HP: We're keeping the PC unit

Updated throughout: HP said it will keep its personal systems group and that it will continue to sell PCs.

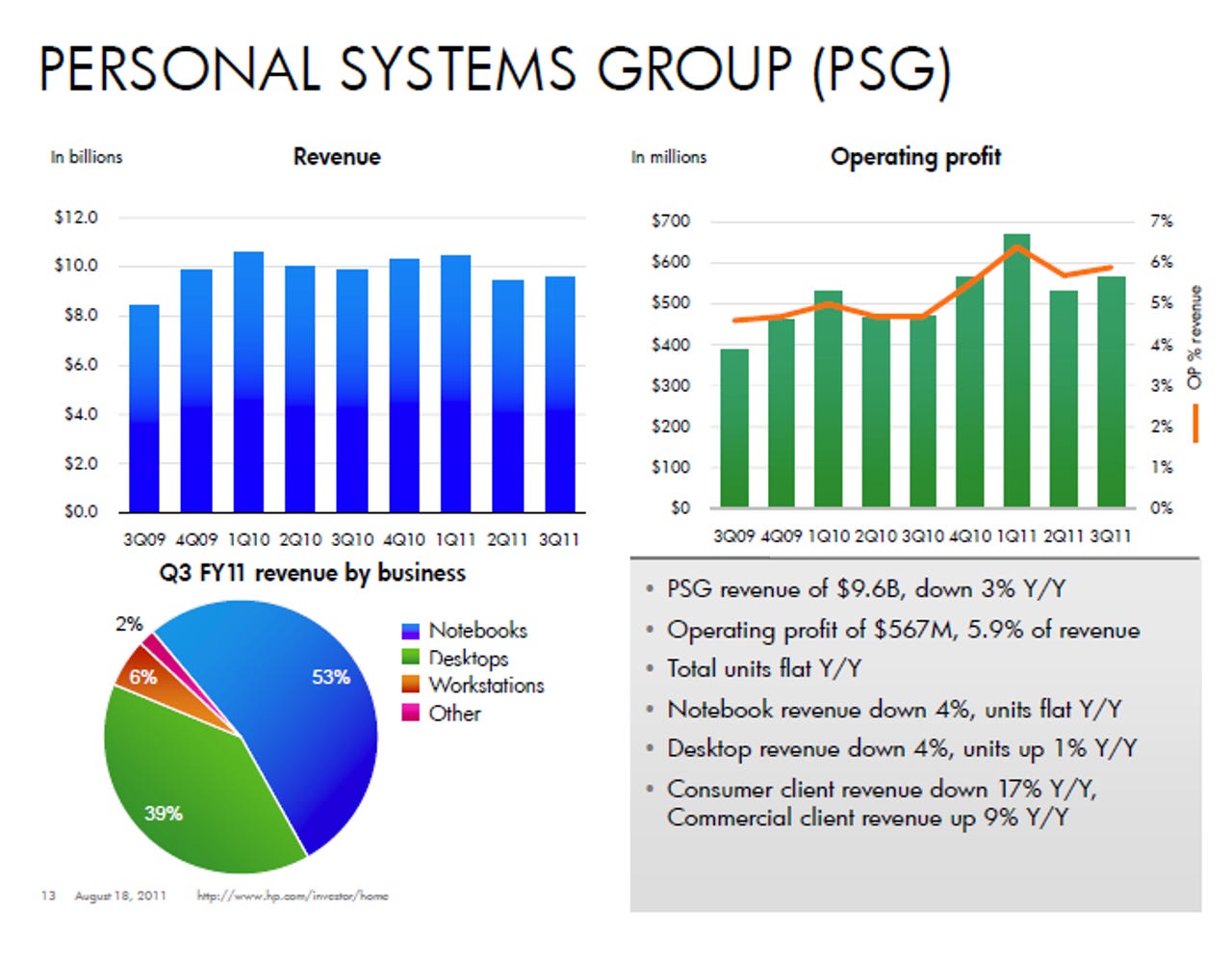

The company added that its strategic review indicated that the supply chain and procurement hit was too much. Meanwhile, HP's PC unit performs well.

When Meg Whitman took over as CEO she promised a quick decision on the PC division. She delivered.

