Box beats Q4 estimates as adoption of Box Suites accelerates

Box on Tuesday delivered better-than-expected fourth quarter financial results. Executives said the company is focused on profitable growth as it eyes revenue of around $200 million for the current quarter.

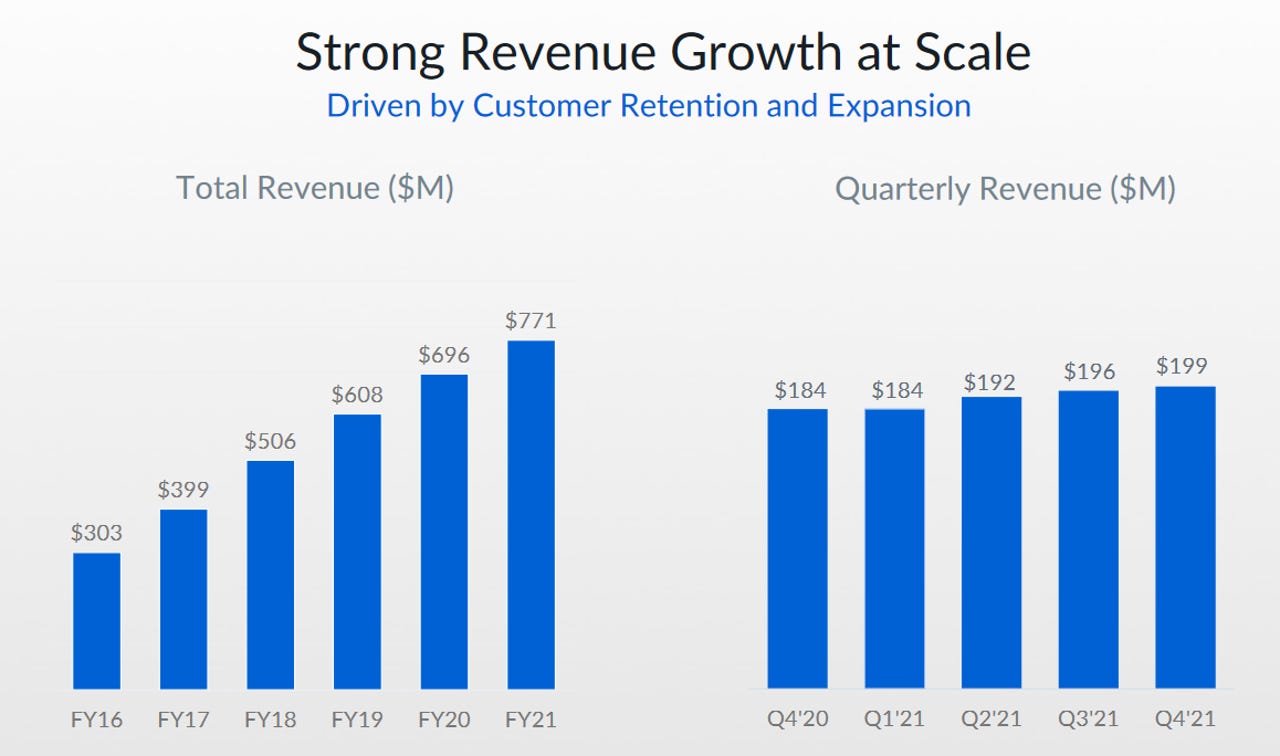

The cloud content management company's Q4 non-GAAP net income per share was 22 cents. Revenue was $198.9 million, up 8 percent year-over-year.

Analysts were expecting earnings per share of 17 cents on revenue of $196.54 million.

"In fiscal 2021, we achieved a significantly stronger balance of growth and profitability while executing on our vision to deliver the Box Content Cloud, a secure platform for managing the entire content lifecycle in the cloud," CEO Aaron Levie said in a statement. "Growing demand for products like Shield and Relay continues to accelerate adoption of our bundled Suite offerings."

For the full FY 2021, Non-GAAP net income per share was 70 cents on revenue of $770.8 million, an increase of 11 percent from fiscal year 2020.

Billings Q4 were $310.1 million, up 10 percent year-over-year. For FY 2021, billings were $812.5 million, an increase of 9 percent from fiscal year 2020.

The company landed deals and expanded business with a number of large organizations in Q4, including Arena Pharmaceuticals, Asahi Group Holdings, Pan-American Life Insurance Group, Talend, Texas Office of the Attorney General, Twilio and United Parcel Service of America.

Box in Q4 also acquired e-signature provider SignRequest and unveiled Box Sign, underscoring the company's broader content management ambitions.

Over the past year, as companies reacted to the Covid-19 pandemic, cloud companies have benefited from accelerated digital transformation initiatives. On a conference call Tuesday, Levie said the growing reliance on cloud applications makes Box's value proposition more compelling. It "increases the need for having a central content cloud that connects to all those tools," he said.

For Q1 FY 2022, non-GAAP diluted net income per share is expected to be in the range of 16 cents to 17 cents. Revenue is expected to be in the range of $200 million to $201 million.

Analysts are expecting an EPS of 16 cents on revenue of $199.09 million.