How deep learning will transform the future of the auto industry

One of CES' major trends over the last few years has been the connected car -- the concept of adding Internet connectivity and networking to our vehicles.

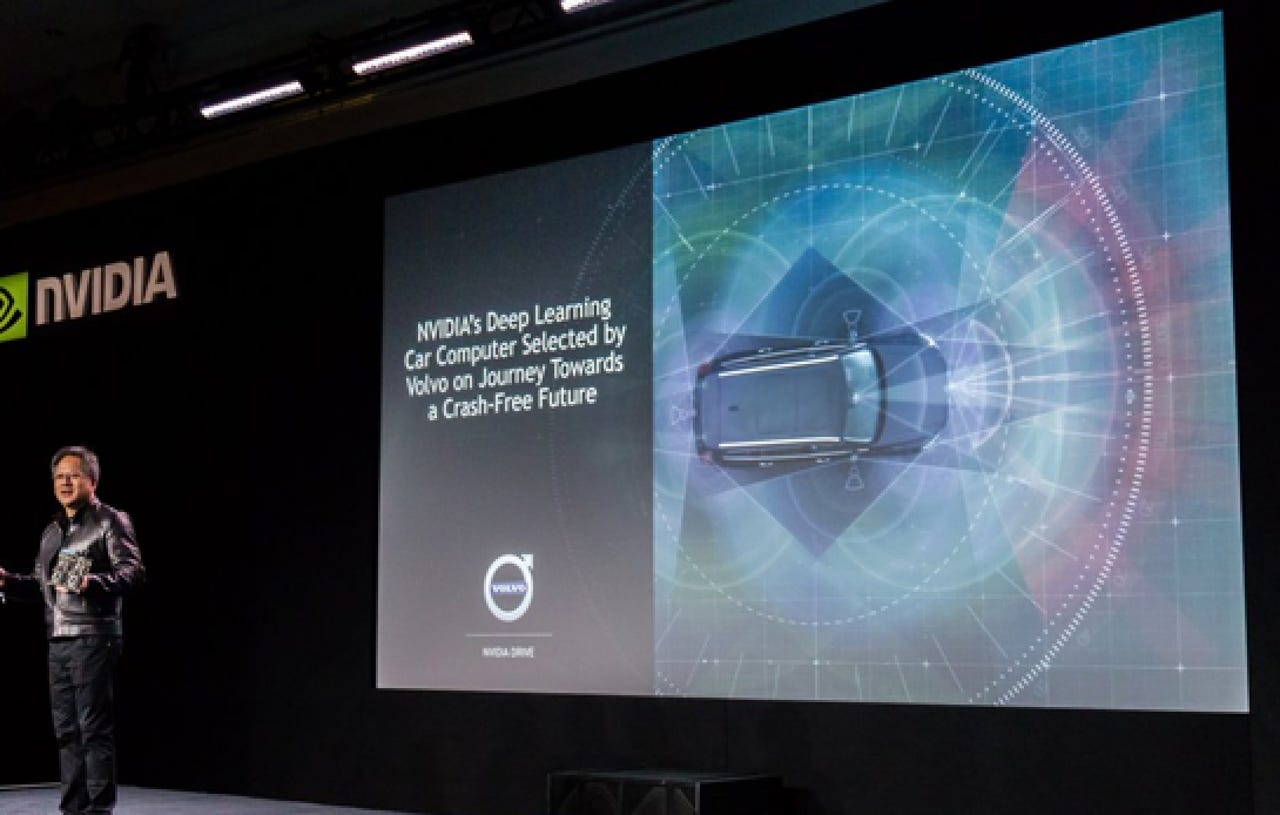

Stealing the spotlight this year was Nvidia, which launched the Drive PX 2 -- an in-car artificial intelligence system. PX 2 is designed for automakers exploring autonomous driving and includes 360-degree situational awareness, deep learning and the processing power of 150 MacBook Pros.

Via: Nvidia

Deep learning -- an advanced type of artificial intelligence (AI) -- is driving significant change for autonomous vehicles and for the automotive and transportation industries in general, according to a new report from advisory firm KPMG.

The study predicts that by 2030 a new mobility services segment linked to products and services related to autonomy, mobility, and connectivity will be worth more than $1 trillion worldwide.

Featured

The report notes that the direct impacts of deep learning will "revolutionize the nature of doing business for automakers." Deep learning is an important enabler of building self-driving vehicles that can operate without human intervention. Underlying those efforts is the need for the vehicle to "see," "think," "drive," and "learn," and it's through this last learning step that deep learning will be critical to achieving fully autonomous cars.

"Deep learning is accelerating autonomy faster than anyone could've imagined, and it has far-reaching implications for the industry and societal mobility as a whole," said Gary Silberg, national automotive leader at KPMG. "If a car can't learn, then it's still reliant on millions and millions of lines of code, with such complexity and ambiguity that full autonomy wouldn't be achievable for many years to come."

We're at the start of what Silberg calls a new era in automotive product development and manufacturing -- one that emphasizes a vehicle's nervous system including a computer "brain," sensors, controls, driver interaction, and data storage even more than the powertrain. "This is an enormous shift in organizational structure, talent acquisition, and operating model for most car manufacturers," he said.

KPMG noted that this is a critical juncture in the history of the automotive industry, with OEMs and technology companies facing off in a battle for specialized talent. Professionals who have deep learning skills are in short supply, the report said, and the pool of experts among those specialists is even smaller.

This gap makes it difficult for traditional automakers to compete with technology leaders. Furthermore, universities are not keeping pace with the autonomous driving market demands for talent.

In the report, KPMG laid out some key developments automakers need to think about if they are to survive the coming transformation.

One is that vehicle operation and ownership is changing. Because of deep learning, autonomy and mobility, car ownership is moving from individually-owned vehicles to shared driving experiences, with a growing consumer focus on mobility and transportation on demand. By 2030, a new mobility services market will emerge for products and services related to autonomy, mobility, and connectivity.

Something else for automakers to consider is that most of them no longer will simply be automakers. With deep learning accelerating autonomy, these companies will need to make choices about whether to remain pure automakers, become mobility service providers, or both.

Furthermore, the nervous system will become the centerpiece of vehicle design, changing the way manufacturers think about the creation of vehicles. Automotive product development and manufacturing will emphasize vehicles' smarts: the computers, sensors, controls, driver interfaces, and data storage components.

Finally, automakers will need to find talent to support these new developments. As KPMG points out, there are few people capable of building deep learning systems, and automotive companies are already scrambling to find them.