Dell is going shopping: Pondering the data center and services targets

Dell CEO Michael Dell said the company is likely to spend some of its $10 billion in cash on an acquisition that would give it more of a foothold in the data center or expand its services.

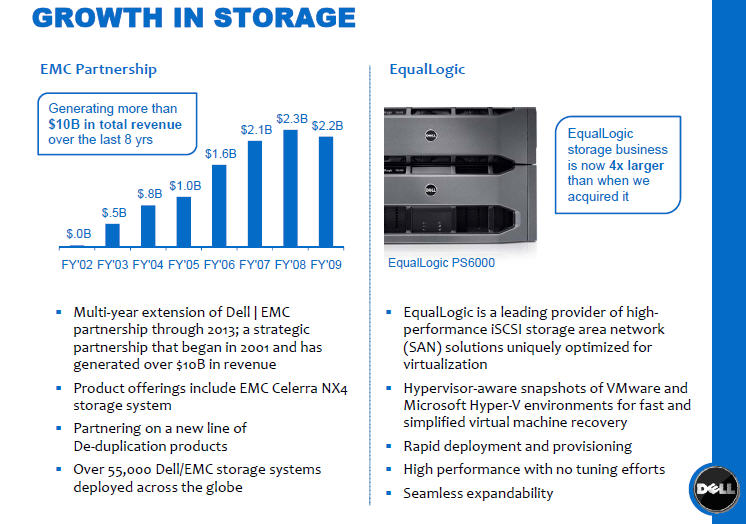

The one bright spot of Dell's first quarter was the company's comments on its revenue mix---software, services and data center products are taking up a bigger chunk of the sales pie. Meanwhile, Dell said its acquisition of EqualLogic was giving it more play in data centers.

But here's the problem: Dell's revenue mix is shifting because its traditional hardware sales are tanking---the fiscal first quarter year over year declines were ugly. If Dell can cement that business mix shift it would go a long way toward becoming more relevant in the hardware replacement cycle. Enter the acquisition talk.

On Dell's earnings conference call, J.P. Morgan analyst Mark Moskowitz asked executives whether they would pursue "inorganic opportunities," also known as acquisitions to make a services or enterprise hardware play. Michael Dell said basically said the company plans to go shopping:

Well, we are piling up cash and we think the cash flow is going to continue to be pretty powerful for the foreseeable future. Feeling pretty good about the operational improvements in working cash flow that are occurring. I think the assets that we have are strong ones and give us a great position to be able to extend as you are suggesting. You know, asset prices are getting pretty attractive and certainly we are looking at how we are going to expand inorganically. You know, in the last couple of years, we sort of entered this process -- we previously hadn’t really done acquisitions have done about 10 transactions, only one of them at any sort of size that would get anyone’s attention. That was the Equal Logic transaction. That business is now roughly four times larger than when we started and significantly more profitable. You know, it’s a very profitable fast-growing part of our business, so yeah, we’ll be looking in that direction and stay tuned.

In a research note, Moskowitz said:

Dell appeared to be open to the idea of expanding its presence in the data center through acquisition. We note the company currently holds approximately $10.1 billion in cash and investments. If the company were to diversify further into the data center and away from its PC-centric model, we could become more constructive on the story.

If you take those comments a step further the transformational acquisition possibilities for Dell are pretty wide ranging.

To wit:

- Dell's market cap as of market close Thursday was $22.4 billion;

- Accenture---a target if Dell wanted to go whole hog on services---has a market cap of $18.4 billion;

- EMC has a market cap of $23.6 billion;

- NetApp has a market cap of $6.27 billion;

- Juniper Networks has a market cap of $13 billion;

- Wipro's market cap is $16.8 billion;

- Cognizant has a market cap of $7.4 billion.

Those market caps and companies (used for illustration purposes only) indicate that almost anything---mergers of equals with Dell and a large player or a strategic pickup---is possible. Some combination of cash and stock would be involved with any deal. If Dell really wants to be a big data center or services player it has the capacity to make a big move.

It's unclear what direction Dell would take. Mergers of equals can be messy, but a pickup of NetApp---even though it would complicate a fruitful Dell-EMC partnership---or Cognizant would make a lot of sense. Dell just loves storage these days given the success of the EqualLogic deal:

Until one of those transformational deals happen there just isn't much to get excited about with Dell. The company's PC business is hoping to be saved by Windows 7.

Michael Dell said:

I think what we are seeing certainly is a big deferral of purchases among corporations but when we talk to them, the thing I’m hearing is they are planning on a pretty big 2010 client refresh, and they are sort of planning around Windows 7. They’ve passed over Vista and they are sort of planning for that now.

I think the client installed base is getting pretty old in these companies and I think there will be quite a powerful cycle of upgrades in the client environment. I do think it will be different this time. I think they will be very focused on newer technologies like virtualization. They will be very focused on ROI. There will be some new opportunities around wireless and mobility, with hoteling and those sorts of things. We’ve been doing some pilots with some large companies and have had some great success there and we think there are some big opportunities there.

Meanwhile, there's no sign of a spending bottom---unless you count the government outspending enterprises progress.