HCM provider Asure Software eyes market growth with trio of acquisitions

Asure Software, an Austin-based provider of human capital management (HCM) and workplace management software for small businesses, has acquired a trio of companies, as it aims to bolster its market position among larger rivals.

The company announced on Tuesday that it recently bought TelePayroll Inc, Pay Systems of America, and Savers Administrative Services. All three companies are providers of HR and payroll services and are current resellers of Asure's HR platform, Evolution.

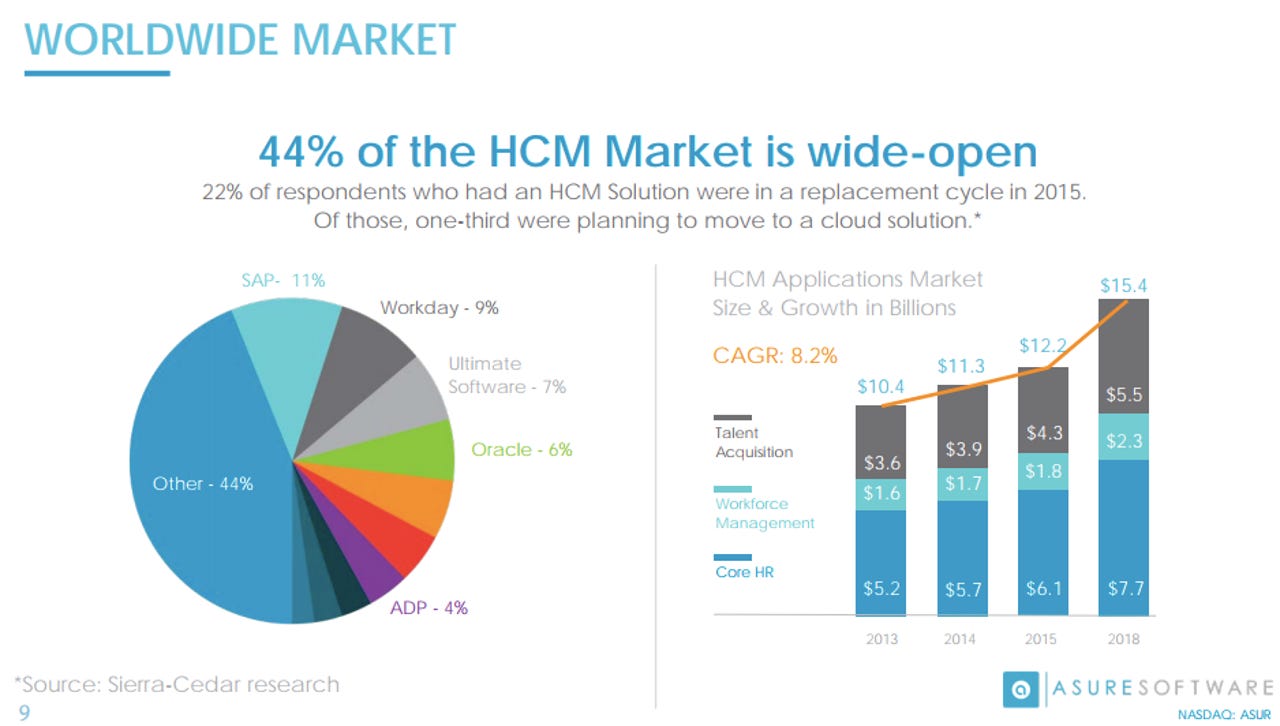

Asure, not to be confused with Microsoft's Azure cloud platform, is nestled in between goliaths and a bunch of smaller vendor companies in the HCM and workplace management space. Its competitors include Workday, Oracle, and ADP on the upper end, and a bevy of small vendors at the low end of the market. Asure's platform is tailored SMBs with 50 to 2,000 employees.

Asure CEO Pat Goepel said in a statement that the acquisitions will provide "significant customer, product and financial synergies" going forward, as well as expand the company's footprint across the US. The company expects the acquisitions to generate roughly $13 million of revenue, in aggregate, in 2018.

"Looking ahead, we are focused on our key growth initiatives, including accelerating the velocity of our cross-selling opportunities and scaling our business both organically and through strategic acquisitions," Goepel said. "Thanks to our overall growth and profitable track record, we are ideally positioned to capitalize on the robust pipeline of opportunities in front of us and remain focused on achieving our mid-term goal of surpassing $100 million in revenue."

In a research note, Cowen analyst J. Derrick Wood said Asure's M&A strategy is part of the company's broader effort to provide a comprehensive platform for the middle market, where there are few vendors competing. To date, Asure has acquired seven payroll service providers that already license its software, which has enabled a more rapid integration of platforms and bolstered its revenue prospects.

From the Cowen research note:

ASUR's formula is to acquire SBs for ~2x revenue and ~4x EBITDA (post cost-cuts), generating an incremental EBITDA contribution margin of 25-50%. ASUR plans to acquire one or two handfuls of these SBs per year, noting that they each tend to generate $1 mln - $3 mln in revenue annually, on average.

PREVIOUS AND RELATED COVERAGE

Microsoft readies new Dynamics 365-branded HCM apps, virtual customer service agents

Microsoft is expanding its Dynamics 365 lineup with new modular SaaS apps, and is selling customizable virtual support-agent services under the 'Dynamics 365 AI' brand.

Oracle acquiring Australian cloud company Aconex for AU$1.6b

Oracle has offered up AU$1.6 billion to purchase an Australian company that provides cloud solutions for construction projects, subject to an independent review and shareholder vote next year.

Workday makes its big analytics bet, launches Prism Analytics, data-as-a-service, benchmarking

Workday has integrated the technology behind Platfora and is betting that the ability to analyze new data sources will complement its people and financial information.