Dell beefs up storage, but EMC partnership could be strained

Dell's acquisition of 3Par gives the company a beefier storage line-up, but the deal is likely to strain a key relationship with EMC, say analysts.

On Dell's conference call with analysts on Monday, the majority of the questions about the 3Par purchase revolved around EMC. Dell and EMC have had a storage partnership for years. The reselling pact renews every year for three years. The company line is EMC and Dell has an evergreen partnership with 24,000 joint customers.

Also: With 3Par, Dell covers its data center storage bases

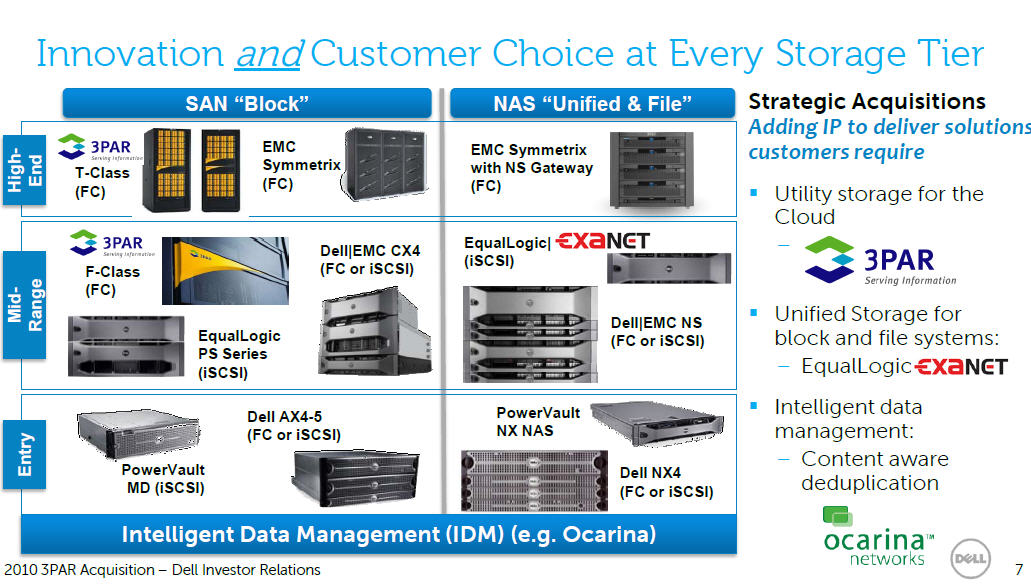

Brad Anderson, senior vice president of Dell's enterprise product group, said that the 3Par deal isn't necessarily competitive with EMC. Dell wasn't selling many of EMC's high-end Symmetrix systems. In fact, 80 percent of what Dell will sell from 3Par and EqualLogic won't overlap with EMC.

Anderson said:

Our plans will be continue to offer EMC. EMC, we have had a 10-year relationship. They are a very important storage provider and they will continue to be an important part of our lineup. And so we will continue to offer the Dell EMC CLARiiON products, as well as their dedupe and NAS capabilities and provide customers the choice of the Dell EMC products, as well as the new 3PAR products. The 3PAR products in general sit above where we sell Dell EMC CLARiiON today.

However, 3Par's gear will compete with EMC's high-end storage systems. The big question is how long this EMC-Dell relationship will last. Dell's Steve Schuckenbrock, president of the company's large enterprise unit, said that "there is plenty of clear water for us to continue to work together."

Analysts weren't buying it. Barclays Capital analyst Ben Reitzes said:

While the acquisition is relatively immaterial for Dell, we believe the biggest impact will be a further strain on the Dell/EMC relationship; we expect EMC to move even quicker to diversify itself further away from Dell.

Reitzes noted that the success of EqualLogic, which is now at a $800 million annual revenue run rate, may be due to replacing EMC gear among Dell's customers.

Susquehanna Financial Group analyst Jeffrey Fidacaro said in a research note that Dell's purchase of 3Par may wind up hurting storage revenue for a bit.

We estimate EMC represents about 50% of Dells’ storage revenue (down from over 80% in FY09), with about 90% of this business coming from sales of Clariion (mid-range) and 10% from high-end Symmetrix systems. With 3Par’s products primarily targeting scalability and performance in high-end SAN implementations (3Par’s T-Class), we believe the acquisition could stress Dell’s EMC relationship or disrupt storage sales in the near-term.

The challenge for Dell is that 3Par's systems are more complex to implement than EqualLogic so it's possible that Dell will have to invest in sales and services to build out enterprise sales.