CBA NetBank gets online makeover

The Commonwealth Bank (CBA) will take down its NetBank online banking platform this weekend, for the second time in two weeks, to give the site a major facelift based largely on customer feedback.

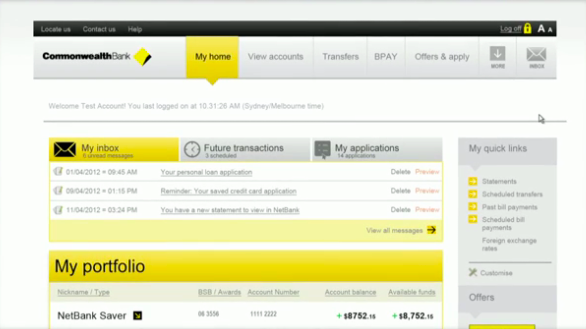

The new NetBank homepage coming into effect next Monday.

(Screenshot by Luke Hopewell/ZDNet Australia)

Cosmetic features include a new home-page design, simplified page navigation and the integration of new functionality, such as a Foreign Exchange toolkit on the front page. Customers will also see new transaction history pages that are displayed when credit card payments are due, and the current interest rate, as well as a new savings goal tool.

Drew Unsworth, the bank's general manager of Online Banking, told ZDNet Australia that the new features are intended to make popular tasks easier to perform.

"A lot of thinking about this is, 'how do we reduce effort for customers and things they do every day'. We tried to simplify popular pages to capture more relevant information, and simplify the navigation up the top.

"We've added some footer information, so that it's easier to find, and then you look at things like transaction history, surfacing key information like how much interest accrued, when payment is due, et cetera," Unsworth said.

The new features will help customers to conduct processes online that they would normally do in branches. Unsworth said that the savings goal tool, for example, steers customers through creating a new account, setting a savings goal and configuring automatic account deposits.

"We've done all that before in branches, but now we want to make it more intuitive for customers," Unsworth said.

While the online banking portal is receiving changes, mobile users shouldn't expect to see changes to apps in the near future, as app development is handled through the Kaching app-development team, while the portal redesign is primarily within the scope of the desktop team.

The bank looks to push usability tweaks to the desktop NetBank platform once every month, but major updates, like the one coming on Sunday, are only scheduled once every six months, according to Unsworth. The next major update to the NetBank platform will enable expanded transaction history information for home-loan products.

The new desktop NetBank design is expected to hit customers by Monday morning. As far as the other features are concerned, Unsworth expects to them to reach all customers by the end of July.

"We will release the home page to all customers first thing next week. Then we'll run a pilot group of the transaction history page over the next four weeks. We dial it up after that, and monitor activities and make sure that if anything's broken, we fix it, and identify that customers learn about these changes," Unsworth said.