Best Buy reports strong Q2, ups outlook as position is 'fundamentally stronger'

Best Buy reported a better-than-expected second quarter, raised its outlook for the fiscal year and said it is a fundamentally better position now that demand is strong in its online and brick-and-mortar stores.

The company's results rhyme with other retailers that have upped their digital transformation game. Retailers ranging from Walmart to Target to Home Depot and Lowe's have all reported strong results. Foot traffic in physical stores have increased as digital channels post growth even against tough comparisons from a year ago when most sales were online.

Best Buy reported fiscal second quarter earnings of $2.90 a share and $2.98 a share non-GAAP. Revenue for the second quarter was $11.85 billion, up from $9.9 billion a year ago. Wall Street was expecting second quarter non-GAAP earnings of $1.85 a share on revenue of $11.49 billion.

CEO Corie Barry acknowledged that Best Buy was lapping an unusual COVID-19 pandemic quarter, but sales were up 24% from the fiscal 2020 second quarter as operating income more than doubled. Barry said demand for technology was strong. She said:

Over the longer term, we are fundamentally in a stronger position than we expected just two years ago. There has been a dramatic and structural increase in the need for technology. We now serve a much larger install base of consumer electronics with customers who have an elevated appetite to upgrade due to constant technology innovation and needs that reflect permanent life changes, like hybrid work and streaming entertainment content.

Best Buy raised its outlook and now expects fiscal 2022 revenue to be between $51 billion and $52 billion with same store sales growth of 9% to 11%. Best Buy was projecting same store sales growth of 3% to 6% for fiscal 2022.

For the third quarter, Best Buy is projecting revenue of $11.4 billion to $11.6 billion with same store sales to fall 1% to 3%.

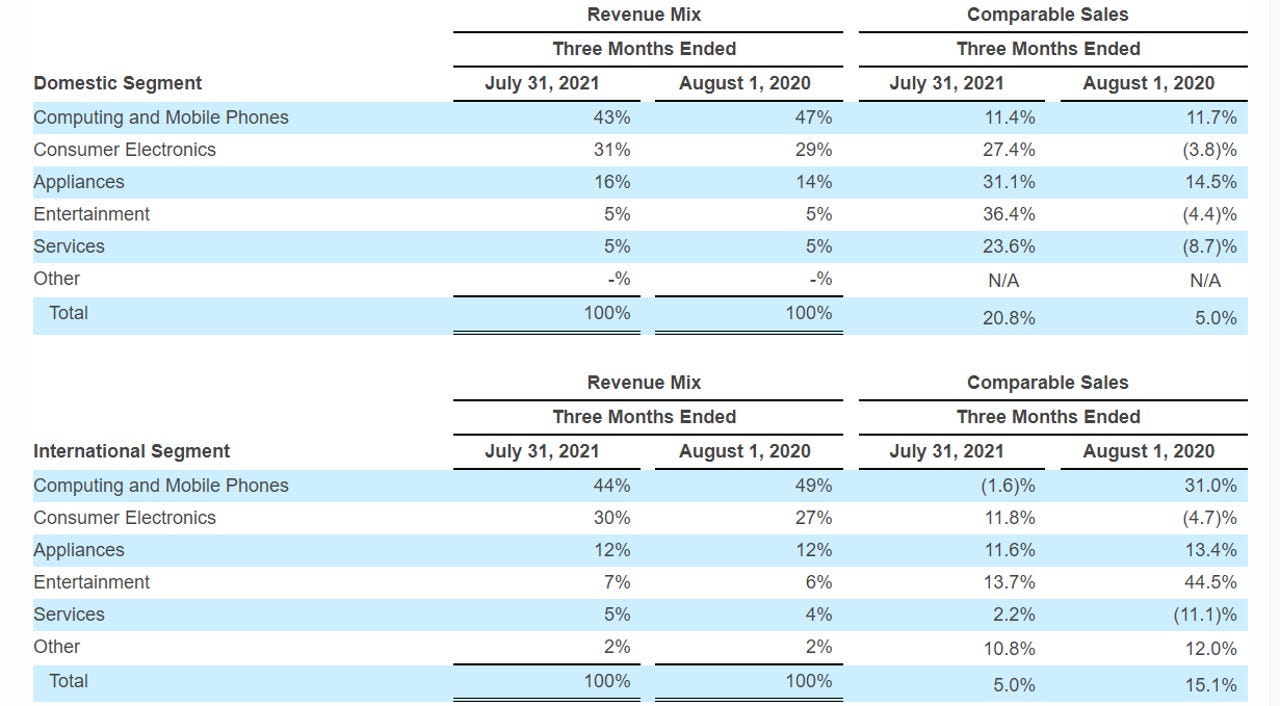

By category, Best Buy saw strong growth across its product lines. The company said 43% of its revenue was from computing and mobile phones with 31% from consumer electronics. Services same store sales growth for the second quarter was 23.6% with consumer electronics up 27.4%. Computing and mobile phone same store sales were up 11.4% ahead of product launches from Samsung and Apple.

Barry outlined a few themes about the state of tech retail. The key takeaways include:

The supply chain is improving. Barry said:

As we think about the holiday period, we often have varying degrees of inventory and supply chain challenges, and this year will be no different. But we feel confident in our ability to serve our customers during the holiday. The continued strong demand across retail resulted in an overall less promotional environment, which was a significant driver of our better-than-expected profitability in the quarter. During the quarter, we provided customers multiple ways to interact with us depending on their needs, preference and comfort. Similar to last quarter, customers migrated back into stores to touch and feel products and to seek in-person expertise and service.

Store fulfillment and curbside pickup endures. Barry said:

In Q2, we continue to see about 60% of our online revenue fulfilled by stores, including in-store or curbside pickup, ship-to-shore or Best Buy employees who are delivering product to customers out of more than 450 of our stores. The percent of online sales picked up by customers at our stores was 42%, similar to last year's second quarter.

Best Buy is betting on membership plans and a pilot is faring well. The membership includes 24/7 support, product protection, free delivery and installation and exclusive member pricing for $199 a year. Barry said:

The goal is to create a membership experience that customers will love, which in turn results in a higher customer lifetime value and drives a larger share of CE spend to Best Buy. We are very excited about this membership offer, and we are encouraged by the pilot results. Membership acquisition has exceeded our initial forecast.

Best Buy continues with its digital transformation efforts. The upgrades include electronic sign labels, a unified omnichannel experience, mobile app checkouts in pilot, a new digital communications digital platform, analytics and cloud migrations.