DocuSign: How it plans to expand from e-signature to digital transformation engine, agreement cloud

DocuSign made its name via e-signature software for small-to-midsized businesses as well as enterprises. But now increasingly is positioned as a digital transformation engine as enterprises look to go paperless and automate workflows.

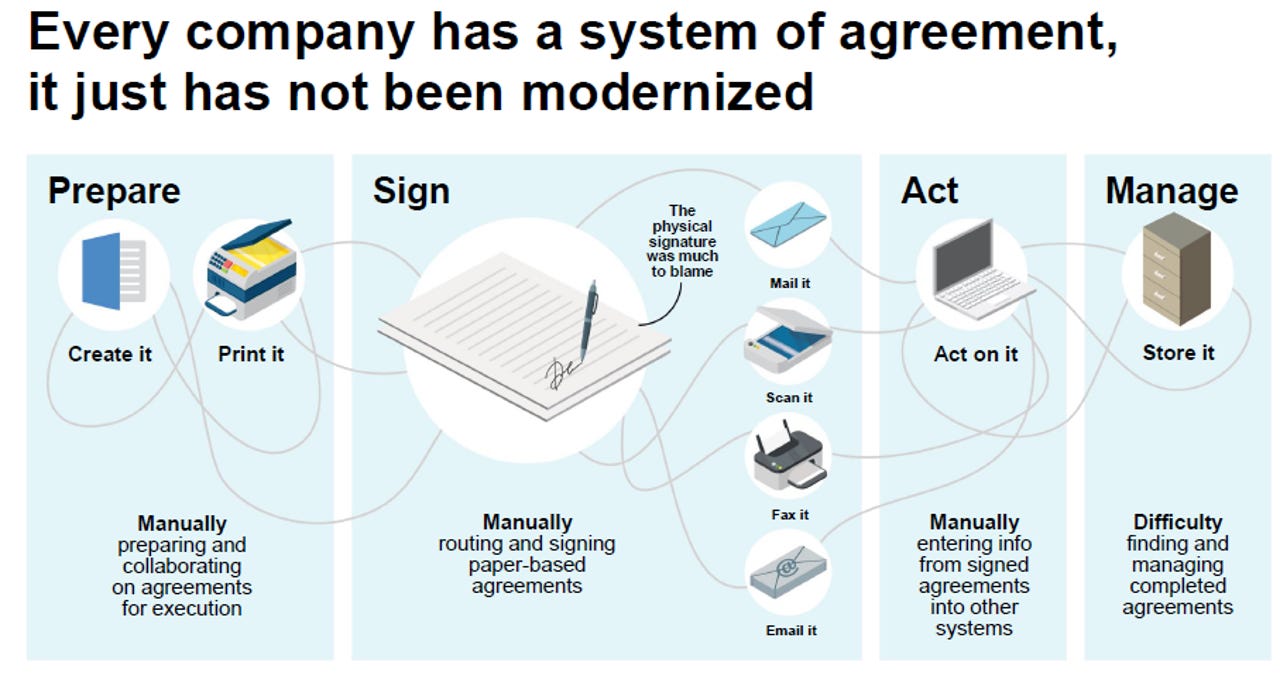

In a nutshell, DocuSign's growth strategy revolves around digitizing paper agreements and contracts into a series of processes that take an agreement and turn it into actions delivered via payment, CRM and ERP systems. DocuSign CEO Dan Springer refers to the strategy as solving the last mile of digital transformation.

Here's a look at the last mile agreement issue and the DocuSign platform that looks to fix it.

Via DocuSign there's an e-signature workflow.

From there, DocuSign has built out what it calls a system of agreement, an Agreement Cloud if you will. "The Agreement Cloud is not complicated, but there is a lot of business process involved," said Springer in an interview. "Once all my agreements are consummated online there is stuff to do before and after."

Add it up and DocuSign is moving up the enterprise software food chain and projecting fiscal 2020 revenue nearing $1 billion. DocuSign reckons it has a $25 billion total addressable market. Meanwhile, analysts are upbeat. Evercore ISI analyst Kirk Materne said in a research note:

We believe DocuSign's expanding product portfolio, which moves DocuSign beyond just e-signature, and growing ecosystem of partners puts the company in a good position to help its customers address the 'last mile' of digital transformation and deliver strong growth over the next few years.

