company reiterated its 2020 outlook. Among the moving parts:

- Wireless service revenue was up 1.8% for the fourth quarter and AT&T had almost 1 million total phone net adds for 2019.

- The company said its FirstNet coverage is more than 75% complete.

- AT&T lost 945,000 net premium TV subscribers for a customer base of 19.5 million. The AT&T TV NOW subscriber base lost 219,000 net customers. AT&T did add 191,000 broadband subscribers.

- The company said that it expects video subscriber losses to ease up in 2020.

- Operating income for the fourth quarter was $5.3 billion, down from $6.2 billion a year ago. Net income in the fourth quarter was $2.4 billion.

For 2020, AT&T is projecting revenue growth of 1% to 2% with adjusted earnings of $3.60 a share to $3.70 a share. AT&T said it expects to pay off 100% of the acquisition debt from the Time Warner purchase in the next three years.