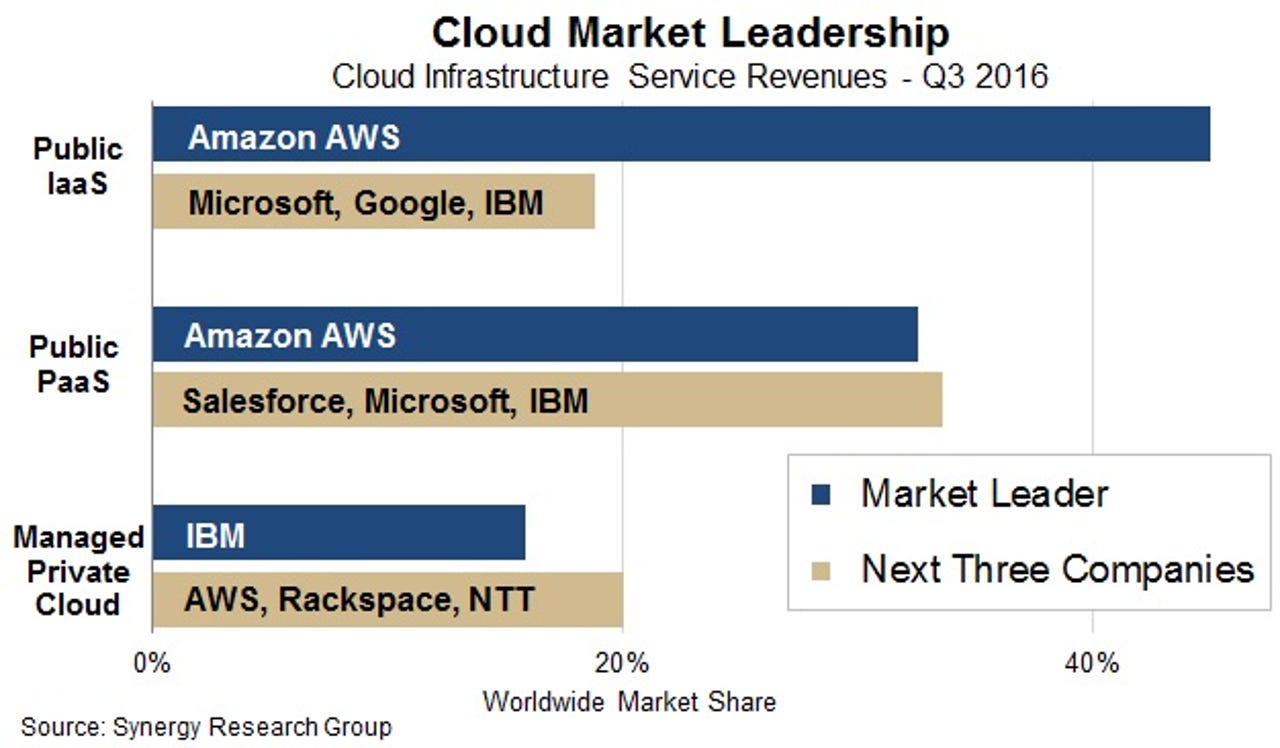

AWS public cloud is twice as big as Microsoft, Google, IBM combined

The Q3 2016 public cloud revenue chart reveals the strength of AWS.

Amazon Web Services is utterly dominating the competition, taking 45 percent of worldwide revenues for public cloud services, according to a new analysis.

Microsoft and Google might be increasing public cloud revenues faster than AWS, but they've also got a long way to go to come close to catching up, a new analysis from Synergy Research Group shows.

The combined revenues from Microsoft, Google, and IBM amount to less than 20 percent of worldwide infrastructure-as-a-service, or IaaS, revenues in Q3 2016, compared with AWS's 45 percent, the research firm reports.

The analysis doesn't delve into the profitability of each firm's cloud business, though that's probably because AWS is the only public cloud outfit that discloses operating income each quarter.

AWS last week reported an operating income of $861m for Q3 2016 on revenues of $3.2bn. With that result AWS has delivered an operating income of $2.18bn on revenue of $8.68bn in the first nine months of the year.

AWS's operating income now overshadows Amazon's North America e-commerce business, which had year-to-date operating income of $1.54bn on revenue of $53.54bn.

AWS's consecutive quarterly revenue gains this year put it on target to generate at least $12bn in revenues, with an operating income of around $3bn by the end of the year.

Microsoft, by contrast, reports its commercial cloud revenue has an annual run rate of $13bn. However, that figure includes Azure, Office 365, and services. Google hasn't disclosed its revenue run rate and IBM puts its as-a-service run rate at $7.5bn.

According to Synergy Research Group, the combined market for IaaS, platform-as-a-service, and managed private cloud was worth $8bn in the third quarter. IaaS is the biggest component, though PaaS is the fastest-growing segment.

AWS also dominates PaaS revenues, with revenues about equal to its three largest rivals, Salesforce, Microsoft, and IBM.

IBM, which is rebranding SoftLayer under the Bluemix brand, is leading the managed private cloud field, ahead of AWS, Rackspace, and NTT.