We also see DocuSign as a 'stealth' ESG (environmental, social and governance) idea given its ability to help companies move to more paperless processes.

We caught up with Springer to talk workflow, digitization and DocuSign's Agreement Cloud.

The customer base. DocuSign has a whopping 540,000 customers with 90% of them coming from the Web and a free trial. While that base provides most of the volume, only 15% of revenue comes from small business via the web and mobile. "We have three segments: web and small business, commercial with $10 million in revenue to $1 billion and enterprise with revenue above $2 billion," said Springer. "The core company strength is commercial and direct sales to midmarket. We don't break it out, but close to half of the business is commercial."

"But enterprise is the fastest growing."

E-signature as a market. Springer said DocuSign's biggest competitor--despite a field of dozens of rivals--is really paper. "Our competitor is paper and manual processes," he said.

E-signature is going to be a core offering for anything that needs a contract or agreement. "We've added the ability to build a document into DocuSign and prepare and create it," said Springer. That feature was added because preparing a contract offline and then uploading it to DocuSign was a process that could eat up time if agreements were a daily occurrence for a company.

Agreement Cloud and what happens after an e-signature. Springer said that DocuSign's enterprise customers are focused on what happens post signature. Enter the Agreement Cloud. The Agreement Cloud revolves around an API system that triggers actions. Once a lease is signed, a company can send a bill. Salesforce sends out a contract and once its signed it goes to a CRM system, service starts and the company sends a bill. There is also contract lifecycle management where agreements are stored in a safe place. Springer explains that once the contracts are in one place, enterprises can search across them to determine how many are pegged to the price of oil and other risks.

That contract lifecycle management features were added via DocuSign's SpringCM acquisition.

Time to integration. Springer explained that the time it take to integrate DocuSign varies from minutes to days. A small business can sign up at DocuSign and be able to deliver agreements in minutes. A large enterprise may see something like a 45 day process and systems integrators. Nevertheless, DocuSign's contract management tools are attracting larger systems integrators as enterprises aim to make workflows more efficient and paperless.

Use cases. "There are multiple front office and back office use cases," said Springer. "By volume, most use cases are front office." In fact, many consumers have encountered DocuSign whether they are buying a house or auto or signing up for wireless service. For instance, T-Mobile uses DocuSign to on-board employees as well as add consumers. Morgan Stanley uses DocuSign for private wealth management agreements. Bank of America gave DocuSign a shout out on a recent earnings call because it is a core part of their digitization efforts.

"Every company has a system of agreement and is looking to automate and make it more efficient," said Springer. "Within Microsoft (a DocuSign customer and partner), we identified 275 use cases. Most customers are using us for less than 5 use cases."

What executives have the buying power? Springer said that traditionally, DocuSign's enterprise contracts run through the CIO, but increasingly executives from all lines of business are involved. "At large companies, it could be legal, the financial head or HR head. They are focused on the process and back office efficiency," he said.

Infrastructure. Given DocuSign's role in agreements and legal documents, the company has built its own data center network. It is working with Microsoft on Azure expansion to comply with local data regulations. Springer said Azure is being explored for DocuSign's Canada and Australia operations. The problem: DocuSign has had trouble matching its cost efficiency with its own data center. "Our own data centers are half as expensive and they are reliable and targeted at what we do," explained Springer. "We have to have high performance because if our system is down our customers can't close a sale."

DocuSign's infrastructure today revolves around 3 data centers in the US and 3 in Europe under a hot backup system that has no maintenance windows. Springer said he would move to the cloud if the returns lined up, but will utilize infrastructure as a service for expansion and data portability regulations.

Targeting industries. DocuSign was recently FedRamp certified and the Department of Veteran Affairs is using the service to reach out to vets for support services. The government market, however, is a marathon not a sprint, noted Springer. No vertical represents 10% of DocuSign revenue, but real estate, banking, insurance, healthcare and telecom are big industries for the company, added Springer.

The environmental and sustainability returns. Springer said that DocuSign can lessen businesses' environmental impact by going paperless. For instance, processing paper requires trees, a lot of water and CO2 to move it. DocuSign doesn't actively market its software as a way to fight climate change, but Springer said customers started seeing the value earlier in 2019.