EMC gobbles up Isilon Systems in pursuit of 'big data' projects

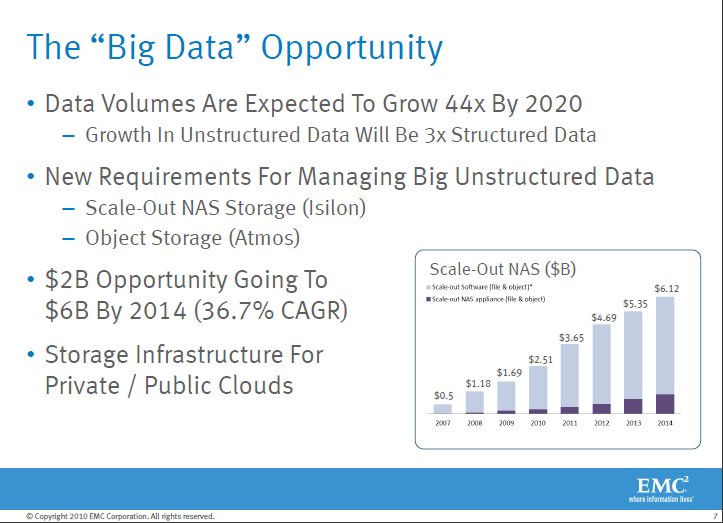

Another independent storage player gets gobbled up. EMC said Monday that it will buy Isilon Systems, a network attached storage company, for $33.85 a share in cash or $2.25 billion. Why? EMC, like a bevy of other vendors, is chasing big data management projects.

Isilon is known as a so-called scale-out network attached storage player. EMC said it will combine Isilon with its Atmos products to focus on data management products for verticals like life sciences, media and oil and gas.

EMC is paying a 29 percent premium from Isilon's closing price on Friday (statement). Isilon, which is likely to have $200 million in 2010 sales, has 500 employees and 1,500 customers such as Sony and Kodak. Isilon was founded in 2001.

From an art of war perspective, the EMC purchase of Isilon is notable. For starters, EMC's acquisition of Isilon makes it more competitive against NetApp. And then EMC blocks Dell from making a NAS play. Wells Fargo analyst Jason Maynard said that the EMC/Dell relationship remains strained. Maynard added:

We believe EMC is acquiring Isilon for the following reasons: (1) EMC is looking to strengthen its position against NetApp in the NAS market; (2) EMC is seeking to replace lost Dell revenue with ISLN; (3) EMC is making Dell's NAS path a little harder. With the acquisition of Isilon, EMC adds a solid low/mid-range NAS offering that overlaps with its existing Celerra product line. Given the industry move towards unified storage and the current Celerra positioning, we assume there will be some rationalization between these two products. With that said, there are some good stand-alone niche markets around media and cloud-based storage, in which Isilon has a strong foothold.

Here's EMC's plan for Isilon:

- Isilon's systems start small and can scale to 10 petabytes. Isilon gives EMC a foot in the door and can use Isilon to sell systems that go beyond 10 petabytes.

- EMC's Atmos object storage will complement Isilon's gear.

- EMC will then target private and public cloud storage environments.

- Joe Tucci, CEO of EMC, said that the combination of Isilon and Atmos will hit a $1 billion revenue run rate in the second half of 2012.

In the big picture, EMC's Isilon purchase highlights how the pursuit of big data projects is quickly consolidating the storage industry. HP acquired 3Par. EMC has gobbled up Greenplum. And IBM bought Netezza. Analytics/storage plays are being gobbled up at a rapid clip.

As for EMC, executives presented EMC's portfolio and how Isilon will fit.

The Isilon purchase won't impact EMC's 2010 earnings and will add to them in 2011.

Needless to say, Isilon shareholders were very pleased on Monday. Shares were up 29 percent.