Overall, HP's move makes sense---at least in the short term. Keeping the PC unit removes a lot of uncertainty for corporate technology buyers who were likely to go with vendors such as Lenovo and Dell. By eliminating that uncertainty, HP can move ahead.

HP's PC unit is profitable, but analysts noted that the business has imploded. In other words, HP couldn't sell the PC division and a spin-off wouldn't have been a boon to shareholders in its current state.

Jefferies analyst Peter Misek said in a research note this week:

In our global travels we have heard time and time again how your PC business has virtually imploded since the spin-off decision. Local managers in Asia, Latin America, and Europe are powerless to fight the competitive message, and customers fear that you are not committed to the business and therefore are going elsewhere (primarily Lenovo and Dell). We suggest either 1) immediately announce a commitment to the PC business (e.g., multi-year onsite warranties, partner with local banks to finance), or 2) have a private equity firm buy a stake in the company.

On a conference call with analysts, Whitman said she looked at the costs of a spin off as well as startup costs. Once the numbers were crunched, it was clear that HP had to keep the PC business. "PSG benefits from HP's global scale and innovation," said Whitman. "It would be very challenging for a new PC company to build such a strong brand."

Related: HP making another run at Windows 8 tablets

CFO Cathy Lesjak said that annual synergies between PSG and HP lead to operating synergies of $1 billion a year.

The reasons to keep the PC unit boiled down to the following:

- The PC unit is too intertwined with HP.

- It would cost $1.5 billion to spin it off in startup costs.

- HP would lose supply chain scale that would hurt other units.

- The PC unit would struggle without HP's channel relationships and brand.

In the long run, HP's decision to keep the PC unit isn't a slam dunk. PCs are still a low-margin commodity business and it's unclear whether the unit can deliver cutting edge designs, navigate the tablet market and generate consumer buzz. When former HP CEO Leo Apotheker announced plans to escape the PC business, most of the criticism revolved around the delivery and communication not the end goal.

The challenge for HP is to boost its margins while still playing in the PC market. For the third quarter, HP's PC unit was 31 percent of revenue. Whitman acknowledged that there will be margin pressure, but the company will work on its supply chain and design PCs that appeal to both consumers and the enterprise. HP executives acknowledged that HP took a competitive hit from rivals. Whitman added that customers told her that "uncertainty is not your friend here" and were holding off on orders.

HP is committed to PSG, and together we are stronger.

Whitman's review revolved around how PCs fit into the supply chain. Removing the PC business could mean that HP would lack the scale to get good component deals for its servers.

In a statement, HP said:

The data-driven evaluation revealed the depth of the integration that has occurred across key operations such as supply chain, IT and procurement. It also detailed the significant extent to which PSG contributes to HP’s solutions portfolio and overall brand value. Finally, it also showed that the cost to recreate these in a standalone company outweighed any benefits of separation.

Going forward, HP's Todd Bradley, who runs the PC unit, said the company is committed to the PC and intends to improve the business. Bradley's comments on the conference call sounded like any other PC company. The plan is to become more efficient, design better PCs and focus on emerging markets.

Keeping the PC business eliminates uncertainty, but key questions still remain for the unit.

Among the key items:

- How should HP organize its design teams? Misek suggested that HP should separate its design team from the bureaucracy. Better designs would help HP battle Apple and generate enterprise sales as consumerization takes hold?

- Does HP have to dangle carrots in front of IT buyers? HP may have to boost warranties and use aggressive pricing to fend off deals with Lenovo and Dell.

- What's the mobile plan? HP still doesn't have a mobile plan and it needs to partner with Microsoft of Google. The WebOS is a dead end due to the ecosystem. Whitman said WebOS plans are being evaluated and that HP will get into the tablet market again.

- HP retains top PC spot, but Lenovo surges to No. 2 in sluggish market

- Could an HP mobile workstation be the only computer you'll ever need?

- HP: Is it a broken company?

- HP CEO Whitman pushing for PC unit decision by end of the year

- No quick fixes at HP, say analysts

- HP's biggest challenge vs. IBM, Oracle: Continuity

- HP CEO Whitman: PC spin-off still in play, Autonomy deal too

- HP's CEO carousel continues: Whitman officially in, Apotheker out