GPU shipments slump during Q4'12, claims report

The final quarter of 2012 was a bad one for the GPU industry, with all the major players experiencing a precipitous slump in shipments.

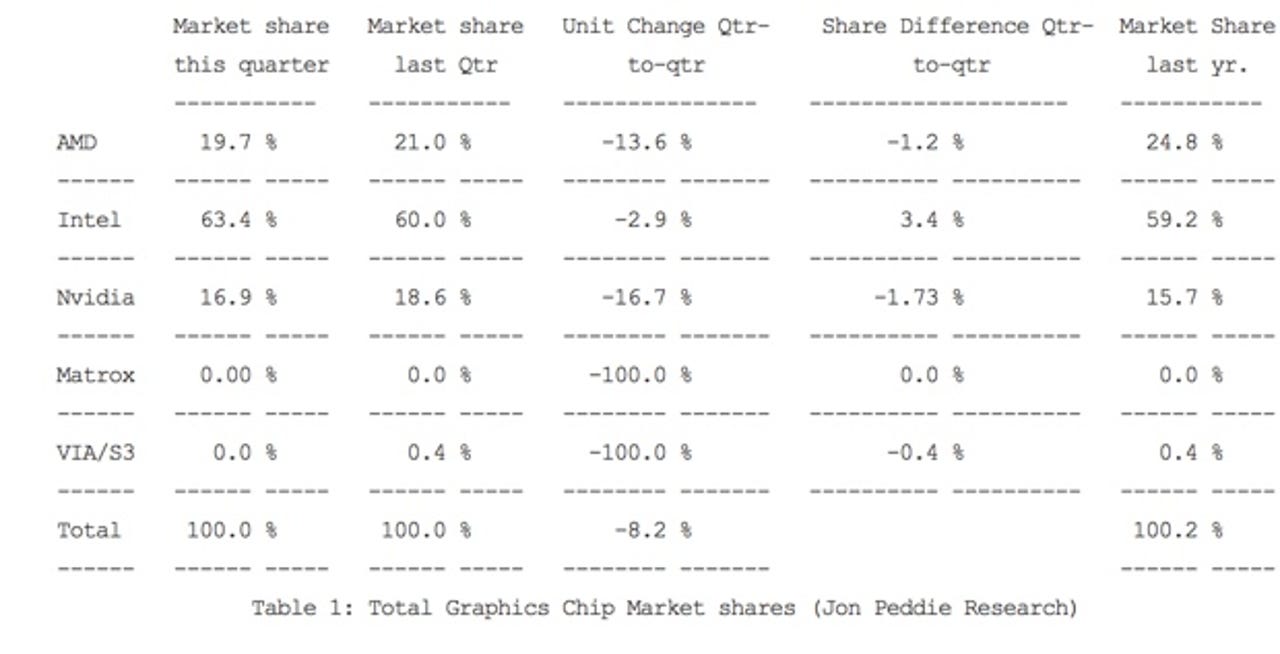

According to Jon Peddie Research, every one of the major players in the GPU market saw shipments of GPU silicon fall. Nvidia saw the biggest drop, falling 16.7 percent quarter-to-quarter, and AMD seeing shipments fall by 13.6 percent. Intel suffered the smallest slip, down only 2.9 percent.

Overall, the graphics market fell 8.2 percent, while the PC industry as a whole grew 2.8 percent. The difference, according to the report, "may be attributed to Intel's improved embedded graphics, finally making 'good enough' a true statement."

"On a year-to-year basis," the report says, "we found that total graphics shipments during Q4'12 dropped 11.5% as compared to PCs which declined by 5.6% overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped and most of the PC vendors are guiding down for Q1'13."

In real terms, shipments were down 3 million units from the same quarter the previous year.

But despite the popularity of tablets and smartphones, the report predicts that the CAGR (compounded annual growth rate) for PC graphics from 2012 to 2016 will be 3.2 percent, and we expect the total shipments of graphics chips in 2016 to be 549 million units.

Both discrete graphics chips (those built onto graphics cards and chips with graphics (such as APUs) are considered a leading indicator for the PC market. At least one GPU is present in every PC shipped, with some shipping with two or more (for example, a discrete GPU and a separate graphics chip inside the CPU. The average number of graphics chips in a system has grown from 1.2 GPUs per PC in 2001 to almost 1.4 GPUs per PC for the end of 2012.